India Strategy Weekly IdeaMetrics : Macro update – Growth soft; RBI lift By Emkay Global Financial Services

Macro update – Growth soft; RBI lift

The RBI took India’s reform and deregulation forward with significant unshackling of bank lending guidelines, aimed mainly at the wholesale segment. This should arrest the slow decline in wholesale growth, though it does not address all the challenges the segment faces. We, though, see the cascading effect of multiple stimuli—both fiscal and monetary—sparking a consumption-led growth revival in H2FY26. We do not, however, believe that the concurrent growth indicators will remain tepid.

Lending deregulation – Big steps

The RBI announced seven measures of lending deregulation, along with the MPC policy announcement on 1-Oct-25. The two most significant are the abolition of i) the ban on funding M&A and ii) the large exposure framework, which opens up new large opportunities for corporate lending. These measures should aid a recovery in corporate lending by banks, and address some of the disintermediation challenges. These could also ease debt funding for large corporates with lower credit ratings. A binding constraint would be banks’ own risk appetites. We see PSU banks as winners, as they would be quicker to capitalize on this opportunity – large private banks may take some time to recalibrate their risk appetites.

Rates on hold, though of little account

The RBI expectedly held rates at its MPC meeting. There were some angels in the detail, however. The inflation forecast was revised down further, and a minority vote went in favor of changing the stance to accommodative. We are not too worried about the RBI staying on hold. There have been significant cuts already which are yet to be fully transmitted, and the stimulus impact has still not been absorbed. Moreover, there is significant fiscal stimulus in play. This does not affect our forecast of a turnaround in growth from H2FY26, led primarily by discretionary consumption.

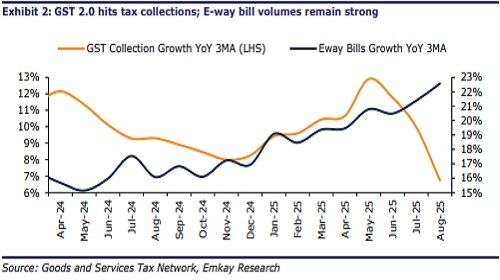

Growth triggers noisy – Strong festive demand outlook

Concurrent indicators are not showing any sign of a growth revival yet. There were some silver linings in e-way bills and ports data, which though are likely to be front-ended pretariff shipments. We may see some noisy indicators in coming weeks, as growth stalled in Sep-26 due to the gap between the GST announcement and implementation on 22- Sep. Our channel checks indicate a strong revival in discretionary demand over the festival season in Q3FY26.

After the GST-cut announcement, auto dealers expect 20-25% YoY growth during the entire festive season (Sep-Nov). Overall industry growth outlook for FY26 has also been revised up, to 4-5%/7-8% for 2Ws/PVs, respectively. Prices have been cut ~7-8% across the consumer durables industry, leading to an overall pricing discipline (price wars have abated and, now, pricing is more star-rating-driven across durables).

Government capex remains robust

Central government capex spend has bounced back after staying indifferent in FY25. Central government expenditure grew 43% YoY during Apr-Aug, reaching 38% of the FY26 Budget estimates. Adjusting for base-effect distortions in the previous two years, the 3Y CAGR is also at a healthy 20%. The spend has been led by the Telecommunications, Transfer to states, Defense, and Railways sectors. We see the central government driving the macro capex cycle in coming years, even if the hypergrowth seen during FY21-24 (31% CAGR) cools down. Corporate capex should also pick up, though it is not enough to make a difference at the macro level.

We bring forward our weekly by a day this week, due to the RBI announcement. This is a one-off.

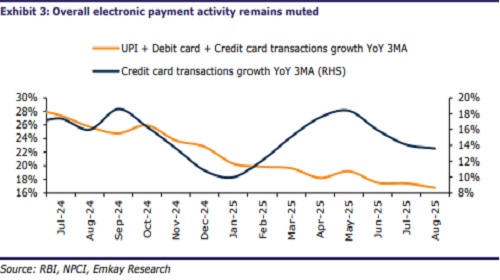

Consumption and growth

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354