Gold trading range for the day is 60415-61145 - Kedia Advisory

GOLD

Gold closed marginally lower by -0.01%, settling at 60713, influenced by subdued inflation and signs of economic slowdown in the US. The market sentiment, driven by expectations that the Federal Reserve won't raise interest rates further, was reinforced by increased unemployment benefit claims, providing the Fed with tools to combat inflation. With the Fed likely to maintain rates in December, attention has shifted to when rate cuts might occur. Recent data indicated a slowdown in US consumer inflation and the first decline in retail sales in seven months. Indian buyers defied record local gold prices during Diwali, contributing to gold purchases, while China, a leading buyer, continued accumulating gold holdings, maintaining buoyant premiums. Coin and bar sales picked up, and jewelry demand improved. Dealers in India offered a discount of up to $3 per ounce over official domestic prices, a decrease from the previous week's $4 discount. In China, dealers charged premiums of $43-$58 per ounce over global spot prices, an increase from the previous week's $40-$50. From a technical perspective, the market witnessed long liquidation with a -5.78% drop in open interest to 8111. Gold is currently supported at 60560, with a potential test of 60415. Resistance is expected at 60925, and a breakthrough could lead to testing 61145.

Trading Ideas:

* Gold trading range for the day is 60415-61145.

* Gold steadied underpinned by cooling inflation and signs of slowing economic momentum in the US

* The number of Americans filing new claims for unemployment benefits increased more than expected last week

* Indian buyers brushed off record high local prices making gold purchases during the Diwali festival

SILVER

Silver closed lower by -0.3% at 73140, driven by profit booking following a period of gains. The surge in demand for silver had been influenced by a decline in US 10-year treasury yields and robust Chinese data. However, a pullback occurred as US inflation and unemployment claims data diminished the likelihood of another Federal Reserve interest rate hike next month. The odds for a 0.25% hike in December dropped to just 1%, with traders now anticipating the first rate cut by the Federal Reserve in May 2024, marking a shift in market expectations. Record industrial demand continues to dominate the silver market, contributing to its third consecutive annual deficit. Despite an expected easing in total global physical demand to 1.14 billion ounces, down 10% from the 2022 record, strong industrial demand is projected to persist. In the US, housing starts rose by 1.9% MoM in October, surpassing market expectations and indicating strength in new construction, particularly in response to limited supply in the resale market. From a technical perspective, the market witnessed long liquidation with a -6.21% drop in open interest to 15902. Silver is currently supported at 72690, with a potential test of 72240. Resistance is anticipated at 73795, and a breakthrough could lead to testing 74450.

Trading Ideas:

* Silver trading range for the day is 72240-74450.

* Silver pared gains on profit booking after prices gained as US 10-year treasury yields tumbled.

* US inflation and unemployment claims data hurt the odds for another Fed interest rate hike next month.

* Record industrial demand will continue to dominate the silver market

CRUID OIL

Crude oil soared by 4.51%, closing at 6346, propelled by rumors of the EU planning a fresh sanction package against Russia. Bulgaria's potential end to the exemption for Russian oil imports adds further pressure on Russian oil, potentially escalating global oil prices as the market strives to fill the Russia gap. Despite a surge in prices, the latest EIA data revealed a substantial increase in US crude oil stocks by 17.5 million barrels over the last two weeks, reaching their highest level in 2-1/2 months. However, higher output from non-core OPEC members provided some relief to global supply levels, mitigating the impact of output cuts from major producers like Saudi Arabia and Russia. Moreover, the EIA report indicated a 7.6% decline in fuel product supplied compared to the previous week in mid-November, aligning with the agency's earlier assessment that the oil market may not be as tight as initially anticipated. U.S. oil output from key shale-producing regions is poised to decrease in December for the second consecutive month, with an expected drop to 9.652 million barrels per day, down from an estimated 9.653 million bpd in November, as reported by the EIA. From a technical standpoint, the market observed short covering with a -4.49% drop in open interest to 13420. Crude oil's current support level is at 6184, with a potential test of 6023. Resistance is anticipated at 6430, and a breakthrough could lead to testing 6515.

Trading Ideas:

* Crudeoil trading range for the day is 6023-6515.

* Crude oil gains on rumours that the EU is planning to issue a fresh sanction package against Russia.

