In big win for Tesla, India to lower EV import tax if $500 million invested

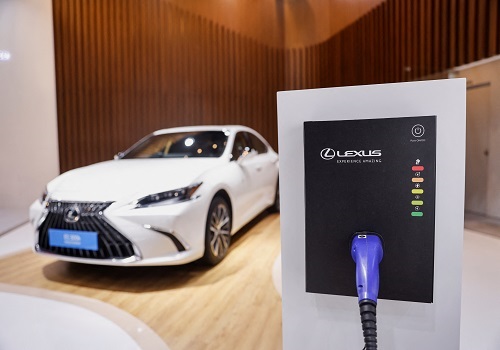

India said on Friday it will lower import taxes on certain electric vehicles for companies committing to at least $500 million in investment and manufacturing facilities within three years, potentially bolstering Tesla's plans to enter the market.

The policy is a big win for Tesla as it's in line with what the company had been lobbying for in New Delhi. Sources said last July that the carmaker had offered to build a factory but, in the meantime, wanted a cut in import taxes that CEO Elon Musk said were among the highest in the world.

For years, Musk has tried to enter the Indian market but New Delhi wasn't keen unless he committed to local manufacturing. Tesla officials visited India several times in recent months, with Musk also meeting Prime Minister Narendra Modi last year.

Companies that meet the investment and manufacturing requirements will be allowed to import a limited number of EVs at a lower tax of 15% on cars costing $35,000 and above. India currently levies a tax of 70% or 100% on imported cars and EVs depending on their value.

Tesla's cheapest vehicle, the Model 3, starts at $38,990 in New York, according to the carmaker's website. The company did not immediately respond to an email seeking comment.

"We invite global companies to come to India. I'm confident India will become a global hub for EV manufacturing and this will create jobs and improve trade," commerce minister Piyush Goyal told reporters at a press briefing after the policy was made public by his ministry.

Goyal said the move will benefit consumers who will get EVs at a cheaper price while also helping the government's objective of reducing oil imports and therefore foreign exchange outflows.

India's EV market is small but growing with domestic carmaker Tata Motors dominating sales. Electric models made up about 2% of total car sales in India in 2023 and the government wants to increase that to 30% by 2030.

The new policy will open the door for global automakers to tap the world's third-largest car market at a time when the pace of growth of EVs is slowing, forcing companies to look for newer markets to boost sales.

Vietnamese EV maker VinFast has said it plans to invest $2 billion in India and last month began construction of a local factory in the southern state of Tamil Nadu.

VinFast had also asked the government to reduce import duties on EVs for about two years so customers can get familiar with its products while its local plant comes on stream.

POLICY IN THE WORKS

India has been working on this policy for several months, Reuters has reported, despite lobbying from Tata Motors and rival Mahindra & Mahindra which fear the lowering of import taxes on EVs would hurt the domestic industry and its investors.

The objective of the new policy is to "strengthen the EV ecosystem by promoting healthy competition among EV players leading to high volume of production, economies of scale, lower cost of production," the commerce ministry said.

This will open up the Indian auto market to new carmakers, suppliers, technologies and the overall EV ecosystem, said Gaurav Vangaal, associate director at S&P Global Mobility.

"Multiple carmakers, who are sitting on the fence, would now like to enter India. Indian consumers would have the choice of experiencing global technologies and products on Indian roads," he added.

Under the new policy, which is effective immediately, EV imports at a lower tax rate will be allowed for a maximum of five years and the total number will be capped at 8,000 a year.

The duty foregone by the government on imported EVs would be limited to the investment made by the company or close to $800 million, whichever is lower.

The investment commitment made by the company will have to be backed up by a bank guarantee, which will be invoked in case the company fails to comply with the policy's mandates.

($1 = 82.8577 Indian rupees)

.jpg)