Sensex trades flat after opening in green

Indian equity indices were trading flat on Thursday after opening in the green.

At 9:40 a.m., Sensex was down 10 points at 79,914 and Nifty was up 8 points at 24,332. It is the second consecutive day when the Sensex is trading below 80,000.

Buying is seen in the smallcap and midcap stocks. Nifty midcap 100 index is up 281 points or 0.49 per cent, at 57,200 and Nifty smallcap 100 index is up 93 points or 0.50 per cent, at 18,887.

Among the sectoral indices, Auto, IT, PSU Bank, Metal, PSE and Media are the major gainers. Fin service, Pharma, FMCG and Realty are the major laggards.

TCS, Tata Motors, Tata Steel, HCL Tech, Infosys, SBI, Titan, Maruti Suzuki, L&T, ICICI Bank and Bharti Airtel are the top gainers in the Sensex pack, whereas Sun Pharma, M&M, HDFC Bank, Nestle and HUL are the top losers.

The foreign institutional investors (FIIs) extended their buying as they bought equities worth Rs 584 crore on July 10, while domestic institutional investors also bought equities worth Rs 1082.4 crore on the same day.

Deven Mehata, Research Analyst at Choice Broking, said, "Nifty can find support at 24,300 followed by 24,200 and 24,150. On the higher side, 24,400 can be an immediate resistance, followed by 24,450 and 24,500."

There is a positive trend in Asian markets. The markets of Tokyo, Hong Kong, Seoul, Shanghai and Jakarta are bullish. Only the Bangkok share market is trading with a decline. US markets closed in the green in Wednesday's session. Crude oil benchmark Brent crude is at $85.76 per barrel and WTI crude at $82.72 per barrel.

Top News

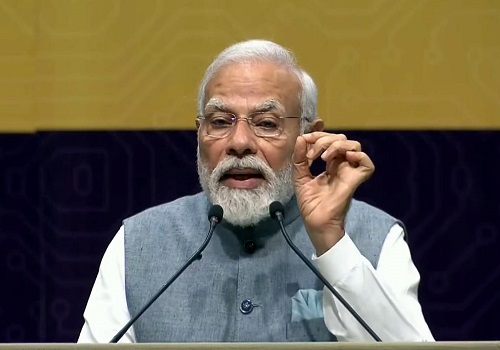

India`s electronics manufacturing jumps from $30 bn to $100 bn: Prime Minister Narendra Modi

Tag News

MOSt Market Roundup : Nifty future closed negative with loss of 1.26% at 23105 levels by Mot...