India-EU FTA to unlock US$ 4-4.5 Billion Export Potential for India’s RMG Sector by CareEdge Rating

Synopsis

* The ready-made garment (RMG) sector contributes a significant share of around US$525 billion to the global textile and RMG trade. The European Union (EU) is the world’s largest RMG market, with imports of nearly US$84 billion (excluding trade among EU countries) in CY24.

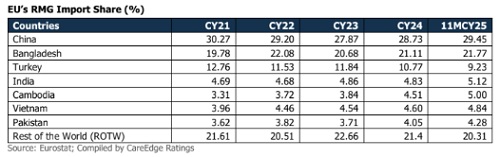

* India currently exports US$4.5-5 billion of RMG to the EU, holding ~5% share of the EU’s RMG market. Unlike India, key competitors such as Bangladesh, Turkey, Vietnam, Pakistan, and Cambodia enjoy duty-free access.

* With the suspension of Generalised Scheme of Preferences (GSP) benefits from January 01, 2026, duties on India’s apparel exports to the EU have increased from 9.6% to 12%, further widening the tariff gap and impacting India’s competitiveness.

* The India–EU FTA is therefore critical to improve competitiveness of Indian RMG exporters. The agreement is called the “Mother of All Trade Deals” because it creates a level playing field for accessing the EU’s RMG market, which is likely to reach US$105 billion shortly (already at ~US$94 billion in 11MCY25).

* Upon implementation by 2027, India will gain a 12% duty advantage over China, which currently holds the largest market share of nearly 30% in the EU’s RMG imports. India is expected to gradually increase its market share from 5% to 8-9% in the EU’s RMG imports, unlocking an incremental annual export opportunity of nearly US$4-4.5 billion over the medium term.

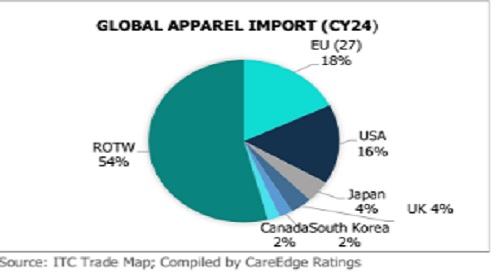

Global RMG Industry

The RMG segment accounted for a significant share of around US$525 billion of the global textile and RMG trade, which stood at around US$900 billion in CY24. Major markets include the European Union (EU), the United States of America (USA), the UK, Japan, Canada, and South Korea, which together accounted for nearly 44% of global imports in CY24.

In CY22, the EU and the USA together accounted for nearly 40% of global RMG imports. However, their combined share declined in CY23 and CY24 due to inflation and higher interest rates in these economies, which impacted consumer discretionary spending. The EU, however, remains the world’s largest RMG market, with imports of around US$84 billion in CY24, although consumer spending is expected to recover gradually.

Countries such as Bangladesh, Turkey, Vietnam and Pakistan enjoy duty-free access to the EU market, while Cambodia benefits from zero tariff on certain high-value apparel. Following the Vietnam-EU FTA effective from August 01, 2020, Vietnam’s share in the EU’s RMG imports increased from 3.90% in CY20 to 4.84% in 11MCY25.

However, overall gains remained limited due to Vietnam’s insufficient backward integration and the EU’s ‘fabric- forward’ rule, which restricts the use of imported fabrics from third countries (except the EU or countries with a separate active FTA with the EU) to qualify for duty-free access.

China continues to command the largest share despite a 12% most favoured nation (MFN) tariff, supported by high productivity and scale in man-made fibres (MMF). India’s GSP suspension from January 01, 2026, increased the duty on India’s apparel exports to the EU from 9.6% to 12%, widening the pre-existing gap vis-à-vis duty-free competitors and thereby impacting India’s competitiveness.

RMG export opportunities for India due to the India-EU FTA

With exports worth US$4.5 billion and US$4.75 billion in CY24 and 11MCY25, respectively, India holds ~5% market share in the EU's RMG imports. At the same time, Bangladesh, Turkey, Vietnam, and Pakistan enjoy duty-free access, giving them a 12% tariff advantage over India. Hence, the India-EU FTA is the need of the hour for India, not only to maintain its market share but also to neutralise the impact of the 50% tariff announced by the US Government. It is described as the “Mother of All Trade Deals” because it creates a level playing field for accessing the EU’s nearly US$105 billion RMG market, the largest in the world.

Once fully implemented by 2027, India will have a clear 12% duty advantage over China, which presently holds the largest market share in the EU’s RMG imports with exports of US$27 billion in CY24. China is expected to lose its share in the EU’s RMG market due to the ‘China Plus One’ sourcing strategy adopted by global apparel brands and retailers. Additionally, socio-political uncertainties in Bangladesh may also lead apparel brands and retailers with a significant presence in the country to diversify their sourcing, thereby benefiting India, among others.

Against this backdrop, India is expected to gradually increase its market share from 5% to 8-9% in the EU’s RMG imports, translating into an incremental annual export opportunity of around US$4-4.5 billion in the medium term. To fully capitalise on this potential, Indian manufacturers must expand their capacities to meet the expected surge in demand. India’s increased competitiveness post-duty removal and continued favourable policy regimes in India, such as removal of Quality Control Order (QCO) on polyester yarn, the PM Mega Integrated Textile Region and Apparel (PM MITRA) park and the Production Linked Incentive (PLI) scheme, is expected to aid the sector in becoming more cost competitive and thereby grab these additional export opportunities.

CareEdge Ratings’ View

India has historically faced a relative tariff disadvantage in the EU market, as key competitors enjoy duty-free access. Despite this, India maintained a steady 5% share in the EU’s RMG imports over the years. In this backdrop, the recent increase in duties from 9.6% to 12% on India’s exports to the EU, effective from January 2026, following our removal from GSP benefits, has further widened the competitive disadvantage, thereby making the India–EU FTA both timely and essential. “India’s RMG exports grew by around 4% in CY25 to US$16.26 billion despite the imposition of 50% US tariff w.e.f. August 27, 2025, mainly due to frontloading of some of the orders and the benefits of geographical diversification of exports. Despite the expectation of a sharper decline of 10-15% in RMG exports to the USA in CY26, assuming no rollback of tariffs, the overall RMG exports are expected to decline only marginally by ~5%, benefitting from the cushion provided by diversification to newer markets and benefits from implementation of the India-UK FTA,”

stated Krunal Modi, Director at CareEdge Ratings. He further added that India is expected to surpass RMG exports of US$20 billion in CY27 even if elevated US tariffs are sustained, as benefits kick in from various bilateral trade deals with the UAE, Australia, European Free Trade Association (EFTA), the UK, Oman, New Zealand and the EU. “With a 12% duty advantage over China post implementation of the India-EU FTA, level playing field vis-à-vis other major competing nations and prevailing socio-political uncertainties in Bangladesh, India is well-positioned to gradually increase its market share in the EU’s RMG market from 5% to 8-9% over the medium term. The India– EU FTA is expected to unlock nearly US$4-4.5 billion of incremental annual export opportunities for the RMG sector and act as a catalyst for large-scale investments across the textile value chain, generating employment, particularly for women and enhancing foreign exchange earnings for the country,” said Ranjan Sharma, Sr. Director at CareEdge Ratings.

Above views are of the author and not of the website kindly read disclaimer

.jpg)