Daily Morning Briefing; Morning Choice by Choice Institutional Equities

Institutional Equities

Stocks gain on rate cut optimism, yen dives after Ishiba resigns

Stocks rose and the dollar weakened as weak U.S. jobs data cemented expectations of a Fed rate cut this month, with markets even factoring in chances of a larger 50 bps move. Gold stayed near record highs, while Treasury yields fell to five-month lows. In Japan, the yen slid and Nikkei gained after PM Shigeru Ishiba’s resignation fueled uncertainty over future fiscal and monetary policy, with investors watching if Sanae Takaichi could succeed him. Global markets remain focused on U.S. inflation data this week and France’s looming political crisis as PM Bayrou faces a likely failed confidence vote.

Japan revises Q2 GDP higher on brisk consumer spending

Japan’s economy grew at an annualised 2.2% in April–June, sharply higher than the preliminary 1.0% estimate, supported by stronger consumption and capital spending, government data showed Monday. Quarter-on-quarter growth was revised up to 0.5% from 0.3%. Private consumption rose 0.4% (vs. 0.2% initially), while capital expenditure increased 0.6%, though below the earlier 1.3% estimate. External demand contributed 0.3 percentage point and domestic demand added 0.2, reversing an earlier drag. The outlook remains clouded by political uncertainty after PM Shigeru Ishiba’s resignation and by U.S. trade tariffs.

Turkey sees inflation at 28.5% in 2025 with single digits by 2027, programme says

Turkey’s new medium-term economic programme projects inflation at 28.5% in 2025, 16% in 2026, and single digits from 2027, with a focus on disinflation, balanced growth, and social prosperity. The plan forecasts GDP growth of 3.3% in 2025, 3.8% in 2026, and 5% by 2028, supported by structural reforms. Unemployment is expected at 8.5% in 2025, while the current account deficit is seen narrowing to $18.5 billion by 2028. Tourism revenues are projected to rise to $75 billion and exports to $308.5 billion by 2028. The roadmap also outlines structural reforms in technology, green transformation, agriculture, and financial sector strengthening.

Oil prices rise as OPEC+ agrees to raise output at slower pace from October

Oil prices edged higher on Monday after OPEC+ agreed to raise output from October but at a slower pace, reflecting concerns over weakening global demand. Brent rose 0.4% to $65.73 a barrel, while WTI gained 0.3% to $62.08. Both benchmarks had dropped over 2% on Friday and more than 3% last week after weak U.S. jobs data hurt the demand outlook. OPEC+ will increase production by 137,000 bpd from October, far below the larger monthly hikes seen in recent months, as Saudi Arabia seeks to balance market share with oversupply risks.

Jaiprakash Associates, Vedanta

Mining conglomerate Vedanta beat Gautam Adani’s Group to make the winning bid for the acquisition of debtridden Jaiprakash Associates (JAL) for Rs 17,000 crore, reports PTI, quoting sources. The bid value translates into JAL’s net present value of Rs 12,505 crore.

Zydus Lifesciences

The US Food and Drug Administration (US FDA) conducted an inspection at the group’s injectable manufacturing plant at Vadodara, Gujarat, during August 25 – September 5, and concluded the inspection with 4 observations. There were no data integrity-related observations.

Aurobindo Pharma

The US FDA inspected the company’s Unit-XII, which includes both oral solids and injectable manufacturing units, at Bachupally, Telangana, from August 25 to September 5. Following the inspection, the US FDA issued a Form 483 with 8 observations. All observations are procedural in nature.

Adani Power

Adani Power has signed a shareholders’ agreement with Bhutan’s state-owned utility Druk Green Power Corp (DGPC) for setting up a 570 MW hydroelectric project at Wangchhu in Bhutan. The company and DGPC will jointly incorporate a public company (with 49:51 shareholding) in Bhutan to undertake the project.

Adani Green Energy

Through its step-down subsidiaries, the company commissioned 87.5 MW power projects at Khavda, Gujarat, raising its total operational renewable capacity to 16,078 MW.

Ceigall India

The company has received a Letter of Intent for the procurement of solar power under the Mukhyamantri Saur Krushi Vahini Yojana 2.0 for 147 MW from Maharashtra State Electricity Distribution Co (MSEDCL), for setting up grid-connected solar power projects at multiple locations in Maharashtra.

Time Technoplast

The company has entered a Memorandum of Understanding (MoU) with the promoters of Ebullient Packaging for the acquisition of a 74% equity stake. EPPL is valued at an estimated enterprise value of approximately Rs 200 crore.

Ratnamani Metals & Tubes

Ratnamani Metals & Tubes signed a Share Purchase Agreement with Technoenergy AG, Switzerland, to acquire its entire stake in Ratnamani Trade EU AG for €400,000, making it a wholly owned subsidiary.

Imagicaaworld Entertainment

The company signed a Business Transfer Agreement to acquire a 6.65 MW solar power plant in Solapur, Maharashtra, from Giriraj Enterprises on a slump sale basis for ?16 crore.

