Derivative Rollovers 28th February 2025 Motilal Oswal Wealth Management

March will continue bears grip after 5 consecutive negative series

Nifty

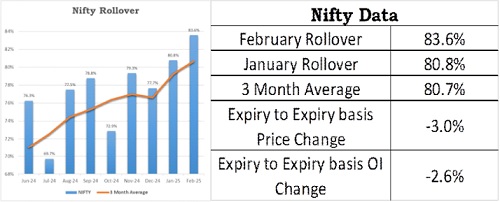

Nifty index started the February series on a flat to positive note but carried on the negative sentiment and fell by 1300 points in this series. Bears had complete dominance and it stretched the weakness to break its crucial support levels. Nifty formed a bearish candle with longer upper shadow on expiry to expiry basis which indicates rejection at higher zones. February series witnessed a reduction in open interest by 2.6% with a fall in price by 3% on an expiry-to-expiry basis which indicates longs have been liquidated in the index. Rollover of Nifty stood at 83.6%, which is higher than the previous month's and its quarterly average of 80.7%.

On option front, Maximum Call OI is at 23000 then 22600 strike while Maximum Put OI is at 22500 then 22000 strike. Call writing is seen at 22600 then 23000 strike while Put writing is seen at 22500 then 22600 strike. Option data suggests a broader trading range in between 21500 to 22800 zones while an immediate range between 21800 to 22500 levels.

Nifty closed near 22550 zones and At The Money Straddle (Mar Monthly 23750 Call and 23750 Put) is trading at net premium of around 650 Points, giving a broader range of 21900 to 23200 levels. Considering overall Derivatives activity, we are expecting Nifty to continue with weakness and pressure due to lack of follow up at any bounce and weakening sentiment due to global cues as we head into the March series with a positional support of 21800 & 21300 zones and hurdles placed at 22800 and 22300 zones.

We have witnessed selling pressure in most of the sectors barring financial space which is showing some resilience amongst such market weakness.

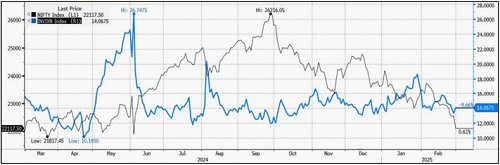

India VIX decreased by 23.5% from 17.39 to 13.31 levels in the February series even after market declines as two major events unfolded. Volatility cooled after the Union Budget and sank towards the end which caused the option premium to become sticky with wild swings within a smaller range.

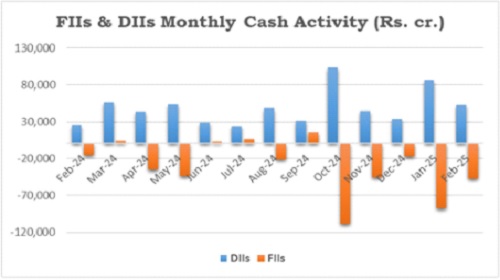

FIIs continued their selling stance in equities but reducing their selling magnitude and sold worth Rs 47,350 crores in the February month so far. DIIs continued their buying stance of the last twenty one months and bought to the tune of Rs 52,550 crores in February so far. The FIIs 'Long Short Ratio' in index futures oscillated in the lower band in the entire series and ranged in between 10.5% to 18% to close near its higher band.

Bank Nifty

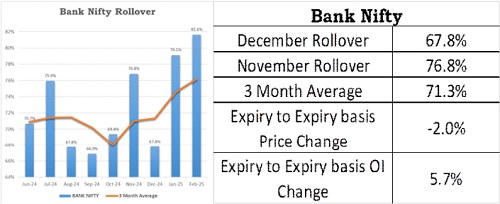

Bank Nifty started the February series on a negative note and recovered in the first half of the series which was again given up in the next half. It respected 48250 zones with a churn of NBFCs and smaller banking names in comparative strength. It formed a small bodied bearish candle on expiry to expiry basis with longer upper shadow indicating pressure at the higher zones. Short built up was seen as open interest increased by 5.7% and price was down by 2% on an expiry-to-expiry basis. Rollover in Bank Nifty stood at 81.6%, which is higher than its quarterly average of 76.2%. Bank Nifty has to hold 47750 zones for a bounce towards 49000 then 50000 zones while a hold below 47750 could open the downside towards 47000 & 46500 levels.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

India Strategy : High-conviction ideas ? Oct 2025 by InCred Equities