Joe Biden’s New deal – Indian small and midcap stocks outperform benchmark indices - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

JoeBiden’s New deal – Indian small and midcap stocks outperform benchmark indices- HDFC Securities

U.S. President Joe Biden rolled out his own version of FDR’s New Deal. Joe Biden's sweeping $2.3 trillion plan to rebuild America's crumbling infrastructure proposes doubling federal funding for mass transit and spending $80 billion to expand and modernize passenger rail service.

S&P 500 and Nasdaq rose on Wednesday, boosted by gains in technology shares. All three major Wall Street indexes registered their fourth straight quarterly rise as investors positioned themselves for President Joe Biden's massive infrastructure plan. The White House plans to fund the bill by taking back some of the tax cuts Republicans gave corporations and the rich four years ago. Much like his Covid-19 rescue bill, the plan faces a narrow path through Congress.

The U.S. private employers hired the most workers in six months in March as more Americans got vaccinated against COVID-19, pushing the economy towards a broader reopening, which is expected to unleash a strong wave of pent-up demand in the coming months.

The dollar index - a basket of six major currencies hit a five-month high of 93.439. The dollar held near a multi-month high as investors bet fiscal stimulus and aggressive vaccinations will help the United States grow faster than other economies.

In Europe, France, and Italy extended restrictions. Asian stocks were set to edge higher early on Thursday after big tech rallied on Wall Street. Japanese big manufacturers’ sentiment improved to pre-pandemic levels in the first quarter as companies planned to increase capital expenditure this year, suggesting the export-reliant economy was benefiting from a recovery in global demand.

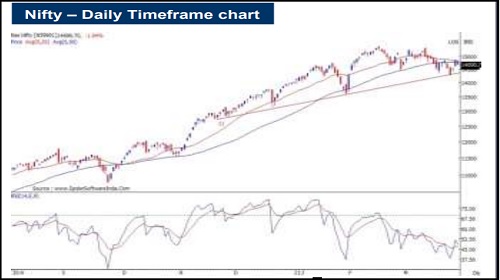

Daily Technical View on Nifty

Observation: Markets ended with losses on Wednesday after a gap down opening. The Nifty finally lost 154.4 points or 1.04% to close at 14,690.7. Broad market indices like the BSE Mid Cap and Small Cap indices ended higher, thereby out performing the Sensex/Nifty. Market breadth was negative on the BSE/NSE.

Sectorally, the top gainers were the BSE Realty, FMCG and CD indices. The top losers were the BSE Bankex, Power and Telecom indices.

Zooming into the 15 minute chart, we can see that the Nifty opened today with a down gap. And selling continued through the day as the index gradually moved lower.

The 15 minute intra day 20 and 50 period moving averages have turned flat indicating that the index is in consolidation mode for the very near term. It will be important that the Nifty holds above the recent lows of 14617 for the short term uptrend to continue in the very near term

On the daily chart, the Nifty has corrected on Wednesday after finding resistance at the previous swing high of 14879 and the 20 and 50 day SMA.

Given that Wednesday’s correction has happened after a decent rise from an upward sloping trend line, we stick with our view that the Nifty could move higher in the coming sessions.

The uptrend is however likely to gain momentum once the Nifty crosses the recent swing high of 14879. In this scenario, the Nifty could once again be headed towards the life highs of 15432.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Nifty registers best week in 2 months after rising for 6 consecutive sessions