* US shale oil output expected to fall in December – EIA

* The latest data from the EIA showed that crude oil stocks in the US rose by 17.5 million barrels in the last two weeks

NATURAL GAS

Natural gas witnessed a significant downturn, closing down by -3.93% at 244.5, driven by record output levels allowing utilities to continue gas injections into storage through late November. Typically, utilities start withdrawing gas from storage by mid-November to meet heating demand. As of Nov. 10, U.S. gas stockpiles were already 6% above normal and were expected to reach 7% above normal by Nov. 17, according to federal energy data. Record-high production levels and ample gas in storage signal a diminishing expectation of winter price spikes in the futures market for 2023-2024. Financial firm LSEG reported a rise in average gas output in the Lower 48 U.S. states to 107.2 billion cubic feet per day (bcfd) in November, up from the previous record of 104.2 bcfd in October. However, recent output trends suggest a potential drop to a preliminary two-week low of 105.7 bcfd. Meteorological projections indicate warmer-than-normal weather until Nov. 21, followed by a shift to colder-than-normal conditions from Nov. 22-Dec. 2. Anticipating colder weather, LSEG forecasts an increase in U.S. gas demand from 112.0 bcfd this week to 126.7 bcfd in two weeks. From a technical perspective, the market observed fresh selling with a 16.84% increase in open interest to 41389. Natural gas is currently supported at 237, with a potential test of 229.4. Resistance is likely at 255.9, and a breakthrough could lead to testing 267.2.

Trading Ideas:

* Naturalgas trading range for the day is 229.4-267.2.

* Natural gas slid on record output that should enable utilities to keep injecting gas into storage

* U.S. gas stockpiles were already 6% above normal in the week ended Nov. 10

* Average gas output in the Lower 48 U.S. states rose to 107.2 billion cubic feet per day (bcfd) so far in November

COPPER

Copper experienced a gain of 0.44%, settling at 711.5, propelled by lower inventories and promising signs of robust demand in the near term. Inventories at the SHFE plummeted on November 17th, leading to an uptick in the Yangshan copper premium, emphasizing the immediate need for the material by firms. The outlook for copper brightened as Beijing pledged to target CNY 1 trillion in manufacturing and infrastructure development, boosting demand. Reports indicating a potential CNY 1 trillion injection by the PBoC into the property sector further fueled optimism. Slowing prices in the US strengthened expectations that the Fed would refrain from further rate hikes, pressuring the dollar and enhancing conditions for manufacturing in economies linked to US credit markets. Notably, China's refined copper production surged by 13.3% to 11.3 million metric tons YoY in October. Copper inventories at SHFE-monitored warehouses declined by 11.0% from the previous Friday. The International Copper Study Group reported a 33,000 metric tons deficit in the global refined copper market in August, compared to a 30,000 metric tons deficit in July. From a technical standpoint, short covering was evident, with a -12.65% drop in open interest to 4411. Copper's current support level is at 707.1, with a potential test of 702.6. Resistance is anticipated at 714.2, and a breakthrough could lead to testing 716.8.

Trading Ideas:

* Copper trading range for the day is 702.6-716.8.

* Copper gains amid lower inventories and signs of robust demand in the near term.

* China's refined copper production in October jumped 13.3% to 11.3 million metric tons year-on-year

* Copper inventories in warehouses monitored by the Shanghai Futures Exchange fell 11.0 % from last Friday.

ZINC

Zinc witnessed a decline of -0.46%, settling at 227.15, influenced by China's refined zinc output in October, which surpassed expectations with a month-on-month growth of 11.14% and a year-on-year increase of 17.6%. The output for the first ten months of the year showed a significant 10.65% YoY rise, reaching around 5.45 million metric tons. Notably, domestic zinc alloy production in October increased by 9,900 metric tons from the previous month. Despite a surge in domestic smelter output to over 600,000 metric tons, concerns emerged about potential output cuts in Yunnan due to power rationing. Meanwhile, London Metal Exchange (LME) data revealed a nearly doubled inventory of zinc, reaching 133,200 metric tons. This surge is attributed to substantial arrivals after months of dwindling stocks, with a 96% increase following inflows into storage facilities in Singapore and Malaysia. The global zinc market displayed a surplus of 489,000 tons in the first eight months of the year, contrasting with a surplus of 156,000 tons in the same period last year, as reported by the International Lead and Zinc Study Group. From a technical perspective, the market saw long liquidation with a -19.66% drop in open interest to 3004. Zinc is currently supported at 226.1, with a potential test of 225.1. Resistance is likely at 228.5, and a breakthrough could lead to testing 229.9.

Trading Ideas:

* Zinc trading range for the day is 225.1-229.9.

* Zinc prices dropped as China's refined zinc output in October, rose 11.14% month-on-month.

