Index began week flat, saw profit booking at highs after last week`s rally - ICICI Direct

Nifty :26250

Technical Outlook

Day that was…

The equity benchmark began the week on a subdued note after registering a fresh all-time high. The Nifty settled at 26,250, down 0.30%. Notably, Midcap index closed negative after hitting fresh all-time high, while Smallcap index outperformed, gaining 0.40%, indicating selective risk appetite. On the sectoral front, Realty, Consumer Durables, and FMCG stocks stayed in focus, whereas IT and Oil & Gas emerged as relative underperformers.

Technical Outlook:

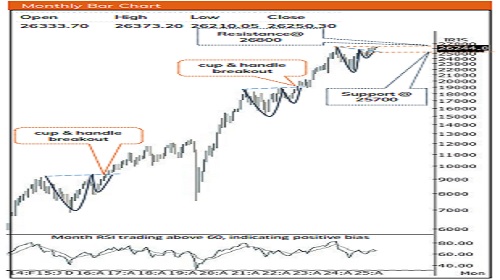

* The index opened on a flat note and witnessed heightened volatility, oscillating within a broad ~160-point range. The daily price structure formed a bearish candle with long wicks on both ends, indicating breather.

* Key point to note is that, index witnessed breather post ~500 points of sharp rally last week, signaling a healthy consolidation. We view the ongoing price action as a temporary pause within the broader uptrend rather than a trend reversal. Going ahead, we reiterate our constructive outlook and expect the Nifty to resume its upward trajectory, with potential to extend the rally towards 26,800 during January.

* In the process, bouts of volatility owing to global development and onset of earning season would present incremental buying opportunity wherein strong support is placed at 25700.

Our constructive bias is further validated by following observations:

1. Bank Nifty: Four weeks decline entirely retraced back in just a single week, propelling index to clock a fresh All Time High

2. The ratio chart of MSCI India vs MSCI World has once again bounced from cyclical lows which has been held since CY21, indicating relative outperformance against global equities going ahead

3. Broadening of rally: The rally has broadened significantly over past two weeks with 53% of the stocks are trading above their 50 days SMA compared to 27% 2 weeks ago

4. Sectors in focus: Banking continues to lead supported by Auto and Metal while revived traction in beaten down sectors like Power, PSU, Realty augurs well for broadening of rally going ahead

Key Monitorable for the next week:

a) Q3-FY26 earnings

b) US-India Trade Deal

c) Quarterly Business updates

d) Brent Crude Oil has remained soft and trading near lower band of consolidation. Breakdown below 58 would result into extended correction

Intraday Rational:

* Trend- Higher High-Low structure, indicating uptrend is intact

* Levels: Buy near 50% retracement level of last 4 days up-move (26130-26506)

Nifty Bank : 60044

Technical Outlook

Day that was:

Bank Nifty concluded the day on a marginally negative note, at 60044 (0.16%), after clocking a fresh All time high. Nifty PSU Bank Index relatively outperformed gaining 0.4%.

Technical Outlook:

* The index started the week on flat note and witnessed profit booking at elevated levels, indicating breather after sharp up move in last week. As a result, the daily price action formed a bear candle carrying higher highlow pattern, indicating profit booking at higher levels

* Key point to highlight is that, post four days rally of ~1700 points, Index witnessed a pause indicating healthy consolidation. Going ahead we maintain our positive outlook and expect Bank Nifty to accelerate its upward momentum and head towards 61500. Hence any dips from current levels should be viewed as buying opportunity as key support is placed at 59300 being 20- day EMA coinciding with 61.8% retracement of current up move.

* Structurally, Index has retraced its entire 4-weeks decline in a single week, while clocking a fresh all-time high, indicating faster pace of recovery.

* Within the banking space, the Nifty PSU Bank Index also witnessed breakout from 4 weeks trading range (8650- 8063)and now Going ahead we expect it to head towards 9200 levels being measuring implication of range breakout in coming weeks.

Intraday Rational:

* Trend- Higher High-Low structure, indicating uptrend is intact

* Levels: Buy near 61.8% retracement level of last 4 days upmove (59587-60537)

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Nifty OI: Weekly ? 26,000 CE & 25,500 PE; Monthly ? 26,000 CE & 25,000 PE - Geojit Investmen...

.jpg)