EV Insights : Tracking the Electric Revolution - September 2025 by Choice Institutional Equities

Strong growth across segments

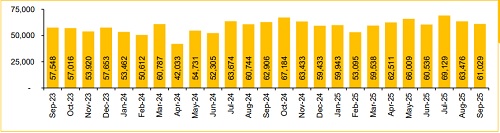

* The E-2W segment experienced a 14.9% YoY growth in volume in September 2025. Hero MotoCorp (EVs contributing ~3% of domestic sales) led the charge with a stellar 184.3% YoY increase in sales. Ather Energy (EVs contributing 100% of sales) and TVS Motor (EVs contributing ~8% of domestic sales) followed suit, with a growth of 40.1% and 23.2% YoY, respectively. This surge was supported by multiple launches across price points, enabling wider customer reach. Bajaj Auto (EVs contributing ~15% of domestic sales) saw a 1.6% YoY increase in sales. For, EV production returned to earlier levels after a decline on account of shortage of rare earth magnets. Meanwhile, Ola Electric (EVs contributing 100% of sales) saw a 46.0% YoY decrease, as intensifying competition from established players weighed on volumes. (Refer to Exhibit 11 for details)

* The E-PV segment saw strong growth in September 2025, with sales increasing by 144.3% YoY. This increase was driven by M&M (EVs contributing ~7% of domestic sales) witnessing a rise in sales, from 476 units to 3,187 units YoY, aided by EV model launches. Sales of MG Motors (EVs contributing ~85% of domestic sales) increased, from 1,014 units to 3,843 units YoY and Hyundai (EVs contributing ~2% of domestic sales) witnessed a rise in sales, from 28 units to 342 units YoY, owing to the launch of its Creta EV. (Refer to Exhibit 12 for more details)

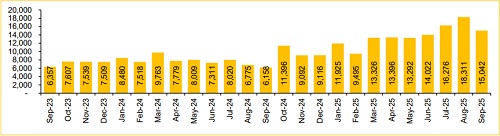

* E-3W segment posted YoY de-growth of 3.0%, while the E-CV segment grew 85.1%, supported by policy tailwinds and improved model availability across segments.

Exhibit 1: E-2W sales grew 14.9% on a YoY basis in Sept ’25

Exhibit 2: E-3W sales were down 3.0% on a YoY basis in Sept ’25

Exhibit 3: E-PV sales expanded 144.3% on a YoY basis in Sept ’25

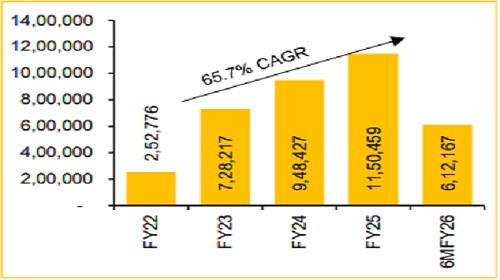

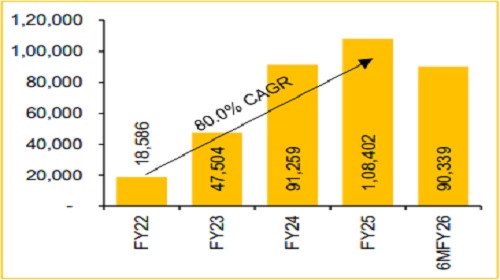

Exhibit 4: FY22–FY25: E-2W sales expanded at a CAGR of 65.7%

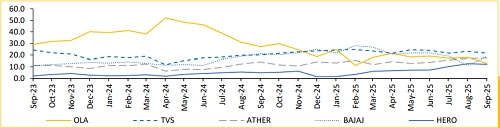

* TVS Motors retained its leadership position in September 2025, with its market share expanding YoY to 21.6%

* Ola Electric sales dropped by 46.0% YoY in September, leading to a sharp fall in its market share. On a YoY basis, its sales plummeted to 12.8% in September 2025, from 27.3% a year ago

* Ather Energy and Hero MotoCorp recorded significant market share gains YoY. Ather Energy expanded its market share, from 14.3% in September 2024 to 17.4% in September 2025. Hero MotoCorp more than doubled its share, from 4.9% in September 2024 to 12.2% on a YoY basis

* Bajaj Auto witnessed a fall in its market share, from 21.2% in September 2024 to 18.8% in September 2025. On a MoM basis, the company gained market share, driven by the improvement in production, led by the easing of rare earth magnet supply.

Exhibit 5: E-2W market share (%) trend

Exhibit 6: FY22–FY25: E-PV sales expanded at a CAGR of 80.0%

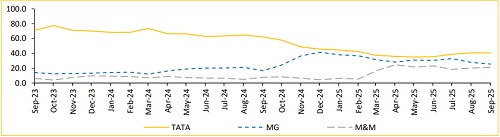

* Tata Motors remained the market leader, although its market share declined, from 62.1% in September 2024 to 40.9% in September 2025, due to new model launches by other OEMs

* Meanwhile, MG Motors captured a significant market share, with an increase from 16.5% to 25.5% on a YoY basis

* M&M almost tripled its market share, from 7.7% in September 2024 to 21.2% in September 2025, owing to the launch of its new EV models

* The competition in the E-PV market has intensified, with multiple model launches by OEMs. Going forward, we believe the industry is poised for strong growth, facilitated by government incentives, increase in investments in both, battery manufacturing and charging infrastructure

Exhibit 7: E-PV market share (%) trend

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131