India Strategy : Gold jewelry = Gold + jewelry? By Kotak Institutional Equities

Gold jewelry = Gold + jewelry?

The acceptance of lab-grown diamonds (LGD) among households may shape the following hypothesis: Can the twin roles of gold jewelry as (1) a store of value and (2) an item of fashion split into (1) gold as a store of value and (2) ‘any’ jewelry as an item of fashion? Indian households will likely continue to see gold as a store of value, despite the rise of equity as an asset class.

Gold is a store of value; diamonds less so

It would be interesting to see if, how and when the consumption patterns of gold and jewelry of Indian households change with the ‘rise’ of LGDs with their competitive prices versus natural diamonds’. LGDs have seen fast adoption in developed countries and are at an early stage of adoption in India. This may have both (1) macro implications through (a) CAD/BoP if adoption of LGD was to rise rapidly and (b) household purchase of gold in ‘financial’ or physical form and (2) micro implications through business models of jewelry companies.

Gold as a store of value—gold or gold jewelry, physical or financial gold

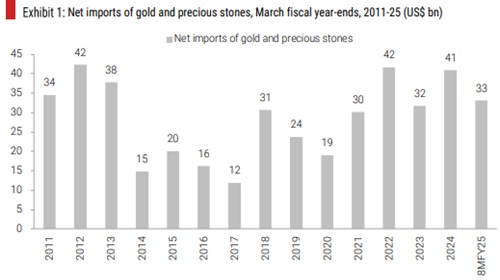

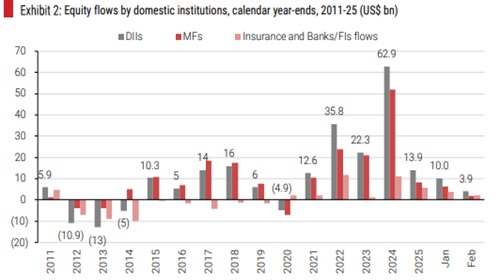

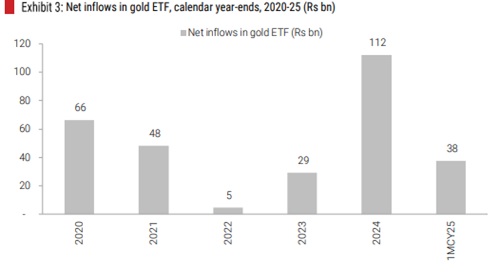

We do not expect a major change in the savings behavior of Indian households over the next few years. We note that gold purchases have held up at high levels in the past 3-4 years, even as Indian households have invested large amounts of savings in equities. Indian households have purchased US$300 bn of gold over FY2015-8MFY25 (see Exhibit 1) against US$194 bn of equity over CY2015- 2MCY25 (see Exhibit 2). However, it is possible that the share of ‘financial’ gold through gold ETFs in overall household gold purchases may increase at the expense of physical gold (see Exhibit 3).

Gold jewelry as an item of fashion—all sorts of jewelry likely

In our view, the jewelry industry and the jewelry purchase mix of households will both evolve over the next few years with the emergence of LGDs at far lower prices than natural diamonds’. The key questions are (1) the level of acceptance and (2) the pace of uptake of LGDs in studded jewelry by Indian households. At this early stage, we will take the risk of hypothesizing (1) women will probably use a combination of natural diamonds and LGDs in studded jewelry, (2) the share of LGD-studded jewelry in overall household jewelry purchases will likely increase over time and (3) the mix of gold, natural diamond- and LGD-studded jewelry among households will depend on education and income levels.

Risks to jewelry business—revenues, profitability and valuations

We see three potential sources of risks to jewelry companies/stocks—(1) revenues given possibly lower mix of physical gold jewelry in overall household gold purchases in the long term (assuming households were to move gradually to financial gold) and lower prices of LGD-studded jewelry versus natural diamond-studded jewelry, (2) profitability given a likely higher share of LGDstudded jewelry in the overall mix and (3) valuations based on any potential negative changes to the former two. It is apparent that TTAN’s multiples (64X FY2026E EPS) do not factor in any of the abovementioned potential risks.

Indian households invested US$300 bn in gold over FY2015-8MFY25

Indian households invested US$194 bn in equities over CY2015-2MCY25 through MFs and insurances

Investment in gold ETFs is at its nascent stage compared to investment in physical gold

Above views are of the author and not of the website kindly read disclaimer