Market is expected to open on a flattish note and likely to witness range bound move during the day - Nirmal Bang Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

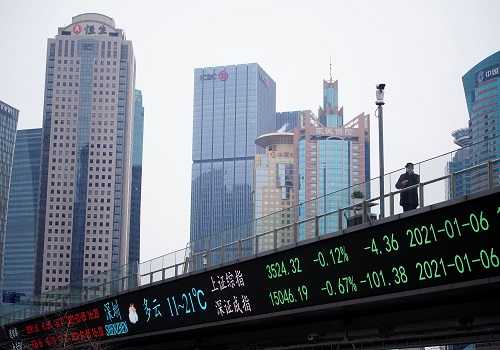

Market Review

US: Stocks fell on Tuesday as strong economic data raised questions about the possibility of Federal Reserve rate cuts later this year, leading to a spike in Treasury yields. Declines across major tech stocks also dragged the market lower.

Asia: Asia-Pacific markets traded mixed on Wednesday, followed US peers lower after a selloff in Treasuries on bets the Federal Reserve will delay cutting interest rates due to inflation risks

India: The benchmark equity indices reversed two sessions of decline to close higher on Tuesday, helped by a broad-based rally led by oil and gas, and financials. Market is expected to open on a flattish note and likely to witness range bound move during the day.

Global economy: Australian consumer price index inflation rose more than expected in November, while underlying inflation also remained above the Reserve Bank of Australia’s target range, presenting a hawkish outlook for interest rates. CPI inflation rose 2.3% year-on-year in November. The reading was higher than expectations of 2.2% and also picked up from the 2.1% seen in the prior month. CPI inflation excluding volatile items and holiday travel rose to 2.8% in November from 2.4% in the prior month

The recent data showed a notable decrease in the inventory levels of US crude oil, gasoline, and distillates stocks. The actual decrease in crude inventories was -4.022 million barrels, a figure that not only exceeded expectations but also surpassed the previous levels. This drop in crude inventories was significantly larger than the forecasted decrease of -0.250 million barrels. This significant deviation from the forecast implies a stronger than expected demand for crude oil, a scenario that is generally bullish for crude prices.

Commodities: Oil prices rose on Wednesday as supplies from Russia and OPEC members tightened, while data showing an unexpected increase in U.S. jobs openings pointed to expanding economic activity and consequent growth in oil demand. Gold prices were flat on Wednesday, pressured by higher yields and a stronger dollar after U.S. data suggested the Federal Reserve might slow the pace of its rate cuts this year.

Currency: The dollar stood tall on Wednesday and the yen sagged close to levels that drew intervention last year after strong U.S. data drove a spike in yields and pared some bets on Federal Reserve rate cuts

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH000001766

More News

Market is expected to open on a flattish note and likely to witness range bound move during ...