Disruption: Slowly, then suddenly by Kotak Institutional Equities

Disruption: Slowly, then suddenly

The market’s gradual at first (time correction for long) and sudden of late (recent price correction) ‘awakening’ to potential disruption in the Indian paints sector may reflect (1) continued skepticism about potential disruption, unless proven otherwise, (2) legacy investment and valuation frameworks and (3) ‘liquidity’ compulsions. We expect more ‘disrupted’ sectors to go through the same cycle over the next few years.

Disruption—depends on how one looks at it

We see a sharp acceleration in disruptive forces (see Exhibit 1) in the near term across sectors such as automobile 2Ws, commodity chemicals and IT services. Consumer-facing businesses are likely to face gradual challenges to their business models in the medium term (see Exhibits 2-4). The market has largely remained oblivious to such risks, enamored by short-term factors of (1) higher profitability (automobiles) or (2) likely recovery in revenues (IT Services).

Increasing impact of EVs in domestic 2W market

EV 2W companies have seen strong traction and have 13% market share of the domestic scooter market (see Exhibits 5-6). EV 2Ws have hitherto competed in the ‘premium’ segment, but they will compete more aggressively in the mainstay mass segment in the near term, with the launch of lower-priced products (see Exhibits 7-8) due to declining battery costs. The increased competitive intensity across segments in the 2W market will not bode well for the high profitability and returns of incumbents (see Exhibit 9).

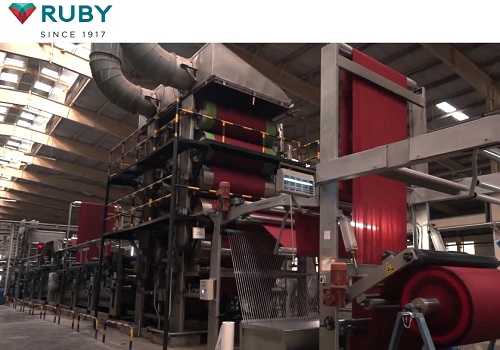

Imminent risk from Grasim for commodity chemicals (paints)

The deterioration in the market structure of the paints market, with the entry of Grasim and more aggressive competition from JSW Paints (see Exhibit 10) may result in lower (1) growth and (2) profitability and return ratios of incumbents, which are at very high levels currently (see Exhibits 11-12). The high multiples of incumbents suggest that the market is still ambivalent about the disruption threat (see Exhibit 13), although multiples have declined over the past 2-3 years. Paint companies’ stocks have been largely flat for the past 2-3 years.

AI to transform Indian IT services industry; impact not factored in

The recent progress made by a number of LLMs, coupled with (1) increasing use-cases and (2) massive computing power, suggests that the entire IT industry may be at the cusp of an AI-led transformation. However, the strong correlation between Indian IT companies and the Nasdaq (especially, the Mag7 AI disruptors) is at odds with the current state of Indian companies’ AI adoption (see Exhibits 14-15). In our view, client budgets may not change materially, but AI projects will see higher allocation. A number of service lines will see disruption risks, even as medium-term opportunities may rise from system integration (see Exhibits 16-18). The relative velocity of application and disruption will determine the quantum of opportunity and risk for Indian companies—(1) more projects per client versus (2) lower cost per project (due to higher productivity).

Above views are of the author and not of the website kindly read disclaimer