expected to open on a flattish note and likely to witness sideways move during the day - Nirmal Bang Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Market Review

US: The Nasdaq ended lower while the Dow and S&P 500 were nearly flat on Tuesday as Treasury yields rose and shares of chipmakers fell after the Biden administration said it planned to halt shipments of advanced artificial intelligence chips to China.

Asia: Asia markets pared some declines from earlier in the session on Wednesday after economic data from China showed stronger-than-expected growth.

India: The gains in index heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. helped India's benchmark stock indices snap a three-day losing streak to close higher on Tuesday.Market is expected to open on a flattish note and likely to witness sideways move during the day.

Global Economy: China's economy grew at a faster-thanexpected clip in the third quarter from a year earlier, official data showed on Wednesday, suggesting the recent recovery may carry enough steam to reach Beijing's full-year growth target. On a quarter-by-quarter basis, GDP grew 1.3% in the third quarter, accelerating from a revised 0.5% in the second quarter, and the rate was above the forecast for growth of 1.0%. U.S. retail sales have seen an unexpected rise of 0.7% in September, due to high demand at auto dealerships, online stores, and increasing gasoline prices. This increase occurred during a period typically considered off-peak, falling between the bustling back-to-school and holiday-shopping seasons.

Commodities: Gold prices rose on Wednesday after a deadly blast in Gaza fuelled fears of an escalating regional conflict, keeping the safe-haven asset in demand among nervous investors despite robust U.S. economic data and a high rate scenario.

Oil prices gained nearly $2 in early trade on Wednesday after industry data showed a bigger-than-expected draw in U.S. crude stocks amid worries about supply disruptions from the Middle East due to a deepening Israel-Hamas conflict.

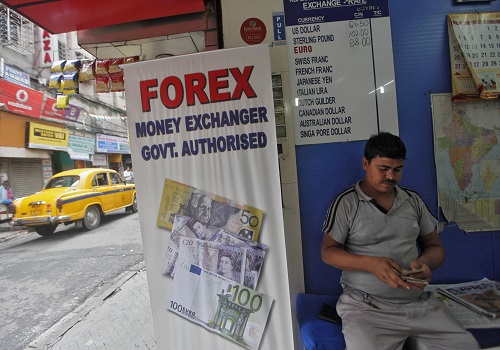

Currency: The dollar stood its ground on Wednesday, though it struggled for further headway despite strong US retail sales data, as traders turned their attention to looming Chinese growth figures and the escalating violence in the Middle East.

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH000001766

Tag News

FIIs were net sellers in Cash to the tune of 168.71 Cr and were net sellers in index futures...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">