Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

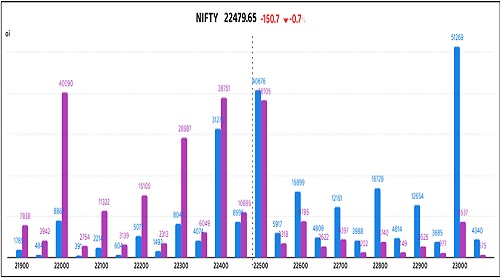

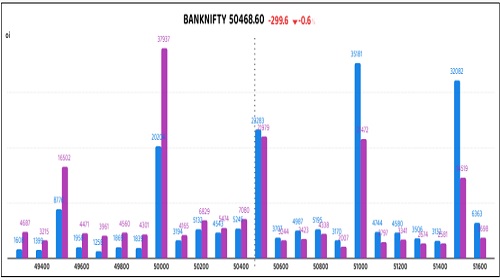

Nifty Futures: 22,479.65 (-0.7%), Bank Nifty Futures: 50,468.60 (-0.6%).

Nifty futures succumbed to global market volatility spurred by the U.S.'s punitive 104% tariffs on Chinese imports, shedding 151 points before a partial recovery at the end of session. Despite heightened India VIX and weekly expiry dynamics, the index showed unexpected stability trading in a very narrow range until the session closed, surprising market participants and highlighting market resilience amid ongoing uncertainties. This market resilience occurred against the backdrop of the Reserve Bank of India's accommodative policy shift, including a 25-basis-point repo rate reduction to 6%, revisions of FY26 GDP growth to 6.5%, and inflation forecasts downward to 4%. The rupee depreciated significantly, weakening 43 paise to 86.69 against the dollar, reaching an intraday low of 86.72. This currency devaluation, the steepest since March 17, underscores the prevailing risk-off sentiment. The premium on Nifty futures dropped from 95 points to 81, while the premium for Bank Nifty fell to 228 points from 257.

Global Movers:

US stocks gave up a fair portion of their Wednesday surge yesterday, as the fallout from tariff fears lingered. The S&P 500 finished 3.5% down, while the Nasdaq 100 and the Dow fell 4.2% and 2.5%, respectively. Volatility remains very high, even as President Trump said that he is close to getting a first deal on tariffs without naming the country. Meanwhile, investors continue to be worried that the 145% tariffs slapped on China are likely to result in considerable damage to global economic activity. Coming to other markets, the VIX ended above 40 from 33 a day ago, the dollar suffered its worst single-day drop since 2022 as it finished 2% down, US treasury yields rose for the fourth straight day, Bitcoin fell 4%, Gold rose to a new record of $3219 this morning as it benefited from a falling dollar and increasing uncertainty while oil prices fell back under $60 and were on track for a second weekly loss spurred recession concerns.

Stock Futures:

Wednesday's session showed a significant rise in trading volume and price fluctuations for NBCC, Housing and Urban Development Corp., Muthoot Finance, and Biocon Ltd. This increase indicates strong momentum and heightened investor interest.

NBCC registered a strong 5.1% intraday rally, marking its most substantial monthly gain, supported by peak single-day volume and a close above the previous month's high. This price movement coincided with the announcement of new work orders totalling approximately ?121 crore, including constructing court buildings for the High Court of Andhra Pradesh in Gudivada and Bhimavaram. Further enhancing investor sentiment, NBCC entered into a strategic five-year MoU with RailTel Corporation of India to jointly develop data centre projects domestically and internationally, with NBCC providing project management consultancy. The notable price increase was accompanied by a significant 3.1% rise in open interest, representing an addition of 9.6 lakh shares in the futures segment – the largest single-day increment in the current series. This long build-up may be combined with short covering as there was relatively lower open interest change, although it signifies strengthening bullish sentiment, but with a lower conviction.

HUDCO's stock displayed strong bullish momentum, extending its rally for a second consecutive session with a considerable 3.3% increase. Since March 19th, 2025, this price appreciation has been highlighted by the highest single-day trading volume in the past two months, which is close to its two-month peak. Fueling this rally are a Memorandum of Understanding with MMRDA to seek ?1.5 lakh crore for Mumbai infrastructure over five years and the Central Board of Direct Taxes' approval for Capital Gain Tax Exemption bonds from April 1st, 2025. This price surge, combined with substantial volume, was accompanied by a significant 24.4% increase in open interest, representing the addition of 40.6 lakh shares – the largest single-day accretion of long positions since early February 2025, signalling strong conviction in further upside. Over the last three trading sessions, HUDCO has recorded a cumulative 9% gain, supported by an 11% expansion in open interest, confirming a marked long build-up and reinforcing market expectations for continued bullish momentum in the near term.

