India`s Investment & Wealth Management Market Set to Double by 2030: Equirus Wealth

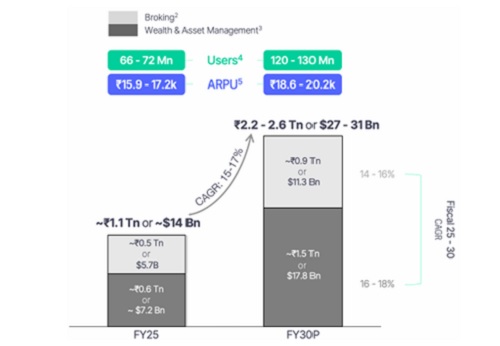

India’s Investment & Wealth Management market is set to double by 2030. The total addressable market for Investment & Wealth Management is likely to grow from $14 bn in FY25 to around $27-31 billion by FY31,implying a CAGR of 15-17% over the next five years (FY25-30) driven by rising investor participation and higher per-user revenues, this accordingto a mediapress note released by EquirusWealth-a unit of Equirus group, India’s leading investment banking and financial services powerhouse.

In the past decade, the industry has shifted from transactional product distribution to holistic, advisory-led wealth management built on transparency and client alignment. The transformation of wealth industry is driven by the advent of dedicated Family Offices, access to Global Investment solutions, One Stop solution providing – Estate Planning, Taxes, Insurance & Wealth solutions and Alternate Accessible Investment solutions.

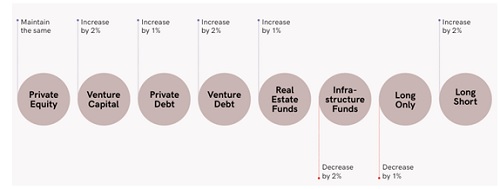

Average Change in Allocation within AIF Portfolio in next 3 years

Investors’preference is shifting toward venture and long–short strategies. Over the next three years, AIF investors plan to increase exposure to venture capital, private debt, and long–short funds, reflecting a tilt toward higher-yield and flexible investment strategies.

Family Offices

India’s Family offices plan to lift alternative allocations by nearly 5% from the current ~10% over the next three years, with private equity, venture capital, and long-only funds taking the largest share and expected to grow further.Over the next three years, AIF investors plan to increase exposure to venture capital, private debt, and long–short funds, reflecting a tilt toward higher-yield and flexible investment strategies.

SIF could be a ‘Game Changer’

Specialized Investment Funds (SIFs), the recently approved product from SEBI, could be a game changer for the Indian Wealth Industry. The bullishness is primarily due to a range of reasons ranging from the flexibility the product provides in terms of investment strategies. The product allows the asset manager to go long as well as short on the market, thereby giving the benefit to investors in either case of market fall or rise. The key point being, lower entry barrier in the form of ticket size that is only Rs 10 lakh.

Financial Sector Resilience a Pre-condition to Bharat’s 2047 Mission

India is confidently progressing towards a developed-nation status by 2047. Achieving this vision will require resilient and sustainable economic growth, supported by a strong financial services ecosystem. As GDP aims to grow 10x, financial assets must expand nearly 20x -demanding a vibrant, well-capitalised sector. The key drivers of scale and innovation will be wealth management, asset management, stock broking, and lending.

UHNWIs could double, narrowing the gap with China

As per Hurun report, the UHNWIs in India ($12Mn – 14Mn+) could double to 1,30,000 bringing India much closer to China’s current level in the next decade. The affluent households (US$1Mn) could rise from 872k to 1.7–2 million. HNIs ($1.2Mn - 1.4Mn+) may grow from 5,90,000 to 1.2 million+, driven by formalization of savings and rising stock market participation. International UHNWIs ($24Mn – 30Mn+) will likely cross 30,000 households, signaling India’s growing global wealth footprint.While China’s wealth story was powered by rapid industrialisation and urbanisation, India’s wealth surge is expected to be fuelled by technology, services, entrepreneurship, manufacturing expansion, and global capital inflows.

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on Pre-market comment for Friday February 6 by Hitesh Tailor, Research Analyst, Choice...