India budget shifts spending priorities while keeping fiscal deficit in check

India struck a balance between greater spending on jobs and rural development as well as transferring more funds to states, while narrowing the fiscal deficit, the 2024-25 budget unveiled on Tuesday showed.

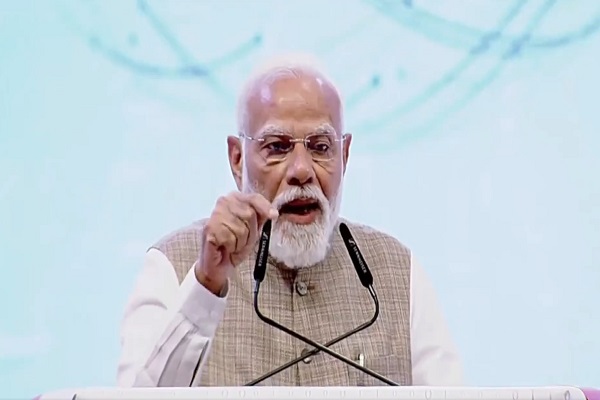

The budget comes on the heels of last month's election setback in which Prime Minister Narendra Modi's Bharatiya Janata Party (BJP) returned to power only with the help of allies.

The government expects the economy to grow at 10.5% in nominal terms, which includes inflation, in 2024-25, with inflation-adjusted real growth seen at between 6.5-7%.

It lowered its fiscal deficit target for the fiscal year to 4.9% of GDP, from the 5.1% target set in the interim budget in February and 5.6% in the previous year.

It lowered its gross borrowing target to 14.01 trillion rupees ($167.40 billion), said it still plans to spend a record 11.11 trillion rupees on longer-term infrastructure and marginally raised its revenue expenditure, which includes more near-term spending.

Overall the government's spending has risen a modest 1.2% since February to 48.2 trillion rupees.

The sharpest increase, of 12.6%, was in funds transferred to states, including to the BJP allies-ruled states of Andhra Pradesh and Bihar.

Spending on home affairs, urban development and agriculture also rose compared to estimates in the interim budget.

While the government spoke of increased focus on jobs and rural areas, spending on its flagship schemes rose only marginally due to an increase in funds for the affordable housing scheme.

Money allocated to the rural employment guarantee scheme was flat.

The government's tax collection estimates were largely unchanged, with net earnings from tax revenues at 25.8 trillion rupees.

Non-tax revenues rose significantly due to a large $25 billion surplus transfer from the central bank earlier this year.

Outside of budget allocations, the government raised the tax rate on capital gains from equity investments and also increased the levy on derivative trading.

Since their COVID-19 lows in March 2020, India's stock indexes have surged more than 200% each, which India's chief economic advisor flagged as a risk in a report released ahead of the budget.

Retail investors have also jumped into the riskiest corners of the market and now account for 41% of overall derivative trading volumes, compared with just 2% in 2018.

The government also provided some tax relief to low-income consumers, by raising the minimum income limit beyond which tax is imposed.

It also widened the income band which attracts the lowest tax rate.