* Inventories of zinc in LME warehouses have nearly doubled owing to large arrivals after months of dwindling stocks

* The global zinc market showed a surplus of 489,000 tons during the first eight months of the year

ALUMINIUM

Aluminium closed down by -0.44% at 203.4, influenced by China's October 2023 aluminium production, which reached 3.641 million metric tons, reflecting a 6.7% year-on-year increase. Daily output averaged 117,500 metric tons, contributing to a cumulative production of 34.458 million metric tons for the year till October, up 3.5% YoY. Notably, there was a shift in production dynamics, with a decline in output among primary aluminium processing producers and an increase in aluminium ingot production. In October, aluminium ingot production rose by 5% YoY but decreased by 10.5% YoY from January to October, totaling 10.21 million metric tons. Amid global economic uncertainties, U.S. economic data suggests resilience, while China's announcement of issuing an additional one trillion yuan of local government bonds aims to stimulate the economy and market. However, challenges persist, such as reduced production in some aluminium billet factories. In Europe, the final values of the Eurozone's services PMI and composite PMI in October reached 47.8 and 46.5, respectively, marking 32-month and 35-month lows. China's aluminium ingot social inventory stood at 677,000 metric tons, down 17,000 metric tons from November 13, but up 130,000 metric tons YoY. From a technical standpoint, the market experienced long liquidation with a -3.47% drop in open interest to 2808. Aluminium is currently supported at 202.7, with a potential test of 202. Resistance is likely at 204.4, and a breakthrough could lead to testing 205.4.

Trading Ideas:

* Aluminium trading range for the day is 202-205.4.

* Aluminium dropped as China's October 2023 aluminum production up 6.7% YoY.

* There is still great uncertainty in overseas macro front. U.S. economic data shows that the U.S. economy is resilient. China has announced to issue an additional one trillion yuan of local government bonds, which could boost the economy

* China has announced to issue an additional one trillion yuan of local government bonds, which could boost the economy

COTTONCANDY

Cottoncandy closed down by -0.21% at 57220, experiencing profit booking after recent support from India's cotton production outlook for 2023/24. The Cotton Association of India (CAI) predicts a 7.5% decline in production to 29.5 million bales due to lower planted areas and the impact of El Nino weather on productivity. Imports for the marketing year starting Oct. 1 may rise to 2.2 million bales, compared to 1.25 million bales last year. The U.S. cotton balance sheet for 2023/24 shows slightly lower consumption, but higher production and ending stocks. Production is estimated at 13.1 million bales, with Texas facing lower production offset by gains elsewhere. Domestic mill use is lower, and exports remain unchanged, resulting in higher ending stocks at 3.2 million bales or 22.5% of use. The global cotton balance sheet for 2023/24 includes lower consumption, higher production, and stocks. Beginning stocks are up by 200,000 bales, mainly due to a 300,000-bale increase in India's 2022/23 production. The CAI raised its final estimate for the 2022-23 season to 31.8 million bales, higher than initial estimates. In north Maharashtra, cotton production is expected to decline by 25% due to inadequate rainfall. Normal annual production is around 20 lakh tonnes, but this year it may fall to 15 lakh tonnes. Agricultural officials attribute the decline to adverse weather conditions. In Rajkot, a major spot market, cotton prices ended at 26908 Rupees, dropping by -0.2 percent. Technically, the market observed long liquidation, with a -3.03% drop in open interest to 96. Cottoncandy is currently supported at 56900, with a potential test of 56590. Resistance is likely at 57460, and a breakthrough could lead to testing 57710.

Trading Ideas:

* Cottoncandy trading range for the day is 56590-57710.

* Cotton dropped on profit booking after prices gains as India's cotton production in 2023/24 is likely to fall 7.5%

* Cotton production likely to decline by 25% in north Maha

* USDA cut U.S. production in 2023/24 to 12.8 million bales

* In Rajkot, a major spot market, the price ended at 26908 Rupees dropped by -0.2 percent.

