F & O Rollover Report 30th August 2025 by Axis Securities

NIFTY HIGHLIGHTS

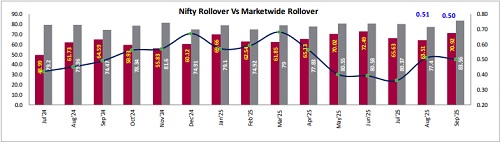

The Nifty September rollover hit 70.9% on Monday, up from 63.5% on the same day of the previous expiry, surpassing the 3-month average of 67.2% and 6-month average of 66.4%, indicating an addition of positioning. The rollover cost in September rollover cost was 0.50%, slightly below the prior expiry’s 0.51%, suggesting efficient carry-forward and stable sentiment with minimal premium for continuity. Bank Nifty rollover stood at 67.4%, sharply higher than 53.2% in the prior expiry, and above the 3-month average of 58.6% and 6-month average of 62.6%, signaling rising trader confidence in banking stocks. The market-wide rollover reached 83.6%, up from 77.4% in the previous expiry, exceeding the 3-month average of 79.45% and 6-month average of 79.3%, reflecting broad-based participation and strong rollover sentiment. The option data for the September series indicates a strong Call Open Interest (OI) at the 25,000-strike price, followed by 24,800. In contrast, a substantial concentration of Put OI is observed at 24,500, with additional levels at 24,600. This suggests the likely range for the current expiry is between 24,500 and 24,800.

Nifty Rollover Vs Market Wide Rollover

Stock & Sector Highlights

* RBLBANK, BANKINDIA, PGEL, PATANJALI and PPLPHARMA saw higher rollover on Monday compared to same day of previous expiry.

* TATACHEM, UNOMINDA, HFCL, ALKEM and FORTIS saw lower rollover on Monday compared to same day of previous expiry.

* The Highest rollover in current expiry for the day is seen in WIPRO, RBLBANK, AUROPHARMA, APLAPOLLO and BANDHANBNK.

* The Lowest rollover in current expiry for the day is seen in TATACHEM, HFCL, UNOMINDA, ALKEM and HINDPETRO.

Sector-wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ0001616

More News

Market Commentary Closing for 02nd September 2025 by Bajaj Broking