Market Watch: Asia firm. Eyes further China stimulus - Geojit Financial Services Ltd

Asia

Asian share markets wavered on Monday amid concerns over potential tariffs, while Bitcoin soared following news of its inclusion in a new U.S. strategic cryptocurrency reserve. Gift Nifty suggests a positive opening for Indian markets

US & Europe

US markets closed higher on Friday, concluding a volatile week and a losing month for the major averages, following a meeting between President Trump and the Ukrainian President in the Oval Office that heightened geopolitical risk concerns. European markets closed mixed on Friday but achieved a tenth consecutive week of gains despite the uncertainty caused by U.S. President Donald Trump’s tariff threats.

Commodities

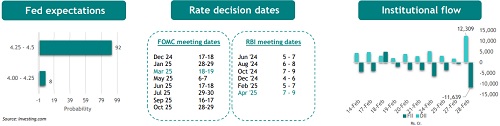

Oil prices declined on Friday, marking their first monthly decrease since November. This drop occurred as markets observed a heated discussion between the U.S. and Ukrainian presidents in the Oval Office, anticipated new tariffs from Washington, and noted Iraq's decision to resume oil exports from the Kurdistan region. Meanwhile, gold prices fell over 1% on Friday, with the dollar remaining near two-week highs following U.S. inflation data that met expectations, indicating the Federal Reserve might take a cautious approach to further rate cuts.

* Events today: Japan/ China/ India/ US, Manufacturing PMI, EA inflation rate.

* Exchange debut: Beezaasan Explotech (SME)

* Dr Agarwal's Health Care will be in focus on March 3 as the lock-in period for 50% of the shares in the company's IPO anchor book opens today.

* NLC India has received a Letter of Award for a 200 MW wind power project from SJVN at a tariff of Rs 3.74 per kWh.

* NCC received an order worth Rs 218.82 crore in February. The order pertains to the transportation division and has been awarded by a state government.

* RailTel has received a work order worth Rs 26.37 crore from the Cuttack Development Authority.

Nifty Outlook

The 420 point fall of Friday completed a 7% decline post turning lower from the 50 day SMA mark early Feb. This has also pushed its RSI as well as stochastics to the lowest level since 2020, while also forcing a close below the lower bollinger band. While these factors do not guarantee a reversal, they do provide enough conditions. This prompts to weigh in the fact that 70% of Nifty50 constituents registered a green candle in the last hour on Friday, encouraging to take a positive stance early today. However, inability to clear 22350 may push index down towards 21851, the 23% fibo retracement of the covid low to 2024 peak move.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

More News

Daily Derivatives Report By Axis Securities Ltd

.jpg)