India`s Retail Payments Revolution: Digital Dominance & Cash Resilience by CareEdge Advisory

Synopsis

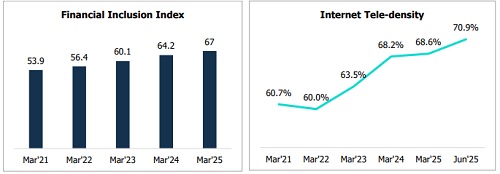

* Retail payments are now 99.8% digital, with paper-based instruments (Cheques) nearly obsolete, owing to policy push, infrastructure support, and deep fintech penetration. Rising internet penetration (from 60.7% in Mar’21 to 70.9% in June 2025 and expected at ~85% in 2028) and smartphone usage have accelerated this shift, enabling financial inclusion by bringing previously unbanked populations into the formal digital economy.

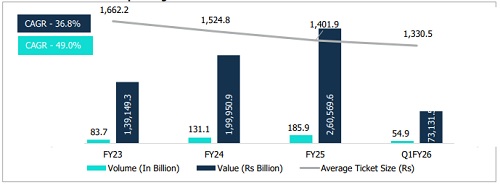

* UPI is the driving force behind the behavioural shift of growing digital transactions, with 54.9 billion transactions in Q1FY26 and 185.9 billion transactions in FY25. UPI transactions grew at a CAGR of 49% between FY23 and FY25, underscoring rapid adoption and deepening penetration in tier 2 and tier 3 cities. UPI is expected to continue its rapid growth, further solidifying its dominance in India’s digital payments landscape.

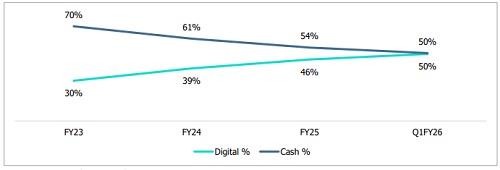

* Despite such huge growth in digital transactions, cash remains resilient. Cash usage in Private Final Consumption Expenditure (PFCE) is estimated to have reached a 50% share as of Q1FY26. While digital payments are likely to dominate in the coming years, the cash mode of payment will continue to coexist.

Overview of Retail Payments System in India

India's payment landscape is regulated by the RBI and technologically enabled by NPCI, which is also responsible for the operational efficiency of the payment system in India. India’s payments ecosystem represents a wellintegrated blend of conventional instruments, such as Cheques, Debit and credit cards, and modern digital platforms, including UPI, ABPS, IMPS, and PPI.

UPI's Dominance and the Future of Payments in India

The government and the RBI are promoting digital adoption nationwide, particularly in tier-2 and tier-3 cities, supported by initiatives such as the Payments Infrastructure Development Fund (PIDF), which aims to accelerate digital payments in underserved regions. The RBI Digital Payments Index (DPI) indicates an increase in digital payment adoption, rising from 445.50 in March 2024 to 493.22 in March 2025.

Digital payments, led by UPI, AePS, IMPS, and others, dominate retail transactions, accounting for 92.6% of payment value and 99.8% of transaction volume as of Q1 FY26. Cards and prepaid instruments are stable or in decline as UPI substitutes for low-value transactions. While UPI leads, other systems, such as NEFT, IMPS, and NACH, remain important, especially for high-value and bulk payments. NEFT remains crucial for mid-to-high-value transactions, with an average ticket size of approximately Rs 48,000 as of Q1FY26, which is significantly higher than that of UPI. IMPS continues to experience steady growth but is being cannibalised by UPI, which offers a similar instant payment experience with broader merchant acceptance. NACH transactions remain important for bulk disbursements, such as salaries, subsidies, and dividends.

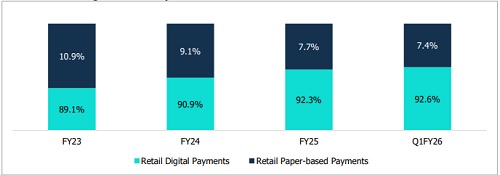

Chart 1: Shift to Digital: Retail Payments Value Mix Over Time

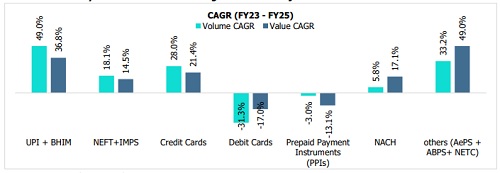

In a significant shift towards a more digitised financial landscape, retail digital payments in India have steadily increased their share to 92.6% in Q1FY26, up from 89.1% in FY23. The primary driver of this growth is UPI, which accounts for over 90% of the total credit payment volume, with 54.9 billion transactions recorded in Q1FY26. The decrease in the average transaction value to Rs 1,330 in Q1 FY26, from Rs 1,662 in FY23, demonstrates the increasing use of UPI for everyday micro-payments. The rapid adoption and deepening penetration of UPI are further evidenced by a 49% CAGR in transaction volume and a 36.8% CAGR in transaction value between FY23 and FY25.

