In Q3FY26, NIMs Pressures Persist, while Easing Marginally Sequentially by CareEdge Ratings

Synopsis

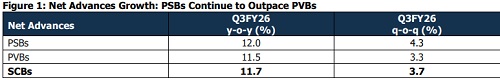

• In Q3FY26, select scheduled commercial banks (SCBs) have reported an aggregate 11.7% year-on-year (y-o-y) increase in net advances, while deposits grew by 9.1% y-o-y.

o For Advances, public sector banks (PSBs) recorded a stronger growth of 12.0% y-o-y, driven by momentum in the retail and micro, small and medium enterprise (MSME) segments. In comparison, private sector banks (PVBs) registered a lower y-o-y rise of 11.5%.

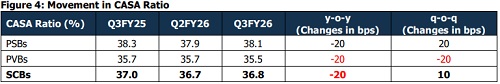

o Meanwhile, PSBs and PVBs deposits grew by 7.5% and 10.6% y-o-y, respectively, in Q3FY26. At the same time, the current account savings account (CASA) ratio of SCBs declined by 20 basis points (bps) to 36.8%, compared to 37.0% in Q3FY25.

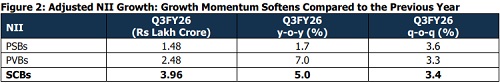

• Adjusted Net Interest Income (NII) of these select SCBs reached Rs 3.96 lakh crore, growing at a slower pace of 5.0% y-o-y in Q3FY26, compared to the 8.2% growth reported in Q3FY25. Excluding one-off items, the SCBs' NII would moderate to 4.1% y-o-y in Q3FY26.

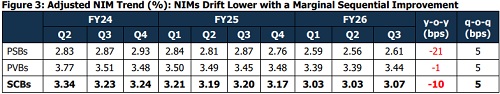

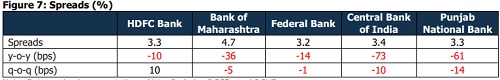

o The adjusted net interest margin (NIM) declined by 10 bps y-o-y to 3.07%, reflecting faster transmission of lending rate cuts compared to slower deposit repricing. Growth in higher-yielding segments remained gradual amid the ongoing shift from secured to unsecured lending. Excluding one-offs, NIM would have declined 13 bps.

o On a sequential basis, NIMs inched up across SCBs by five bps, with both PSBs and PVBs recording a fivebps improvement, supported by loan mix and deposit repricing.

• SCBs reported a 11.7% y-o-y growth in net advances in Q3FY26, driven primarily by festive seasonal demand and impact of GST rate cuts, especially on housing, automobiles and white goods. Within the sector, PSBs continued to outpace PVBs marginally, posting 12.0% y-o-y growth, compared with 11.5% for PVBs.

• Sequentially, net advances rose by 3.7% for SCBs, with PSBs and PVBs recording growth of 4.3% and 3.3%, respectively, reflecting sustained loan momentum during the quarter. Growth was supported by steady retail demand, continued traction in MSME lending, and ongoing disbursements in infrastructure, housing, and working capital loans.

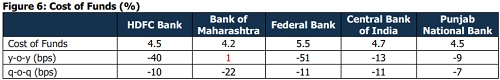

• In Q3FY26, SCBs reported a moderation in adjusted NII growth to 5.0% y-o-y compared to 8.2% last year, largely driven by the narrowing of spreads. This was attributed to lending yields repricing downward faster than banks could reduce their cost of funds, owing to benchmark-linked loan resets, while deposit repricing lagged. Within the sector, PVBs reported stronger NII growth of 7.0% y-o-y, supported by better pricing power, incremental lending and favourable product mix. In contrast, PSBs recorded modest NII growth of 1.7% y-oy in Q3FY26. However, this was impacted by the non-recurrence of around Rs 800 crore of one-off income recognised by one PSB in Q3FY25 from IT refunds and interest on NPA/TWO accounts. Without adjusting this one-off, aggregate PSBs’ NII would have declined by 0.4% y-o-y, reflecting the high base effect.

