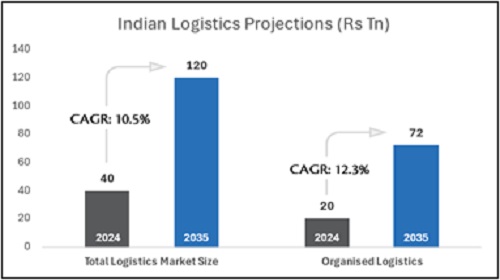

India`s logistics sector to triple in size to ~Rs 120 trillion by 2035: OmniScience Capital

According to a report by Omniscience Capital, India’s logistics sector is expected to grow threefold to approximately Rs 120 trillion over the next decade. The growth comes on account of a Capex 'supercycle' and strong infra-push. Notable highlights include the Rs 185 trillion National Infrastructure Pipeline, the PM Gati Shakti initiative, which comprises strategic investments in dedicated freight corridors, policy reforms, strategic global positioning, and the adoption of digital technologies.

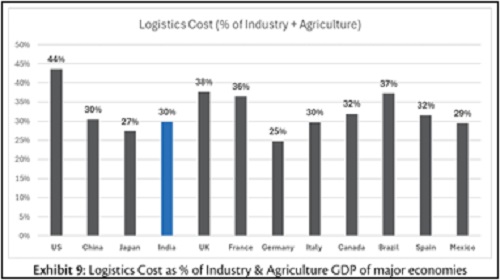

India’s GDP is expected to increase from $4.2 trillion in 2025 to $10 trillion by 2035. Industry and Agriculture are expected to contribute 40% of this growth, or $4 trillion. With logistics costs in India equaling 30% of the agri-industry GDP, the value of the logistics sector is estimated at $1.2 trillion (or ~Rs 120 trillion, assuming Rs 97 = $1 in 2035).

Ashwini Shami, President and Chief Portfolio Manager at OmniScience Capital, said “India's logistics sector is on the verge of a multi-decade boom, fueled by record infrastructure investment and sweeping reforms. Government initiatives, such as the National Infrastructure Pipeline, PM Gati Shakti, and the National Logistics Policy, directly address the sector's inefficiencies. Meanwhile, digitalization and the Goods and Services Tax (GST) are accelerating the formalization of the largely fragmented logistics industry.”Besides significant government investments in roads and infrastructure development, key growth drivers for the logistics sector include the increase in manufacturing output, which is supported by programs such as Make in India and Production-Linked Incentive schemes. The sector's adoption of digitization through the Unified Logistics Interface Platform, e-way bills, and RFID-enabled tracking has increased efficiency. Meanwhile, policies such as GST 2.0 and the National Logistics Policy are formalizing the sector. Up to 60% of the logistics industry is expected to be formalized by 2035. However, the report suggests that nearly 80% of the sector remains unorganized, dominated by small fleet owners and fragmented operators. Furthermore, India is positioning itself as a node in global trade by developing the India-Middle East-Europe Economic Corridor (IMEEC), a multimodal network of ports, railways, and roadways. The corridor is expected to reduce costs and transit time, enabling further growth of the logistics sector in India.

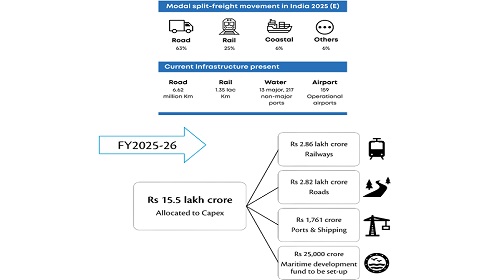

India’s current modal split for freight transportation is approximately 63% by road, 25% by rail, and 6% by coastal shipping. The overreliance on less efficient road freight is due to the underinvestment in rail and shipping infrastructure, as seen in the USA and China, where the figures stand at 40% and 55%, respectively. Nevertheless, the central government's infrastructure spending has increased from 2.1% of GDP in 2021 to 3.1% in 2025. According to the report, infrastructure spending is expected to reach approximately 5% by 2030 due to estimated cumulative investments of Rs 105 lakh crore. The government's push for infrastructure-focused growth is also evident in the country's performance on the World Bank's Logistics Performance Index (LPI). India improved 16 positions, ranking 38th in the latest report from 2023, up from 54th out of 139 countries in 2014.

Once-in-a-generation transformation in the logistics sector

With robust policies, investment support from the central government, and formalization, India's logistics transformation is a promising long-term investment opportunity. As a result, the sector is expected to evolve from a cost burden to a strategic growth driver for India's $10 trillion economy by 2035. Growth in components such as multimodal logistics parks, warehousing, rail freight, the cold chain, and third-party logistics will boost trade, create jobs, and establish India as a global logistics hub.

Above views are of the author and not of the website kindly read disclaimer