Gold ETF Industry data by Akshay Tritiya Nippon India Mutual Fund 2.9x Almost 3 times as that of last

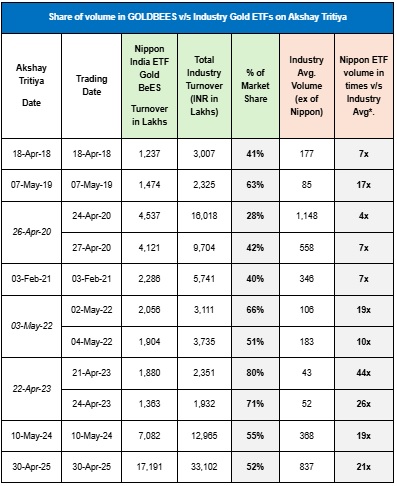

Nippon India ETF Gold BeES had a 52% of total industry turnover. Volume in our ETF was 21x vis-à-vis industry average (ex of NIMF)

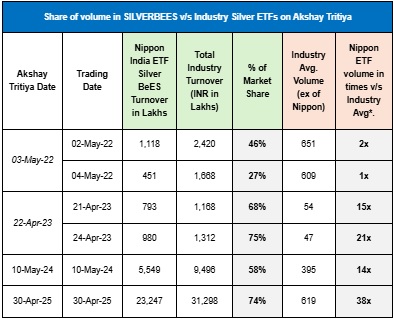

Nippon India ETF Silver BeES had a 74% of total industry turnover. Volume in our ETF was 38x vis-à-vis industry average (ex of NIMF)

This Akshay Tritiya sees stronger interest in Gold and Silver ETF as combined Industry volume has increased from INR 224 Cr to INR 644 Cr i.e., 2.9x – Almost 3 times as that of last year

Gold ETF volume up from INR 130 Cr to INR 331 Cr i.e., 2.5X

Silver ETF volume up from INR 95 Cr to INR 313 Cr i.e., 3.3X

Silver outshines Gold in terms of growth in traded volume

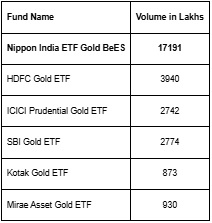

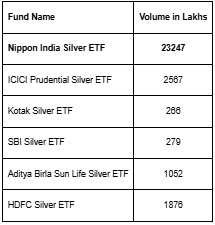

On this festive occasion, NIMF Gold and Silver ETFs got benefited the most as both of these ETFs command highest volume in the Industry

Gold ETF volume at INR 172 Cr – 52% of total Industry volume of Gold ETF

Silver ETF volume at INR 232.5 Cr – 74% of total Industry volume of Silver ETF

Combined volume at INR 404 Cr – 63% of total Industry volume of Gold + Silver ETF

Please find the tabulated below contribution in turnover/volume of our Gold & Silver ETF v/s Industry ETFs on Akshay Tritiya Days. (Detailed data in excel attached herewith)

In past when Akshay Tritiya occurred on a trading holiday; pre & post trading day volume has been considered i.e. on 26th Apr 2020, 03rd May 2022 and 22nd Apr 2023,

Table 1: GOLDBEES v/s Industry Gold ETF

Table 2: SILVERBEES v/s Industry Silver ETF

Enclosing the Top 5 AMC data for reference:

Above views are of the author and not of the website kindly read disclaimer

Tag News

Invesco Asset Management (India) announces change to OPA