Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

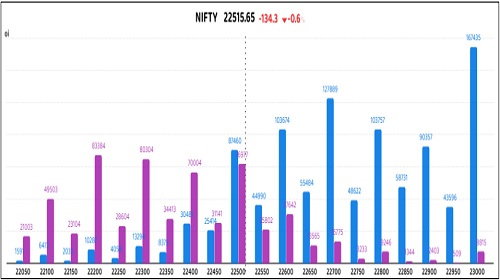

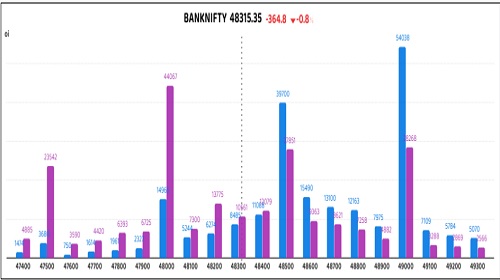

Nifty Futures: 22,515 (-0.59%), Bank Nifty Futures: 48,315 (-0.75%).

On Monday, despite a flat opening, both indices came under selling pressure, with Nifty Futures closing 134 points lower, reflecting cautious sentiment amid concerns over US economic growth, shifting trade policies, and inflation trends. January inflation eased to 4.31%, marking the lowest year-on-year level since August 2024, while the Consumer Price Index (CPI) data for February 2025 is set to be released later this week. Bank Nifty declined by 365 points, with an 8% rise in open interest, indicating that short positions remain intact. Meanwhile, Nifty Futures premium narrowed to 55 from 97 points, and Bank Nifty premium fell from 183 to 99 points.

Global Movers:

US equities sank, with the Nasdaq 100 witnessing its worst sell-off since 2022, as uncertainty mounted around the true effect of the global trade war. The benchmark slumped 3.8%, while the S&P 500 plunged 2.7% despite a last-hour recovery. The slump saw the VIX spike to near 30 as the demand for protection surged. In notable movers, Tesla sank over 15% due to sales-related concerns. This was its most significant drop since 2020. President Trump stated that the US economy is facing a "period of transition", adding to investor concerns, especially as hedge funds have net sold US equities in the nine of the last ten weeks. In markets, the dollar rose slightly while the 10-year treasury yield slumped, bitcoin dropped below its 28th Feb low, Gold ended below $2900/ounce, and oil continues to struggle near $65, a near four-year low.

Stock Futures:

In Monday’s session, Hindustan Unilever, Bajaj Auto, IndusInd Bank, and Trent experienced marked market activity, high trading volumes and notable price changes, signifying increased momentum and stronger investor engagement.

Hindustan Unilever (HINDUNILVR) surged 1.9%, extending its four-session rally, with a 6% rise in open interest signaling sustained bullish sentiment. At a recent Barclays conference, the CEO projected QComm’s market share in India to grow from 2% to 10-15% in 2-3 years, boosting revenue prospects. The price momentum and rising OI reinforce a positive near-term outlook for the stock.

Bajaj Auto witnessed a sharp decline, retesting its low near its 52-week, despite a 2% growth in sales volume for February. However, a 14% slump in domestic sales fuelled investor concerns. Open interest contracted by 17.9%, coupled with a 10.9% depreciation since the start of the expiry, indicating unwinding of long positions. This divergence was further reinforced by today’s 2.5% fall, affirming that short positions remain dominant, sustaining the prevailing bearish sentiment in the market.

IndusInd Bank extended its losing streak, hitting a monthly low and edging closer to its 52-week low. This decline was accompanied by a 2.1% surge in open interest, reaching a two-month high with 5.36 million shares added. The bearish momentum intensified after multiple analysts downgraded the stock and slashed price targets. The correlation between the falling price and rising open interest signals a substantial short build-up, reflecting sustained bearish sentiment in the stock.

Trent sank 4.1%, extending its downtrend and nearing last month’s lows, marking a 40% decline from its recent peak. This drop was accompanied by a 2.8% rise in open interest, driven by a domestic brokerage's price target cut amid concerns over sustained revenue pressure. The simultaneous price decline and OI surge indicate a strong short build-up, reflecting bearish sentiment and expectations of further downside.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) decreased to 0.91 from 1.08, whereas the Bank Nifty PCR dropped from 0.99 to 0.93.

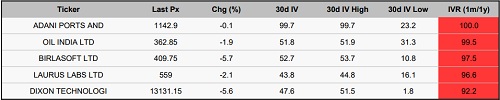

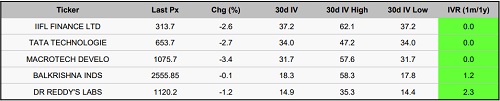

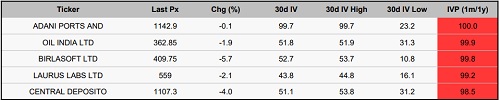

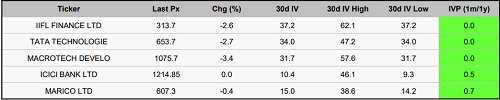

Implied Volatility:

Adani Ports and Oil India are experiencing significant price volatility, reflected in their high implied volatility rankings of 100 and 99, respectively. The latter's implied volatility was at 52%, while that of Dixon was at 99%. This rise in implied volatility means underlying options on these stocks are expensive, which may prompt traders to implement hedging strategies to manage the risks associated with potential price fluctuations. In contrast, IIFL and Tata Technologies were exhibiting the lowest implied volatility rankings, with implied volatilities of 37% and 34%, respectively. This means their options are relatively inexpensive, creating an advantageous opportunity for investors looking to create long exposures.

Options volume and Open Interest highlights:

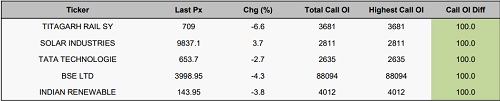

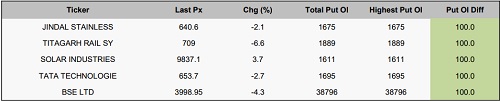

Phoenix Mills and Berger Paints are attracting significant attention from traders, evidenced by their call-to-put volume ratios of 5:1 and 4:1, respectively, indicating a bullish sentiment. However, these ratios may also reflect divergent investor opinions. On the other hand, L&T Technology Services and Laurus Labs are experiencing increasing put option volumes compared to call, with ratios of 3:1 and 2:1, respectively, which signals heightened caution regarding potential downside risks. From a positioning perspective, IIFL Finance and Phoenix Mills ltd, a new entrant in the F&O segment from current series, have recorded the highest open interest in both call and put options, followed by BSE Ltd on the call side and Jindal Stainless Ltd on the put side, indicating a likelihood of greater price volatility. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In Monday’s session, in index futures, FIIs and clients collectively reduced their positions, indicating a bearish sentiment among major participants. FIIs pared down 3,321 contracts, while clients trimmed 4,556 contracts. In contrast, proprietary traders took a contrarian stance, accumulating 8,270 contracts, suggesting a potential bullish outlook. Shifting focus to stock futures, FIIs, clients, and proprietary traders collectively reduced their positions, signalling a bearish market sentiment. FIIs led the sell-off with 20,755 contracts offloaded, followed by clients trimming 13,326 contracts and proprietary traders unwinding 3,979 contracts. This broad-based selling reflects a cautious to negative outlook in the segment.

Securities in Ban for Trade Date 11-March-2025:

1) BSE

2) HINDCOPPER

3) MANAPPURAM

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Tag News

Sensex, Nifty end in green after positive cues from RBI MPC meet