Large-ticket transactions drive leasing, accounting for 45% of industrial & warehousing demand in 2025: Colliers India

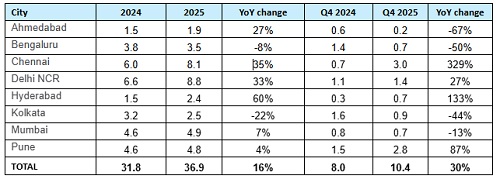

With 36.9 million sq ft of leasing in 2025, industrial & warehousing demand across the top eight cities remained strong, witnessing a 16% YoY growth. During the year, Delhi NCR led the demand with 24% share, closely followed by Chennai at 22% share. On a quarterly basis, after a relatively modest third quarter, Q4 2025 saw about 10.4 million sq ft of industrial & warehousing demand. Chennai, closely followed by Pune, cumulatively accounted for 56% of the quarterly demand.

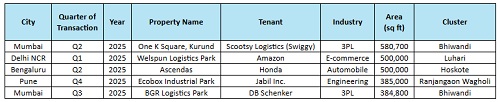

While Third Party Logistics (3PL) players drove overall demand during the year, and accounted for 32% share in overall leasing, demand from Engineering and E-commerce segments too gained significant traction. At a micro market level, Bhiwandi in Mumbai led the leasing activity in 2025 with about 4.9 million sq ft of Grade A space uptake, followed by Chakan-Talegaon in Pune and Oragadam in Chennai. Both micro markets contributed to more than 2.5 million sq ft of demand each in their respective cities.

Trends in Grade A Gross absorption (million sq ft)

“A strong performance in the last quarter has propelled the demand for Grade A industrial & warehousing space to around 37 million sq ft in 2025, highest in recent years. Space uptake was driven by large deals, especially by 3PL firms which accounted for almost one-third of the leasing activity in the year. Moreover, developers remained upbeat about long-term prospects, and this is reflected by over 40 million sq ft of completions during 2025 - highest in recent years. With the government’s continued focus on ramping up manufacturing and logistics infrastructure, industrial & warehousing requirements are likely to scale up over the course of next few years” says Vijay Ganesh, Managing Director, Industrial & Logistics Services, Colliers India.

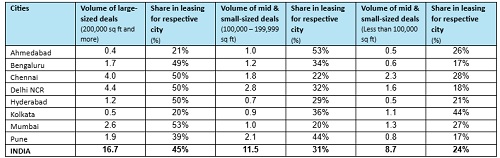

3PL occupiers drove large-sized deals across cities

Third-Party Logistics (3PL) players continued to dominate leasing activity during 2025 with about 12 million sq ft of Grade A space uptake, accounting for almost one-third of the annual demand. Demand from Engineering and E-commerce players also remained firm and cumulatively accounted for about 35% of the leasing activity during the year.

During the year 2025, large deals (≥ 200,000 sq ft) accounted for about 45% of the overall demand. Amongst these larger deals, 3PL companies continued to account for the bulk of share, followed by E-commerce and Engineering players.

Deal size trends in 2025 Grade A demand (million sq ft)

Interestingly, on a quarterly basis, within the E-commerce segment, about 61% of the industrial & warehousing space uptake was through large deals, driven by large storage requirements of fulfillment centers and delivery hubs. On the contrary, more than two-thirds of deals in the FMCG and Retail segments were in the mid-sized category (100,000-200,000 sq ft), driven by the growing popularity of hyperlocal delivery firms.

“Delhi NCR and Chennai each recorded over 8 million sq ft of demand in 2025, collectively contributing over 45% of the leasing activity. Concurrently, markets like Pune and Mumbai saw space uptake of around 5 million sq ft each. The demand for Grade A warehouses across these four primary industrial hubs was predominantly driven by 3PL and engineering firms. With well-established manufacturing clusters and superior infrastructure connectivity, we expect these markets to cumulatively account for 70-80% of industrial & warehousing demand in 2026 as well.” says Vimal Nadar, National Director & Head, Research, Colliers India.

Top 5 Industrial & Warehousing deals for 2025-

Above views are of the author and not of the website kindly read disclaimer