Indian shares set for a muted start as U.S. data adds to rate cut woes

Indian shares were set for a muted start on Friday, after notching up record highs in the previous session, as robust economic data in the U.S. dampened hopes of early interest rate cuts.

The Gift Nifty was trading at 22,975 as of 7:58 a.m. IST, indicating the Nifty 50 will open near Thursday's close of 22,967.65.

Indian benchmarks closed at all-time high levels, and posted their best session since March 1 on Thursday, as the central bank's record dividend to the government boosted financials.

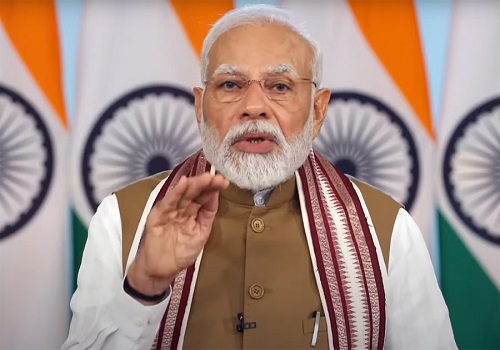

"We are seeing some short covering in the market. If the election outcome aligns with current market expectations, we expect Nifty to reach new highs in the first week of June," Neeraj Chadawar, Head – Fundamental and Quantitative Research at Axis Securities said.

Indian shares' volatility index has been hovering around 19-month highs amid uncertainty around outcome of general elections and sustained foreign selling pressure.

Foreign investors have sold Indian shares worth 279.38 billion rupees ($3.36 billion) so far in May, the highest since January 2023.

Wall Street indexes declined overnight as strong labour market and business activity data fueled concerns over tighter-for-longer monetary policy.

Asian peers were also lower with the MSCI Asia ex-Japan falling about 1%.

STOCKS TO WATCH

** Interglobe Aviation - India's IndiGo airline operator's fourth quarter profit doubled beating analyst estimates while the airline said it will introduce business class on some domestic flights this year.

** Honasa Consumer - Indian skincare firm Mamaearth's parent posted a fourth-quarter profit compared to a loss year ago as consumers stocked up beauty and personal care products.

** Key earnings: Aluminium and copper producer Hindalco Industries, automaker Ashok Leyland and JM Financial

Tag News

Market Watch: Asia follows US higher - Geojit Financial Services Ltd