EV Insights: Tracking the Electric Revolution - May 2025 by Choice Broking Ltd

Legacy OEMs Zoom Ahead in EV Race

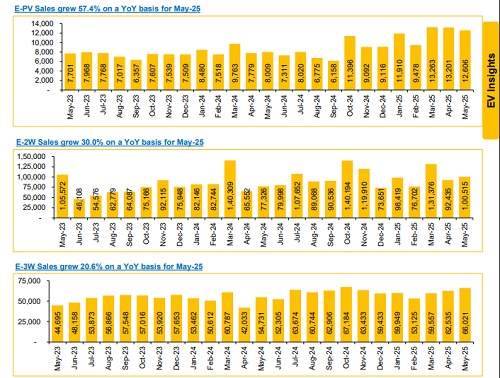

* The Electric Passenger Vehicle segment saw strong growth in May 2025, with sales increasing by 57.4% YoY. This growth was driven by MG Motors (with EVs contributing to 75% of total sales), whose sales increased from 1,508 units to 3,889 units YoY; Hyundai (with EVs contributing to 2% of total sales) with sales rising from 103 units to 615 units YoY, owing to the launch of its new Creta EV and M&M (with EVs contributing to ~5% of total sales) experiencing a rise in sales from 594 units to 2,710 units YoY, driven by new EV model launches.

* The E-2W segment posted a strong 30.0% YoY growth in May 2025, driven by legacy OEMs gaining traction. Hero MotoCorp led the charge with a stellar 162% YoY increase in sales. Bajaj Auto and TVS Motor followed with impressive growth of 136% and 108% YoY, respectively, though EVs still account for only ~5% of their total sales. This surge was supported by multiple new launches across price points, enabling wider customer reach. Meanwhile, Ola Electric saw a 51% YoY decline, as intensifying competition from established players and early signs of saturation in key urban markets weighed on volumes.

* Additionally, the E-3W and CV segments experienced a growth of 20.6% and 92.9% YoY, respectively.

* Impact of restrictions on export of rare earth magnets by China: China’s restrictions on rare earth magnet exports, particularly neodymium-based magnets, pose a significant challenge to the global auto industry, which heavily relies on these materials for EV motors, hybrid systems, and various components in internal combustion engine (ICE) vehicles like power steering and infotainment. With China controlling over 80% of global rare earth magnet supply, these curbs could lead to supply chain disruptions and rising input costs. Automakers may face increased lead times, higher costs, and the need to secure alternate sources or technologies. This has triggered a strategic shift toward diversifying supply chains, investing in rare earth recycling, and developing magnet-free or alternative motor technologies. With Chinese approvals not yet received for the Indian manufacturers, production disruptions can be seen starting from July 2025 unless the licensing backlog is cleared.

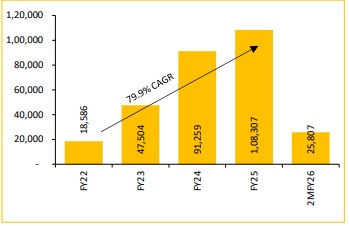

E-2W Sales grew at a CAGR of 65.7% from FY22 to FY25

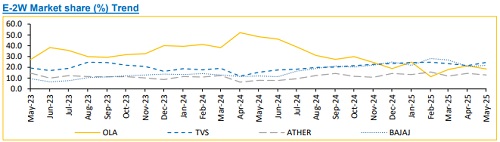

* Ola Electric’s sales dropped by 50.5% YoY in May 2025, leading to a sharp decline in its market share. On a YoY basis, its market share fell from 48.3% in May 2024 to 18.4% in May 2025.

* Bajaj Auto and TVS Motors recorded significant market share gains, with TVS Motors securing the top position by increasing its share from 15.3% in May 2024 to 24.5% in May 2025. Bajaj Auto followed closely, expanding its market share from 12.0% in May 2024 to 21.8% in May 2025

EV Passenger Vehicle Sales grew at a CAGR of 79.9% from FY22 to FY25

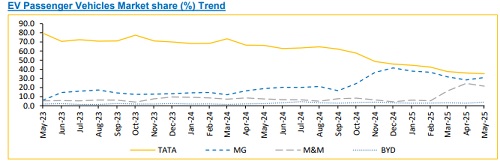

* Tata Motors’ market share declined from 66.2% in May 2024 to 35.1% in May 2025, though it remained market leader. Meanwhile, MG Motors captured a significant share, increasing its market share from 18.8% in May 2024 to 30.9% in May 2025. M&M more than doubled its market share, rising from 7.4% in May 2024 to 21.5% in May 2025, owing to the launch of its new EV models.

* Tata Motors and MG Motor are expected to witness a decline in market share in the coming months as new launches from major OEMs like Maruti Suzuki, M&M, and Hyundai gain traction.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131