Factbox-What industry wants from India`s budget on February. 1

India's Finance Minister Nirmala Sitharaman will on Thursday present the last federal budget of the current Narendra Modi-led administration before the country heads for polls in the summer.

Industry lobby bodies are suggesting the government continue spending on infrastructure, expand incentives for manufacturing and tweak import taxes on inputs for certain goods.

The government is considering raising capital spending to as much as 12 trillion rupees from the current year's plan of 10 trillion rupees. India's electronics minister has made a case for lowering duty on mobile phone components.

INVESTMENT SPENDING

The government should continue to focus spending on infrastructure and increase it by at least 20% to 12 trillion Indian rupees ($144.39 billion), the Confederation of Indian Industry (CII) lobby group said.

The federal government's spending on infrastructure has been key to the Indian economy growing at 7.3% for the financial year ending March 31, 2024. The CII said the federal government should continue to extend support to states in the form of interest free 50-year loans, and increase the allocation by 23% to 1.6 trillion rupees in 2024/25.

BOOST MANUFACTURING

Industry is pitching for an extension of the concessional tax regime for setting up of new manufacturing facilities for another five years, the Federation of Indian Chambers of Commerce and Industry (FICCI) lobby group suggested.

India's government had announced a lower 15% corporate tax rate for companies registered after Oct 1, 2019, that commence manufacturing by March 31, 2024.

The Production Linked Incentive (PLI), the Modi government's flagship industrial incentive scheme, should be expanded to labour intensive sectors, such as apparel, toys, footwear, and chemicals, CII said.

The PLI scheme earmarked incentives worth 1.97 trillion rupees for 14 sectors ranging from electronic products to drones, and so far incentives worth 44.15 billion rupees have been paid out to eight sectors.

IMPORT DUTIES

The CII has asked for a review import tariffs to a three-tier duty structure with raw materials and inputs at zero or low duties, final goods at the standard rate of about 7.5%, and rate for intermediates goods in middle.

Industry says this will help address concerns across some sectors where inputs are taxed at a higher rate than final goods.

Among specific sectors, India's steel industry has sought a higher import tax on finished steel products as shipments from China have surged, and a zero import duty on coking coal.

The gems and jewellery industry has asked for a lowering of import duty on precious metals such as gold bars to 4% from 15% presently.

Import duty on cut and polished gem stones should be lowered to 2.5% from 5%, it has said.

For mobile phone parts, the India Cellular and Electronics Association (ICEA) is seeking import duty cuts on components like camera modules from 2.5% to zero and chargers to 15% from 20%.

TAX CHANGES

A tax exemption limit for individuals must be increased and linked with inflation, the CII said. This would help boost consumption.

The government should also review its capital gains tax structure by bringing consistency in tax rates for different asset classes such as debt, equity and immovable assets, it said.

The holding period to determine whether short term or long term capital gains tax is applied also differs for these asset classes.

HEALTHCARE AND EDUCATION

The federal and state governments should together increase spending on healthcare to 2.5-3% of GDP and on education to 6% of GDP, the CII said.

Currently spending is at 2.1% and 2.9% of GDP on health and education, respectively.

Tag News

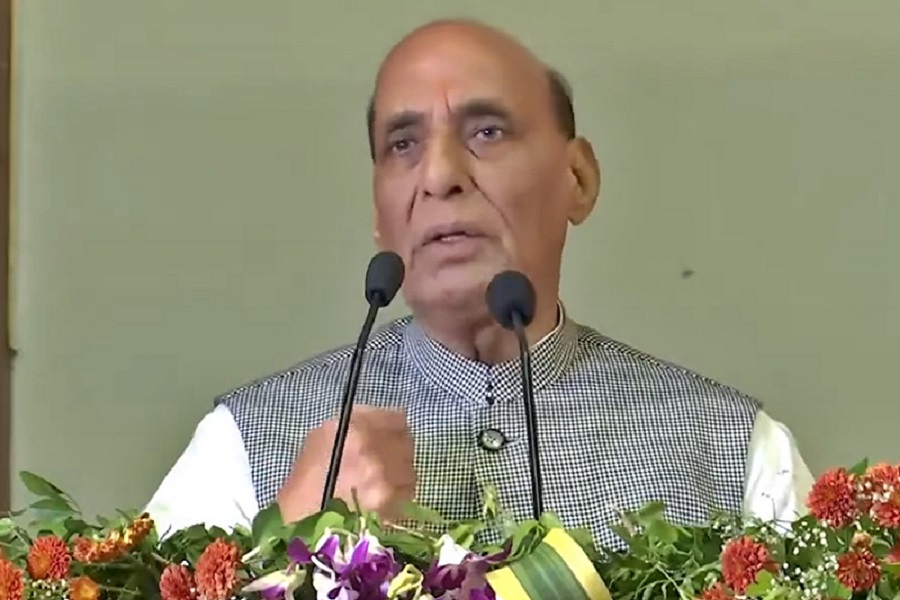

India fast-developing country but development needs to be inclusive, equitable: Rajnath Singh