Muthoot Finance's stock underwent a turbulent trading session, marked by a sharp 7% intraday decline and significant volatility, registering its highest single-day volume since early January 2024. This erratic price movement was triggered by RBI Governor Malhotra's initial statement regarding forthcoming comprehensive guidelines on gold loans, briefly sending the stock into a 10% lower circuit. However, a subsequent clarification in a press conference from the Governor stating that the guidelines aimed at rationalisation rather than tightening prompted a partial recovery. Despite the pullback, intense selling pressure persisted, evidenced by a substantial 20% rise in open interest in the futures segment. This addition of 7.8 lakh shares indicates a significant short build-up, reaching a yearly high and the largest single-day increase in open interest for the year. Concurrently, the options market reflected a cautious-to-bearish outlook, with call options showcasing the highest open interest for the current series, indicative of aggressive call writing. The convergence of this price decline and bearish derivative indicators strongly suggests an anticipation of continued downward momentum in the stock.

Biocon Ltd's stock faced a steep reversal, plummeting by 5.2% and erasing the previous session's gains. This significant decline, accompanied by increased trading volumes, stemmed from concerns over potential US tariffs on pharmaceutical imports, as US President Donald Trump's trade policy indicated. The sharp correction highlights investor worries about Biocon's US market exposure. Adding to the bearish sentiment, open interest in Biocon futures saw a notable 8.8% increase – the largest single-day growth in the past two months, representing the addition of 17.5 lakh shares. This considerable open interest build-up strongly suggests aggressive short-selling activity, reflecting a negative market outlook on Biocon's near-term prospects due to potential trade headwinds.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.93 from 1.01 points, while the Bank Nifty PCR fell from 0.81 to 0.78 points.

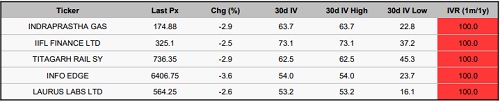

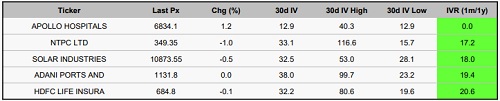

Implied Volatility:

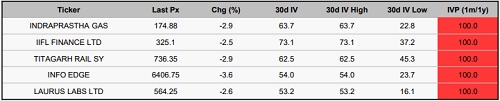

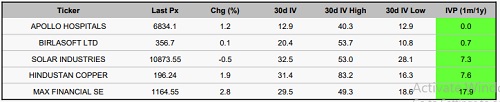

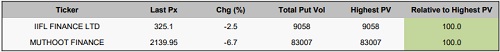

Indraprastha Gas and IIFL Finance have seen significant shifts in their stock prices, reflected in their high implied volatility rankings, recorded at 64% and 73%. This increase in implied volatility suggests that options for these companies are becoming pricier, leading traders to consider risk management strategies to counteract the effects of price fluctuations. In contrast, Apollo Hospitals Enterprise and NTPC Ltd have the lowest implied volatility rankings, with their reading at 13% and 33%, respectively. This decrease in volatility signals that their options are relatively more appealing, creating a favourable opportunity for investors pursuing long positions.

Options volume and Open Interest highlights:

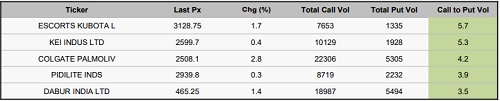

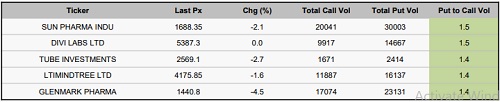

Escorts Kubota and KEI Industries show a bullish outlook with call-put volume ratios of 6:1 and 5:1, respectively, indicating strong demand for call options and expected price increases. However, a steep call skew may signal potential overvaluation or demand for downside protection. In contrast, Sun Pharmaceutical and Glenmark Pharmaceuticals exhibit substantial put option activity, reflecting bearish sentiment and concerns over price declines; yet, excessively high put volume could suggest an oversold market and potential for contrarian buying. Coforge Ltd and Persistent Systems have significant open interest in call options, indicating possible price volatility, which may act as resistance or trigger upward movement. Conversely, Aurobindo Pharma and Manappuram Finance show notable interest in put options, suggesting active trader participation and hedging, implying the potential for significant price fluctuations that could support or lead to declines. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a significant shift in open interest was observed, with a total of 7,900 contracts changing hands. Notably, client activity demonstrated a strong bullish sentiment, aggressively adding 7,900 contracts, indicating a positive outlook on the underlying index. Conversely, Foreign Institutional Investors (FIIs) exhibited a discernible bearish bias, liquidating 6,706 contracts, suggesting a cautious or negative perspective. Similarly, proprietary traders reduced their positions by 714 contracts, reflecting a more neutral or risk-averse stance. Contrasting this, the stock futures market witnessed a substantial turnover of 28,049 contracts. Here, the pronounced buying activity by clients, who augmented their holdings by a substantial 17,819 contracts, signalled considerable optimism within this segment. However, this bullish inclination was starkly countered by the substantial reduction in positions by FIIs and proprietary traders, who decreased their exposures by a significant 21,770 and 6,279 contracts, respectively. This divergence indicates a sector-specific bearish sentiment among institutional traders, despite optimism from clients.

Securities in Ban for Trade Date 11-April-2025:

1) BSOFT

2) HINDCOPPER

3) MANAPPURAM

4) NATIONALUM

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Volume Relative to Record High

Put Volume Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633