o In Q3FY26, interest income of SCBs rose by 2.2% y-o-y, PVBs rose by 1.1% y-o-y, while PSBs grew at 3.7% y-o-y.

o Meanwhile, interest expenses of SCBs rose marginally by 0.2% y-o-y in Q3FY26. While PVBs reported a 3.3% y-o-y decline, reflecting a better funding mix and faster repricing of incremental and rollover deposits, PSBs saw a 4.9% y-o-y increase, driven by a declining CASA ratio and a higher reliance on costlier term deposits.

• Sequentially in Q3FY26, NII for SCBs saw an increase of 3.4%. Among SCBs, PVBs reported an uptick of 3.3%, while PSBs registered an increase of 3.6%.

Adjusted NIMs of SCBs declined by 10 bps y-o-y in Q3FY26, reflecting broad-based margin compression. PSBs and PVBs reported y-o-y declines of 21 bps and one bp, respectively. Without adjusting the one-off item, overall PSBs' NIM would decline by 26 bps. The contraction in PSBs was driven by faster growth in lower-yielding loans, while lending rates, particularly on EBLR-linked and home loans, fell more quickly than deposit costs, widening the gap between loan yields and funding costs.

On a sequential basis, SCBs reported a slight five-bps improvement in NIMs, with PSBs and PVBs each saw a fivebps increase, supported by loan mix and incremental repricing of deposits. While margin pressures persist, the sequential uptick indicates early signs of stabilisation, as a substantial portion of the earlier cumulative rate-cut impact on deposits has already been absorbed, while the December 2025 rate cut is yet to reprice and will transmit with a lag.

In Q3FY26, the CASA ratio of SCBs further declined by 20 bps y-o-y to 36.8%, although it increased slightly on a sequential basis. The y-o-y moderation was broad-based across bank groups; however, sequential trends diverged. PVBs witnessed continued pressure, with CASA declining by 20 bps both y-o-y and q-o-q, reflecting sustained challenges in low-cost deposit mobilisation and the impact of RBI’s current account maintenance norms. PSBs recorded modest y-o-y moderation in CASA, though ratios edged up q-o-q, supported by their relatively strong retail deposit franchise. Additionally, the shift from CASA to term deposits reflects depositors’ preference for higher returns amid deposit repricing and competition from alternative investments. At the same time, banks have also supplemented funding through higher-cost certificates of deposit, which have gained traction during periods of deposit tightness.

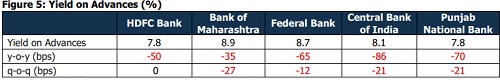

SCBs witnessed a broad-based decline in yields on advances in Q3FY26, with all select PSBs and PVBs reporting yo-y compression. On a sequential basis, yield improvement was limited, with only one PVB maintaining a stable level, and the rest of the banks witnessing a decline, underscoring persistent downward repricing pressures on lending rates.

Conclusion

In Q3FY26, SCBs reported mixed performance with steady loan growth, supported by festive demand in October, strong retail and MSME lending, and GST-led consumption gains in housing, automobiles, and consumer durables. The CD ratio rose to a record 81.7% in December 2025, reflecting healthy credit deployment, alongside comparatively slower deposit accretion. Margins faced pressure due to faster transmission of lending rate cuts, while deposit repricing remained gradual. Sequentially, early signs of margin stabilisation emerged, as a large part of the earlier 100 bps rate cut impact on deposits had already played out. However, the 25-bps repo rate cut in December 2025 has yet to transmit fully, and with deposit repricing typically lagging, NIMs are likely to remain under pressure in Q4FY26 until the benefits of lower funding costs begin to flow through.

Above views are of the author and not of the website kindly read disclaimer

More News

Traders are advised to buy intraday declines, avoid chasing gaps, and watch for sustained ho...