Market Watch: Trade fears to force yet another lower opening - Geojit Financial Services Ltd

Asia

Asian stocks experienced fluctuations, with losses remaining limited as U.S. Commerce Secretary Howard Lutnick hinted that the Trump administration might reconsider some tariffs that had triggered a global market selloff. Gift Nifty suggests a flat opening for Indian markets.

US & Europe

U.S. stocks closed lower on Tuesday, with the tech-heavy Nasdaq approaching correction territory, as trade tensions intensified following President Donald Trump's new tariffs on Canada, Mexico, and China. European markets also ended sharply lower on Tuesday as global investors prepared for the widespread impact of the new U.S. tariffs on Mexico, Canada, and China, along with potential retaliatory measures.

Commodities

Oil prices plummeted on Tuesday, settling near multi-month lows after reports indicated that OPEC+ plans to proceed with output increases in April, coupled with news of U.S. tariffs on Canada, Mexico, and China, as well as retaliatory tariffs from Beijing. Meanwhile, gold prices rose on Tuesday, fueled by a weaker dollar and increased safe-haven demand amid escalating trade conflicts following President Donald Trump's imposition of new tariffs.

Trade fears to force yet another lower opening.

* Events today:

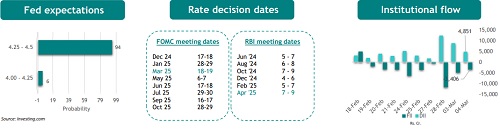

US Fed Williams Speech, US API / EIA crude oil stock change, Japan/ China/ India/ US Services PMI, US ADP employment change/ Total vehicle sales, ECB monetary policy meeting (Day 1).

* Exchange debut: Shreenath Paper Products(SME)

* Ex-Date: Anand Rathi Wealth (Bonus)

* Adani Wilmar has signed a definitive agreement to acquire GD Foods Manufacturing (India).

* GE Vernova T&D India has received three orders worth Rs 500 crore from Power Grid Corporation of India for the supply and installation of transformers and reactors under bulk procurement.

* Walchandnagar Ind has announced a deal to acquire a 60.3% stake in AiCitta Intelligent Technology.

* RVNL has received a Letter of Acceptance for a project worth Rs 729.82 crore from HPSEBL.

Nifty Outlook

The downside gapped opening yesterday, as well as the inability to clear previous day’s close are indeed signs of prevailing weakness, but the fact that most trades were seen at the upper quadrant, points to a rise in risk appetite. Hence, even though yet another weak opening is likely today, we are encouraged to look at the prospects of a rise to 22222 or 22400, should early trades not slip much beyond the 22000-21950 region. Failure to do this could see continuation of downtrend with deeper support below 21851 seen at 20900, though a collapse is less likely today.

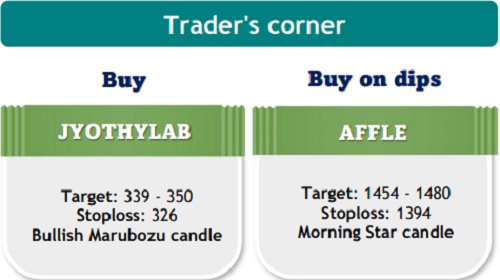

All 'Buy' recommendations have a holding period of 5 trading days.

All 'Sell' recommendations are for the recommended day.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

More News

Quote on Weekly Market by Krishna Appala, Sr. Research Analyst, Capitalmind Research