IT Sector Update : Muted Q4FY25 Expected; Read our Base Case & Bear Choice Broking Ltd

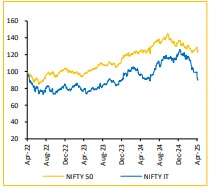

India's IT sector is expected to face subdued performance in Q4FY25, with cautious near-term guidance expected by managements due to clients reassessing their businesses and reducing discretionary IT spends. As a result, revenue growth for IT and ER&D service providers may drop by 2- 3% in FY26. This shift stems from concerns over potential retaliatory tariffs under Trump, which could lead to a global slowdown or even a recession, especially in the US. While US tariffs don’t directly affect services, they may still hurt India’s software exporters by impacting key client sectors. With a heavy reliance on US and European clients, this poses significant risks for India's IT industry. Global firms like Accenture raised their FY25 revenue guidance to 5-7% from 4-7%. However, uncertainty persists for FY26E as clients prioritize cost efficiency and large-scale transformations, limiting discretionary spending. Considering this, we have developed two distinct cases—Base and Bear—each addressing two different scenarios as outlined below:

BASE CASE (US Slowdown + Continuous Deal Momentum + Range bound USD/INR): In the coming weeks and months, countries affected by tariffs may have the opportunity to negotiate more favorable terms with the US. As the US heads into an economic slowdown, this could have a soft impact on the clients of US-based IT companies. However, these are early stages of what could be a prolonged tariff dispute, and the outcomes will largely depend on the specific agreements that individual countries manage to secure with the US. While large-scale transformation deals continue to gain momentum, there may still be pockets of discretionary spending. The USD/INR is expected to fluctuate within a range.

BEAR CASE (US led Recession + Services under tariff negotiations + USD Depreciation): If trade negotiations with other countries fail to yield favorable outcomes, a global recession could follow, severely impacting businesses and their IT spending. In an event that India's services sector is hit with additional tariffs under BTA negotiations, IT services companies could face significant challenges, potentially leading to negative top-line growth rates. USD aggressively depreciating against INR breaching the threshold level of 85 INR/ USD.

We may change our sector view to ‘Cautious’ if the likelihood of Bear Case playing out increases significantly.

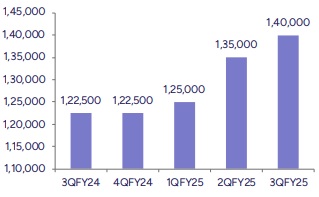

View on our Coverage Companies: Revenue of Tier-I companies in our coverage are expected to grow between -0.1% to 1.5% QoQ in CC while TierII companies are projected to grow in the range of 0% to 4.5% QoQ in CC. We have updated our forecasts, adjusted PE multiples, and revised target prices following Q3FY25, incorporating the impact of tariffs as outlined in the table. We expect companies like HCLT, LTIM, and TECHM, with higher exposure to verticals such as Manufacturing, Retail, and Logistics, to be unfavourably impacted by the US tariffs. Margin expansion is expected to be moderate across most companies. Employee attrition in the IT sector has bottomed out, enhancing operational efficiency. However, hiring plans may face delays as companies assess demand environment. Firms continue to focus on improving the employee pyramid, optimizing subcontracting costs, increasing utilization, and implementing efficiency measures to drive margin growth. While the current scenario have caused short-term challenges, the significant correction in Indian IT stocks provides opportunities for companies that are now trading at decent valuations as a long term bet. We prefer Infosys, HCL Tech & LTIMindtree in Tier-I and Coforge & LTTS among Tier-II companies

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131