India Strategy: Nifty-500: 4Q review - Broad-based earnings growth led by Telecom by Motilal Oswal Financial Services Ltd

Telecom and Metals drive earnings; Automobile and O&G lag

The Nifty-500 companies delivered a healthy performance in 4QFY25, driven by strong macroeconomic fundamentals despite geopolitical uncertainties, weak consumption trends, and a high base in 4QFY24.

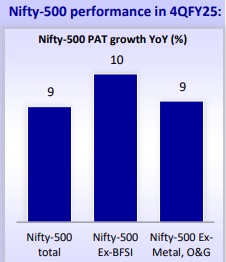

The aggregate sales/EBITDA/adj. PAT of Nifty-500 companies grew 6%/11%/9% YoY to INR36.4t/INR7.5t/INR4.3t in 4QFY25.

Earnings for the quarter were primarily driven by broad-based growth, with key sectors such as Telecom (loss-to-profit), Metals (+47% YoY), PSBs (+13% YoY), and Healthcare (+46% YoY) contributing positively. In contrast, Automobiles (-22% YoY),O&G (-4% YoY), and Pvt. Banks (-3% YoY) dragged overall earnings.

Chemicals and Media recorded strong YoY growth of 67% and 51%, respectively, on a weak base, while Consumer Durables delivered a robust 41% YoY growth despite a high base. Meanwhile, Consumer (+4% YoY), Real Estate (+4% YoY), andTechnology (+3% YoY) exhibited muted earnings growth in 4QFY25.

The Nifty-500, ex-BFSI, reported an aggregate earnings growth of 10% YoY, whereas aggregate earnings grew 9% YoY (ex-global commodities).

The EBITDA margin of Nifty-500 (ex-BFSI) came in at 16.8%, up 80bp YoY (+30bp QoQ). EBITDA margin, ex-commodities (i.e., Metals and O&G), came in at 19.9% (up 80bp YoY/30bp QoQ).

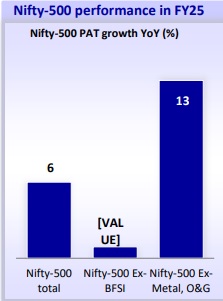

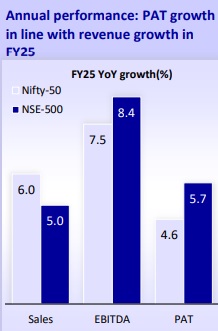

FY25: Sales/EBITDA/adj. PAT grew 5%/8%/6% to ~INR136t/INR28t/INR15t led by PSBs, Healthcare, and Telecom, while O&G, Auto, and Cement weighed on the year’s earnings. Ex-BFSI, the FY25 aggregate sales/EBITDA/PAT rose 6%/4%/1% YoY. Further, ex-Metals and O&G, sales/EBITDA/PAT grew 7%/14%/13% YoY during the fiscal. EBITDA margin, ex-BFSI, contracted 30bp YoY to 16.4%; however, ex-Metals and O&G, operating margin expanded 50bp YoY to 19.5%.

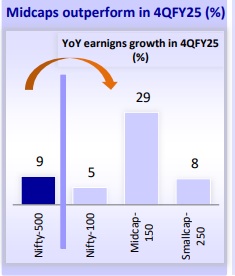

Mid- and small-caps drive earnings: The earnings performance of Nifty-500 companies was led by Midcaps in both 4QFY25 and FY25. The aggregate earnings of Nifty-100/Nifty Midcap-150/Nifty Smallcap-250 grew 5%/29%/8% YoY in 4QFY25. Whereas the aggregate PAT grew 3%/22%/7% YoY in FY25.

Sectors and companies: Of the 21 key sectors, 16 reported profit growth in 4QFY25, while 17 reported profit growth in FY25. In 4QFY25, 234 companies reported earnings growth of over 15% YoY, while 179 companies saw a decline in earnings. For the full FY25, approximately 237 companies recorded earnings growth above 15% YoY, whereas 151 companies reported a decline.

Heavyweights dominate: FY25 earnings were skewed towards Banks, Telecom, and Metals companies. The top 10 companies by incremental profit growth contributed approximately 97% to the incremental YoY earnings in FY25, compared to 50% in FY24.

Key sectoral highlights for 4QFY25

Telecom led earnings growth for the quarter, with aggregate losses turning into a profit of INR 61b in 4QFY25 compared to an INR15b loss in 4QFY24, primarily driven by Bharti Airtel. However, other peers reported muted to negative earnings for the quarter.

Metals also contributed significantly to the quarter’s earnings, driven by a weak 4QFY24 base and strong performance from non-ferrous companies. Aggregate revenue for non-ferrous players was supported by favorable pricing, while healthy volumes in ferrous companies were offset by muted NSR during the quarter.

Within BFSI, PSBs led the aggregate earnings while Pvt. Banks dragged. Most of the large private banks had seen a sequential improvement in NIMs amid lower-day adjustments in 4Q, while PSBs continue to see a moderation in NIMs. NII growth stood at ~7% YoY for Pvt. Banks and 3% YoY for PSBs.

Healthcare: The sector delivered a strong quarter with 46% YoY earnings growth, driven by increased momentum in chronic therapies within the DF segment and favorable currency movements in regulated markets.

Technology companies reported a muted 4QFY25 performance, with PAT growth of just 3% YoY. Tier-1 companies remained weak due to lower-than-expected growth and subdued demand. The backdrop remains challenging, as macroeconomic uncertainty continues to weigh on IT spending.

The Automobile sector reported a weak quarter, impacted by modest domestic volume growth of 2% YoY and a high earnings base in 4QFY24. Nifty-500 companies in the sector recorded sales and EBITDA growth of 6% and 2% YoY, respectively, while PAT declined 22% YoY.

Consumer demand remained subdued during the quarter, with volume growth across most companies limited to the low- to mid-single digits. While rural demand showed gradual improvement, urban demand remained weak. Nifty-500 companies reported sales/EBITDA/PAT growth of 8%/17%/4% YoY.

The Oil & Gas sector weighed on 4QFY25 performance, with sales and EBITDA growing marginally by 1% and 2% YoY, respectively, while adjusted PAT declined 4% YoY. Excluding OMCs, the performance was weaker, with sales growing 5% YoY, while EBITDA and PAT declined 1% and 13% YoY, respectively.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty slips below 25K as US airstrikes on Iran raise Mid-East tensions...