Since its launch, UPI transaction limits have been progressively raised, reflecting both growing user confidence and the maturation of India’s digital payments infrastructure. Initially designed with modest limits to ensure system stability and encourage cautious adoption, these thresholds have been gradually relaxed to support higher-value transactions across various use cases, including tax payments, educational fees, healthcare, and investment activities. This evolution underscores UPI’s transformation from a peer-to-peer payment tool into a robust, scalable platform that underpins the broader digital economy.

Chart 2: Trend in UPI’s Expanding Scale

The UPI system is a major player in India's digital payments, serving over 491 million individuals and 65 million merchants. It has a significant global reach, powering nearly 50% of worldwide real-time digital payments and operating in seven countries, with its recent expansion into France marking its first step into the European market.

While credit cards are still widely used for e-commerce and high-value purchases, debit cards and Prepaid Payment Instruments (PPIs) are losing ground to UPI for smaller transactions.

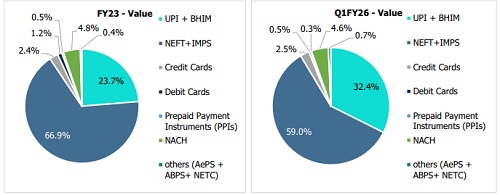

Chart 3: Digital at the Core, Cash at the Edge: India’s Evolving Payment Landscape

NEFT and IMPS still dominate with a majority share, but their share has declined gradually compared to FY23. UPI (including BHIM) has emerged as a key driver of structural growth, increasing its value share. This underscores UPI’s growing releva expanding nce not just in terms of volume, but also in higher-value transactions, which is a signal of maturity and merchant adoption. Cards remain stable, while PPIs continue to decline, signalling displacement by UPI. NACH holds steady, anchoring recurring and bulk flows, and Others (AePS, APBS, NETC) remain niche but relevant for inclusion and specialised use cases.

Chart 4: Retail Payment Instruments: Divergent Growth Trajectories

Some of the key initiatives for each of these payment instruments are discussed below:

* UPI + BHIM: UPI has undergone several policy enhancements, including UPI Lite for offline payments, UPI123Pay for feature phones, and increased transaction limits for specific categories such as IPOs, insurance, and education. The standard limit for peer-to-peer (P2P) transfers is Rs 1 lakh per day, while person-tomerchant (P2M) transactions can go up to Rs 10 lakh for select sectors. UPI supports a wide range of transactions, including bills, subscriptions, travel, investments, and foreign exchange payments. Security is ensured through two-factor authentication, UPI PIN, device binding, and tokenisation.

* NEFT + IMPS: It continues to play a vital role in mid-to-large value transfers despite UPI’s dominance. NEFT operates in half-hourly batches and is available 24/7, while IMPS offers real-time fund transfers. NEFT has no upper limit, whereas IMPS allows transactions up to Rs 5 lakh. These systems are commonly used for business payments, interbank transfers, and higher-value individual transactions. Security is maintained through encrypted banking channels, OTP verification, and secure login protocols.

* Credit Cards: The use of Credit cards is fuelled by rising consumer credit adoption, e-commerce expansion, and attractive EMI options. Credit cards have undergone key policy changes, including mandatory tokenisation and enhanced card control features. Transaction limits vary by issuer, typically ranging from Rs 1 lakh to Rs 5 lakh per day. They are widely used for retail purchases, travel, dining, subscriptions, and lifestyle spending. Security features include CVV verification, OTP-based authentication, biometric login, and fraud monitoring systems.

* Debit Cards: Historically popular for ATM and POS transactions, debit cards are witnessing a sharp decline in usage due to the convenience of UPI and its zero Merchant Discount Rate (MDR). Limits vary by bank, typically ranging from Rs 25,000 to Rs 1 lakh per day. These are still being used for ATM withdrawals, POS payments, and online purchases. Security is ensured through PIN-based authentication, tokenisation, and biometric options.