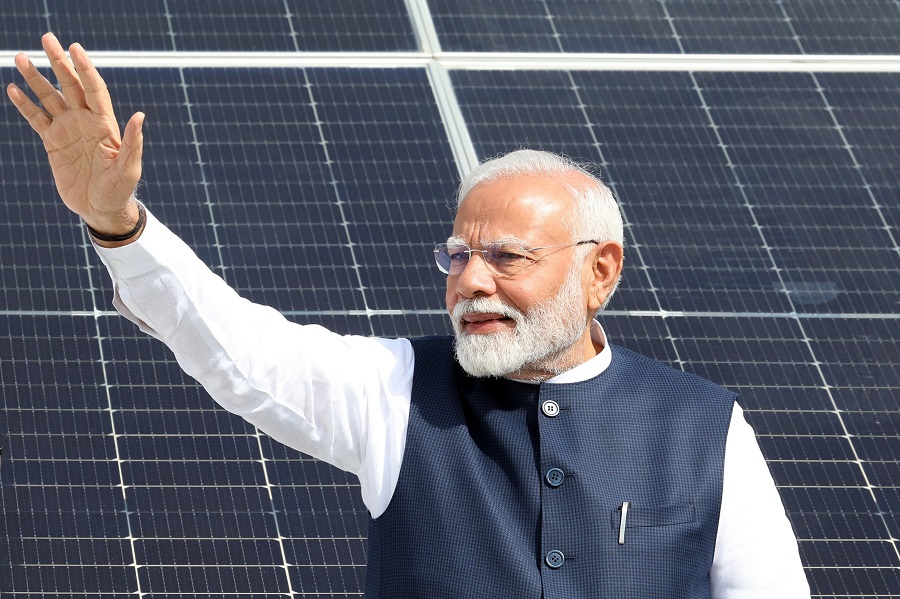

TURMERIC

Turmeric faced a significant drop of -5.38%, settling at 12698, triggered by concerns among Maharashtra farmers over the location of PM Modi's Turmeric Board in Telangana. Slow buying activities were observed as farmers expected stock releases ahead of the new crops in January 2024. The market also felt pressure due to favorable weather conditions improving crop conditions, with harvest readiness expected from January to March. The October projection of drier-than-average weather by the IMD raised concerns about crop growth. Improved export opportunities add support, with a 25% increase in turmeric exports, driven by increased demand in both developed and emerging nations. Expectations of a 20–25% decline in turmeric seeding, particularly in Maharashtra, Tamil Nadu, Andhra Pradesh, and Telangana, contribute to the downward trend, reflecting shifting priorities among farmers. The potential for yield losses due to unfavorable weather conditions also limits the downside. Turmeric exports during Apr-Sep 2023 increased by 4.14% to 92,025.16 tonnes compared to the same period in 2022. In September 2023, turmeric exports dropped by 19.75% from August but rose by 35.06% compared to September 2022. In the major spot market of Nizamabad, prices ended at 13401.15 Rupees, marking a -1.11% decrease. Technically, the market observed long liquidation, with a -0.4% drop in open interest to 12550. Turmeric is currently supported at 12404, with a potential test of 12108. Resistance is likely at 13208, and a breakthrough could lead to testing 13716.

Trading Ideas:

* Turmeric trading range for the day is 12108-13716.

* Turmeric dropped after PM Modi's Turmeric Board in Telangana sparks farmer concerns in Maharashtra over HQ location.

* In Sep 2023 around 9,085.81 tonnes exported as against 11,322.58 tonnes in Aug 2023 showing a drop of 19.75%.

* Expectations for a 20–25 percent decline in turmeric seeding this year

* In Nizamabad, a major spot market, the price ended at 13401.15 Rupees dropped by -1.11 percent.

JEERA

Jeera witnessed a 1.03% increase, settling at 43030, driven by short covering following a recent price drop. Adequate soil moisture and favorable weather conditions are expected to boost overall sowing activities for jeera, keeping upcoming sowing normal. Stockists are now showing interest in buying due to the recent price downfall, triggering short covering. However, global demand for Indian jeera has slumped as buyers prefer other destinations like Syria and Turkey due to higher prices in India. Export activities are likely to remain subdued in the upcoming months, aligning with export seasonality. Despite the competitiveness of Indian jeera prices in the global market, overseas demand remains subdued, affecting export activity. Jeera exports during Apr-Sep 2023 dropped by 29.79%, totaling 76,969.88 tonnes compared to the same period in 2022. In September 2023, jeera exports decreased by 11.02% from August and by a significant 60.27% compared to September 2022. The IMD's definition of average rainfall as ranging between 96% and 104% of the 50-year average indicates normalcy in weather conditions, which is favorable for jeera crop growth. In the major spot market of Unjha, prices ended at 45429.75 Rupees, gaining by 0.04%. Technically, the market is under short covering, with a -1.18% drop in open interest to settle at 4011. Jeera is currently supported at 42190, with a potential test of 41360. Resistance is likely at 43550, and a breakthrough could lead to testing 44080.

Trading Ideas:

* Jeera trading range for the day is 41360-44080.

* Jeera gains on short covering after prices dropped as favorable condition for crop will boost the overall sowing activities.

* The upcoming sowing of jeera that is expected to remain normal due to favorable weather condition.

* Stockists are showing interest in buying on recent downfall in prices triggering short covering.

* In Unjha, a major spot market, the price ended at 45429.75 Rupees gained by 0.04 percent.

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer