India Decodes the Future - 2,400 GCCs, 2.8M Careers by 2030 – FICCI-ANAROCK

Beating macro-economic and geopolitical headwinds, India’s office market in 2025 demonstrated marked resilience, with all-time high office space leasing across the top 7 cities. This surge is driven by the Global Capability Centres (GCCs), which now account for more than 40% of total gross leasing in these cities.

Moreover, India is poised to host more than 2,400 GCCs by 2030, employing over 2.8 Mn professionals, reveals the FICCI-ANAROCK report ‘Workplaces 2025: India Commercial Real Estate Reimagined’, released at the 3rd Edition of FICCI Commercial Real Estate Conclave in Bangalore today.

“By 2024-end, India hosted over 1,700 GCCs, employing more than 1.9 million professionals,” says Anuj Puri, Chairman – ANAROCK Group. “Over the years, India’s GCC landscape has expanded rapidly, with its market size rising from USD 30 Bn in 2019 to approx. USD 64 Bn in 2024. This growth is fuelled by an ever-increasing demand from key sectors like IT/ITeS, BFSI, Healthcare & Life Sciences, and Engineering Research & Development (ER&D).”

“The momentum is expected to continue,” says Puri. “The Indian GCC market is projected to reach a market size of USD 105 – 110 Bn by 2030, growing at a CAGR of 10%. The sector’s ability to attract and retain global talent, coupled with India’s cost efficiency and its skilled captive workforce, continues to fuel demand for premium office spaces. Further, India’s GCC footprint is rapidly expanding beyond the top 7 cities, spreading steadily into Tier 2 cities such as Jaipur, Indore, Surat, Kochi, and Coimbatore. These cities are gaining increasing prominence as the next GCC growth hubs.”

Growth Snapshot:

- In 2025, GCCs accounted for over 32.5 Mn sq ft of the total gross office leasing (80.5 Mn sq. ft.) across the top 7 cities.

- Bengaluru continues to lead India’s GCC landscape, backed by its deep talent pool, well-developed ecosystem, and sustained global investment interest. In 2025, the city captured more than one-third of the country’s total GCC leasing, maintaining a clear edge over other markets.

- Pune followed with a 15% share, while Delhi-NCR and Hyderabad accounted for 14% - reflecting their growing appeal, but still trailing Bengaluru’s dominant position.

Raj Menda, Chairman - FICCI Committee on Urban Development and Real Estate & Chairman of Supervisory Board, RMZ Corp, states, “For three decades, India’s office real estate market was largely viewed as a cost line to be managed. Today, it is a strategic lever. It shapes where global capital is deployed, where high-value jobs are created, and where India’s young workforce chooses to live. In that sense, Grade A buildings are no longer just piles of concrete and glass – they are operating systems for productivity, culture, technology, and climate resilience.”

“As this report documents, India’s top 7 cities already host around 800 million sq. ft. of Grade A office stock, with Bengaluru and the NCR together accounting for nearly half of that universe. Net absorption in 2025 has been over 58 Mn sq. ft., with gross leasing of over 80 Mn sq. ft. – adding yet another record-breaking year.”

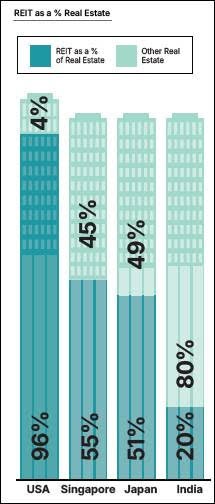

Indian Vs. Global REITs

The report also highlights Indian office real estate’s structural transformation with the introduction of five listed Real Estate Investment Trusts (REITs). These have effectively ‘democratized’ property investments, allowing retail investors to participate in a previously institutional-dominated asset class.

While India joined the REIT bandwagon later than many global counterparts (the country’s first REIT was listed only in 2019), it has swiftly reached a market capitalization of nearly USD 18 Bn - driven by just five listed REITs.

India’s REIT market is growing steadily but still accounts for only about 20% of the country’s total institutional real estate. This is markedly lower than in mature markets like the US, Singapore, and Japan.

However, the landscape is widening in tandem with the sector’s rapid evolution. Future growth will be driven by diversification into alternative asset classes such as data centres, logistics parks, and retail malls, reflecting changing investor preferences and occupier trends.

Residential REITs may be slower to materialize given regulatory and market complexities; however, it is reasonable to expect progress in this direction eventually.

With increasing institutional participation, policy support, and expanding asset inclusion, India’s REIT penetration could climb to 25-30% by 2030 - positioning it among the world’s most dynamic and rapidly expanding USA REIT ecosystems.

Other Report Highlights

- FDI inflows in India rose to a provisional USD 81.04 billion in FY 2024-25, a 14% increase from USD 71.28 billion in FY 2023-24, underscoring India’s continued appeal as a preferred investment destination

- India’s office real estate market maintained strong development pace through 2025, with new completions surpassing 51 Mn sq. ft - an 8% rise against 2024

- Regionally, the southern markets continued to dominate India’s office supply pipeline, collectively contributing around 51% of the total new additions

- The outlook remains positive, with sustained demand for premium offices, growing global interest, and India’s workplaces evolving from cost centres to strategic assets

- Office demand is diversifying, with coworking (23%), BFSI (18%), consultancy, & manufacturing gaining ground alongside IT/ITeS

- Favourable government policies & states’ proactively formulating their GCC policies showcase India’s preparedness to leverage and propel demand

Above views are of the author and not of the website kindly read disclaimer

.jpg)

More News

Chef Vikas Khanna Joins Hands with Lotus Petal Foundation?s to Support Education for Underpr...