India VIX decreased by 2.05% to close at 12.30 touching an intraday high of 12.9 - Nirmal Bang Ltd

Summary

* Indian markets closed on a positive note where buying was mainly seen in IT, Pharmaceuticals, Metal. Nifty Nov Futures closed at 25694.50 (up 105.30 points) at a premium of 120.15 pts to spot.

* FIIs were net sellers in Cash to the tune of 4114.85 Cr and were net sellers in index futures to the tune of 919.82 Cr.

* India VIX decreased by 2.05% to close at 12.30 touching an intraday high of 12.93.

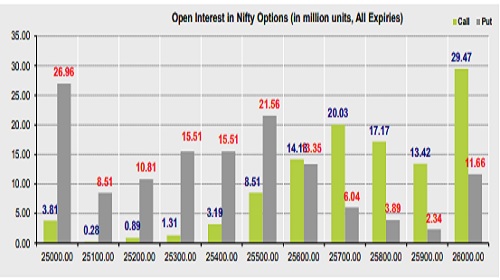

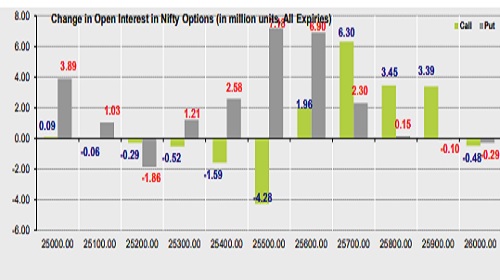

* The above second chart shows previous trading day’s change in Nifty options where Additions in OI were seen in 25600, 25700,25800, 25900 strike Calls and at 25500, 25400, 25300, 25100 strike Puts indicating market is likely to remain range bound in the near term.

* Highest OI build-up is seen at 26000 strike Calls and 25000 strike Puts, to the tune of 29.47mn and 26.96mn respectively.

Open Interest in Nifty Options:

Outlook on Nifty:

Index is likely to open on a flattish note today and is likely to remain range bound during the day.

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176