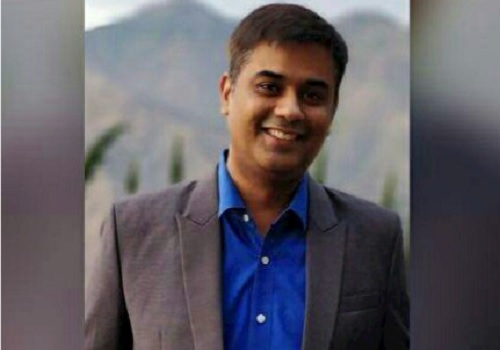

Expert views on the renting of commercial properties brought under the reverse charge mechanism by Shrinivas Rao, FRICS, CEO, Vestian

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below the Expert views on the renting of commercial properties brought under the reverse charge mechanism by Shrinivas Rao, FRICS, CEO, Vestian

“Earlier, Goods and Services Tax (GST) was charged under Forward Charge Mechanism (FCM) only while renting a commercial property by a GST unregistered person (landlord) to a GST registered person (tenant). This caused significant revenue leakage for the government as the Reverse Charge Mechanism (RCM) was not applied. To stop the revenue leakage and widen the purview, the GST Council included this under RCM which may increase compliance for GST-registered persons (tenants).”

Rao further added, “Moreover, the government has clarified theGST liability on location charges or Preferential Location Charges (PLC) on residential/commercial/industrial complexes and bundled them under construction services reducing the tax liability from 18% to 5%/12%. This is likely to reduce friction between developers and tenants and ensure transparency.”

Above views are of the author and not of the website kindly read disclaimer