* PPIs: The usage of PPIs has declined due to UPI wallet integration and regulatory constraints. Non-KYC wallets have a transaction limit of Rs 2,000, while full-KYC wallets can transact up to Rs 1 lakh per month. PPIs are mainly used for small-ticket purchases, mobile recharges, and transit payments. Security includes wallet PINs, OTPs, device binding, and biometric login.

* NACH: NACH remains a stable instrument for processing bulk recurring transactions, such as salaries, subsidies, pensions, EMIs, and utility bills. It is mandate-based with no fixed transaction limit. Recent enhancements include eNACH and API-based mandates. Security is ensured through encrypted file processing and audit trails.

* Others (AePS, ABPS, NETC): AePS allows biometric withdrawals with a Rs 10,000 per transaction limit, while ABPS is used for subsidy disbursements based on mandates. Both systems rely on biometric authentication and encrypted processing for security. NETC has transaction limits ranging from Rs 2,000 to Rs 5,000 and is being expanded to support QR and NFC-based payments. Security is maintained through encrypted transactions and secure tag management.

Chart 5: Financial Inclusion and Internet Penetration: Twin Catalysts for Growth in Digital Payments

The continued rise in financial inclusion will serve as a structural tailwind for UPI’s future growth. As more individuals gain access to bank accounts, credit, and digital infrastructure, the addressable base for UPI expands significantly. Enhanced financial literacy, increasing merchant onboarding, and government-backed initiatives promoting digital payment ecosystems will further deepen usage beyond peer-to-peer transfers. Internet connectivity in India has strengthened steadily, driven by the increasing affordability of smartphones and low-cost data plans. This expanding connectivity broadens the digital payments user base, directly supporting the sustained growth of UPI. Higher teledensity not only broadens the user base but also supports transaction frequency and diversity, making it a critical growth lever for India’s digital payments ecosystem.

The Future of Payments Is Hybrid — Digital for Convenience, Cash for Certainty

Despite the rise of a digital-first economy, cash remains a vital component of the payment system due to its reliability, inclusivity, and widespread accessibility, especially in rural and informal sectors. It serves as a crucial fallback during crises, such as natural disasters or system failures, when digital payments are not feasible. Furthermore, cultural practices and established trust in physical currency ensure its enduring relevance. Therefore, while digital payments are growing, cash remains deeply embedded in the consumption cycle, supporting continuity, particularly during economic shocks and ensuring a hybrid and resilient payment ecosystem.

Chart 6: Share of cash in PFCE

India's payment landscape is undergoing a significant shift, with the share of digital transactions in PFCE increasing from 30% in FY23 to 50% in Q1 FY26, driven by UPI adoption, policy changes, and evolving consumer behaviour. Despite this growth, cash remains resilient, maintaining a 50% share in PFCE. The current 50:50 split represents a tipping point, suggesting that the digital segment has substantial headroom for growth. Cash will persist as a complementary asset, ensuring a hybrid and resilient payment system. Cash's continued relevance is also attributed to its role in personal budgeting and cultural practices, as well as its function as a hedge against systemic risks, such as cyberattacks or network failures. While digital payments have grown rapidly, cash will continue to be embedded in India’s consumption cycle.

CareEdge Research’s View

While UPI has revolutionized payments in India, several challenges remain. The rapid growth of digital payments introduces heightened fraud risks, necessitating robust security and monitoring frameworks.

“UPI transactions have registered phenomenal 49% CAGR between FY23 and FY25, underscoring rapid adoption with rising internet penetration as well as deepening penetration in tier 2 and tier 3 cities. However, its zero-MDR framework challenges long-term sustainability. The next growth phase will hinge on smart monetization through value-added services like micro-credit, merchant analytics, insurance, and fintech partnerships, ensuring UPI remains both accessible and economically self-sufficient,” said Tanvi Shah, Senior Director at CareEdge Research.

India's payments system is undergoing a structural shift towards a hybrid model, where digital and cash channels coexist, serving distinct yet complementary roles. Supported by a conducive regulatory environment and innovations that enhance interoperability, UPI is well-positioned to consolidate its role as the backbone of India’s payments landscape, driving both transactional efficiency and broader economic participation.

“From 70% share of cash usage in Private Final Consumption Expenditure (PFCE) in FY23 to 50% in Q1FY26, India has been witnessing a payments system revolution, where cash and digital transactions will co-exist to drive financial inclusion and power a truly inclusive economy,” said Kalpesh Mantri, Assistant Director at CareEdge Research.

Above views are of the author and not of the website kindly read disclaimer