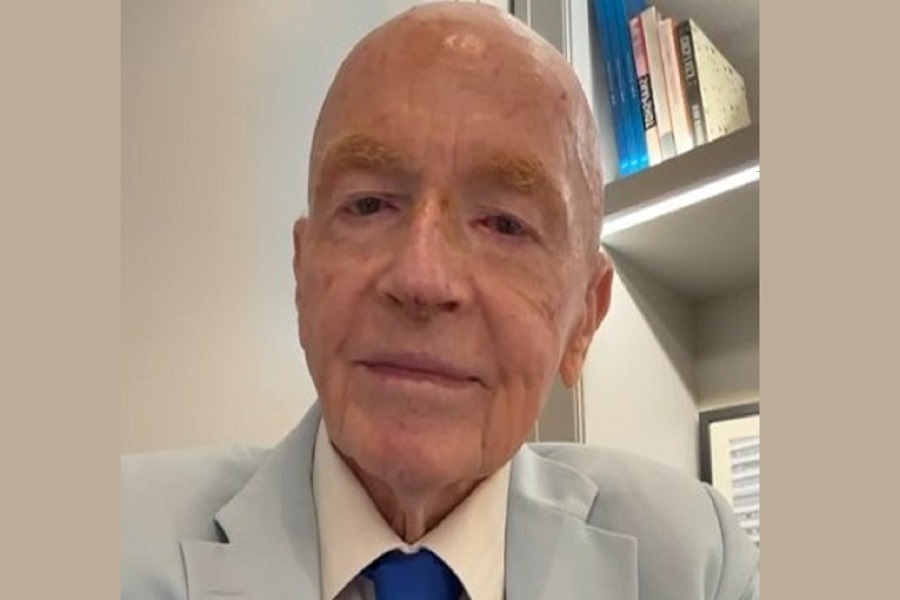

Gold Commentary: 22nd May 2024 by Mr. Navneet Damani, Senior VP - Commodity Research at Motilal Oswal Financial Services

Below the Quote on Gold Commentary: 22nd May 2024 by Mr. Navneet Damani, Senior VP - Commodity Research at Motilal Oswal Financial Services

Gold prices cooled near a record peak hit in the previous session as the dollar held ground, but stayed afloat at the $2,400 level on support from safe-haven interest and prospects of U.S. interest rates easing this year. Safe haven demand for Gold and Silver increased as traders feared some geopolitical instability in the Middle East after Iran’s President was killed in a helicopter crash however, the immediate impact of his death remained unclear. The lack of any major instability in the Middle East sapped safe haven demand for gold, leaving it more vulnerable to concerns over U.S. interest rates. String of Fed policy makers warned that the central bank needed much more convincing that inflation was easing before it could begin trimming interest rates, maintaining higher for longer stance. Recent report from WGC suggest that Global gold physically-backed gold exchange-traded funds (ETFs) saw net inflows of $1 billion last week - the largest weekly inflow since October 2023. Focus today will be on UK CPI, US existing home sales and FOMC meeting minutes. Broader trend on domestic front prices could be in the range of Rs 73,500-74,500.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Perspective on Gold Hits High from NS Ramaswamy, Head of Commodity & CRM - Ventura