Aegis Logistics

The company announced a new capacity addition of 61,000 KL at Mumbai Port, with an investment of Rs 99.88 crore.

Max Estates

The Board approved acquiring Base Buildwell, which holds rights to a 7.25-acre land parcel at Golf Course Extension Road, Gurugram, making it a wholly owned subsidiary.

ACME Solar Holdings

The company has executed a share purchase agreement for the acquisition of 100% equity shares of AK Renewable Infra, for an enterprise value of Rs 79.25 crore.

HFCL

HFCL secures export orders ~USD 40.65M (INR 358.38 Cr) for optical fiber cables; delivery by April 2026.

NTPC Green Energy

The company has signed a Memorandum of Understanding (MoU) with VOC Port Authority to set up a green hydrogen fueling station at VOC Port, along with hydrogen-based internal combustion engine trucks for port operations.

BHEL

BHEL signed exclusive 10-year MOU on 05.09.2025 with Horizon Fuel Cell for hydrogen fuel-cell rolling stock

GST Cut Eases Capital Costs For Trucks, Boosting Demand: JK Tyre

* GST reduction on tractor tyres to 5% and other tyres to 18% (from 28%) is seen as a big boost for demand, lowering transport costs and reviving the auto industry.

* JK Tyre expects industry growth in FY26 at 7–8%, with a marginal upside post-GST cut; tyre demand is largely inelastic but sentiment improves.

* No direct “price cuts” planned; customer acquisition cost reduces as GST drops from 28% to 18%, while rubber and other raw material prices remain stable.

* Mexico plant plays a strategic role in exports to the US, helping offset tariff pressures; production and sales reallocation across geographies provides flexibility.

* Premium customer acquisitions are ongoing, with discussions and evaluations in progress, though no major closures confirmed in Q2.

Believe The ?7,500/Night Room Rate Limit Needs To Be Increased To ?12,500: Chalet Hotels

* GST cut to 5% (without Input Tax Credit) for hotel rooms under ?7,500 won’t directly impact Chalet Hotels since average rates are above ?12,000, but it should spur overall consumption and boost hospitality demand.

* CEO recommends restoring input tax credit for hotels under ?7,500, raising the limit to ?12,000, and linking it to CPI for automatic annual adjustments.

* Input tax credit removal slightly reduces margins, but lower GST on hotel consumables (linen, toiletries, food items, electronics) offsets costs, keeping the net effect positive.

* Chalet Hotels sees 60% of F&B revenue from non-resident guests (banquets, bars) and 40% from resident guests; GST on restaurants remains 18%.

* Heavy rains and flight cancellations affected occupancy in some regions, but overall growth for the quarter is still expected.

GST Of 28% & 12% Cess Has Now Changed To 40% On Aerated Beverages: Varun Beverages

* No change in GST for carbonated soft drinks (CSD) — still effectively 40% (28% GST + 12% cess earlier, now subsumed).

* Big positive on water, juices, and value-added dairy (~30% of volumes) with GST reduced from 12–18% to 5%; benefit to be fully passed on to consumers, boosting demand.

* Despite rains impacting Q2 and Q3 volumes, management expects recovery with weather normalization and sees double-digit growth returning.

* Ongoing aggressive expansion: adding 4–5 lakh outlets annually (currently ~4.5M vs 13M FMCG outlets in India), with large plant capacity helping sustain healthy 20–25% margins.

* Competition from Campa, Coke, and Pepsi seen as expanding the market rather than hurting volumes; Varun Beverages remains confident on margins and long-term growth.

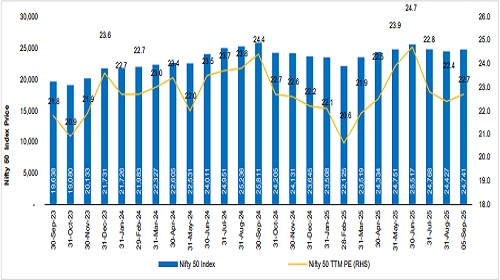

Nifty 50 Index & TTM PE

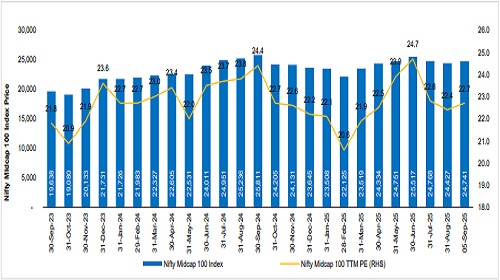

Nifty Midcap 100 Index & TTM PE

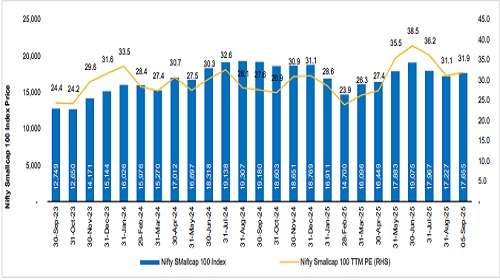

Nifty Smallcap 100 Index & TTM PE

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131