2025-02-02 09:16:01 am | Source: PR Agency

Highlights of Direct Tax proposals in FINANCE BILL, 2025

Finance Minister Nirmala Sitharaman presented her record 8th consecutive Union Budget 2025-26 today (on February1, 2025) of Modi 3.0 Government. Key highlights of direct tax proposals are as under:

- New Income Tax Bill will be introduced in the next week

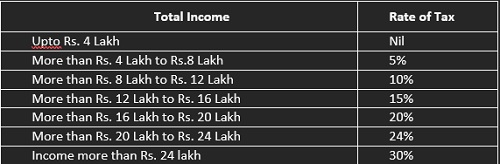

- Salaried Individuals will not have to pay tax upto Rs. 12,75,000/-. New slab rate for Individual/HUF opting new tax regime are as follows:

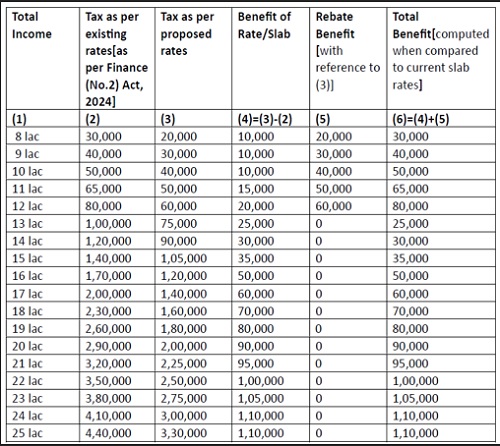

Accordingly, tax benefits by revised slab rate can be summarised as follows:

- Rs. 12,00,000/- under new regime and in consequently the Limit of Rebate enhanced from Rs. 25,000/- to Rs.60,000/- (except for income taxed at special rates).

- Under the new tax regime, Section 87A tax rebate will not available on any special rate income (such as S. 111A, 112 etc). Whereas, for the old tax regime, Section 87A tax rebate is still available on special rate income like STCG covered in Section 111A,LTCG covered in Section 112. Section 87A Rebate was never available on long term capital gain on equity (covered in Section 112A) under both regimes and no changes are made in the budget for the same.

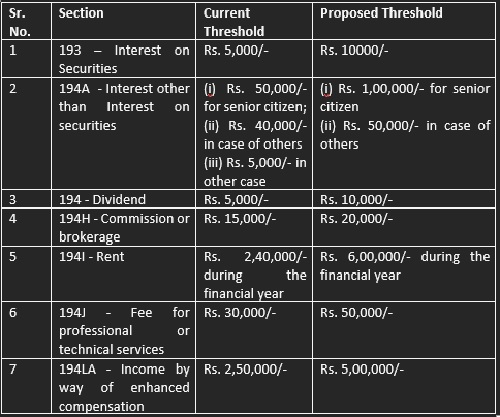

- Limit of TDS on interest for senior citizens increased from Rs. 50,000/- to Rs. 1,00,000/- which will provide greater financial relief to retirees. Further, Limit on Rent enhanced from Rs. 2,40,000/- to Rs.6,00,000/- benefitting small tax payers earning rental income.

- Time limit to file updated return increased from 2 to 4 Years which will allow taxpayers correcting errors or omissions or allows to file ITR if they have not filed ITR.

- Period of Registration of smaller trusts has been increased from 5 to 10 Years on the condition that Total income without giving tax benefit does not exceed Rs. 5 Crore during preceding 2 years.

- Timeline for tax benefits to start-ups has been extended by another period of 5 Years i.e. start ups incorporated before 01.04.2030 will be eligible for deduction.

- As per NPS Vatsalaya scheme Started from 18th September 2024, parents/guardian can open account for minor child future benefit. It is now proposed to provide deduction u/s 80CCD(1B) of Rs.50,000 for contribution made to NPS Vatsalya Account which will be similar to deduction available as per current provisions for employer contribution to NPS available under new old regime.

- Rationalization of Tax deducted as Sources (TDS) Rates - Few summarization is given below

- Provision of higher TDS rate will be applicable only in case PAN is not available and accordingly, provision of higher TDS on payment to non-filers (of return of income) is removed.

- Provision of higher TDS rate will be applicable only in case PAN is not available and accordingly, provision of higher TDS on payment to non-filers (of return of income) is removed.

- The TCS threshold on remittances under the Liberalized Remittance Scheme (LRS) has been raised from Rs 7 lakh to Rs 10 lakh and no TCS will be applicable on goods but TDS on sale goods will continue to apply.

- TCS on education loans up to Rs 10 lakh (from specified financial institutions) will be removed.

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

Kumaraswamy holds FKCCI talks to boost EV sector, se...

Yusuf Pathan, Harbhajan Singh along with their famil...

Evening Roundup : Daily Evening Report on Bullion, B...

Watch! Union Defense Minister Rajnath Singh celebrat...

Regulatory reform needed for Indian collaboration to...

UP CM Yogi Adityanath celebrates Holi at Gorakhnath ...

AAP`s Manish Sisodia celebrates Holi with party work...

Invesco Asset Management (India) announces change to...

Aditya Birla SL AMC announces change in address of C...

South Korean markets in freefall, log steepest drop ...