Daily Derivatives Report 30th September 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 24,685.0 (0.0%), Bank Nifty Futures: 54,550.2 (0.1%).

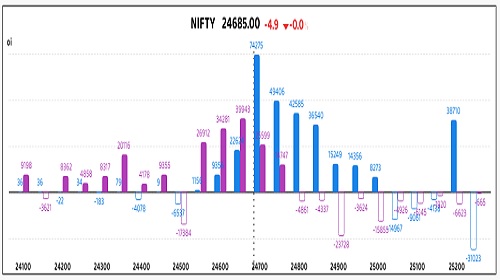

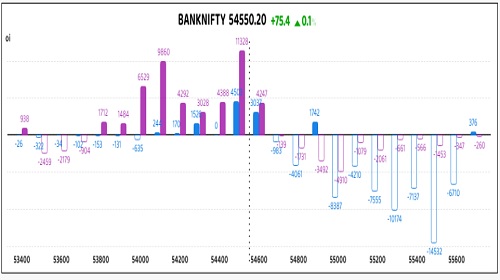

Nifty Futures and Bank Nifty Futures concluded Monday’s volatile session with marginal index divergence, as investor sentiment remained cautious ahead of the Reserve Bank of India’s monetary policy decision. Nifty Futures slipped 4.9 points, reflecting a Short Build Up, as open interest rose 3.9% to 210.8 Lc contracts, an addition of 7.8 Lc shares, while the futures premium widened from 35 to 50 points, signalling bearish undertones. In contrast, Bank Nifty Futures advanced 75.4 points, supported by Short Covering, with open interest declining 6.0% to 26.2 Lc contracts, a reduction of 1.7 Lc shares, and the futures premium edged up from 85 to 89 points, indicating unwinding of bearish positions. Broader equity indices extended their losing streak for the seventh consecutive session, weighed down by investor indecision ahead of the RBI’s stance on inflation and interest rates. Sectoral rotation was evident, with declines in media, private banking, and pharma stocks, while PSU banks, oil & gas, and realty counters saw buying interest. Oil marketing companies surged 3–5% after the Oil Minister highlighted undervaluation in fuel pricing. Meanwhile, India VIX eased 1.7% to 11.23, underscoring the range-bound and cautious tone of the market. In the currency space, the Indian Rupee traded at approximately 88.75 against the US Dollar.

Global Movers:

US stocks rallied yesterday, despite some concern about a looming government shutdown and announcements of new tariff measures. The S&P 500 rose 0.3% to 6661, while the Nasdaq 100 gained 0.4%. Besides data on job openings later today and non-farm payrolls on Friday, investors are keeping an eye on a quarter-end rebalancing from US pension funds, which could create some selling pressure for stocks. In related markets, the VIX jumped 5.4%, while the dollar index and the US 10-year treasury yield both fell. Elsewhere, Gold rose to a fresh record high of $3834/ounce on fears of the potential shutdown, while brent crude dropped over 3% and settled under $68 due to concerns of excessive supply.

Stock Futures:

Sammaan Capital Ltd. (SAMMAANCAP) skyrocketed to a seven-month intra-day high amidst heavy trading volumes, a rally propelled by the market's positive reception of its asset-light model, retail-centric strategy, and diligent debt servicing. This bullish sentiment was mirrored in the derivatives market, which signalled a clear Long Addition, with the stock price gaining 12.1% on a substantial 45.1% surge in open interest. Futures positioning intensified, with 8,582 new contracts bringing the total open interest to 27,608. The options data reveal an explosive build-up in activity, where the addition of 4,817 put contracts narrowly outpaced the 4,290 new call contracts, pushing the Put-Call Ratio up to 1.01 and causing implied volatility to spike by 21.5% to 47%. This indicates that while call buyers are aggressively speculating on further upside, put writers are simultaneously building significant positions, betting on the premium decay and establishing a strong support level for the stock.

IIFL Finance Ltd. (IIFL) rallied significantly after the Reserve Bank of India lifted its embargo on the company's pivotal gold loan business, restoring investor confidence and triggering a wave of buying interest. The derivatives action was characteristic of a Short Covering, as the price appreciated by 4.7% while futures open interest concurrently declined by 0.8%, shedding 72 contracts to a total of 9,176. This relief rally was further evidenced by the futures premium to the spot price widening from 0.25 to 0.6 points, indicating strengthening near-term expectations. In the options arena, the unwinding of 245 call contracts suggests call writers booked profits on the stock's rebound, while the addition of 198 put contracts indicates put writers are establishing new positions, anticipating that the upward momentum will sustain, thereby creating a potential floor for the price.

Dixon Technologies (India) Ltd. retreated sharply by 4.6% as the stock succumbed to a bout of profit-booking after a period of robust performance, a short-term correction that contrasts with its strong underlying fundamentals. This downward pressure was confirmed by derivatives data indicating a Short Addition, where the price drop was accompanied by a 3.4% increase in open interest, reflecting 1,060 newly added futures contracts for a total of 32,192. The options data signals a decisively bearish stance, with a massive addition of 13,511 call contracts overwhelming the 1,527 new put contracts, causing the Put-Call Ratio to collapse from 0.66 to 0.46. This lopsided activity, combined with a 12.08% jump in implied volatility to 35.72%, points to aggressive call writing, as traders are selling call options to capitalise on the falling price and bet against any significant near-term recovery.

Kaynes Technology India Ltd. (KAYNES) faltered, closing 4% lower in a classic "sell on news" reaction, as traders liquidated positions despite the landmark announcement of a Rs 3,330 Cr joint venture for a semiconductor facility. The market action was identified as Long Unwinding, with the price decline corresponding to a 3% reduction in futures open interest, as 343 contracts were closed out, leaving the total at 11,250. The options landscape suggests a tactical repositioning, where the decrease of 666 put contracts outstripped the modest addition of 425 call contracts, causing the Put-Call Ratio to dip to 0.54 from 0.61. This indicates that put buyers are booking profits while some call writers may be cautiously entering, a dynamic that, alongside the futures unwinding, frames the day's move as profit-taking by existing bulls rather than the initiation of a new bearish trend.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.63 from 0.68 points, while the Bank Nifty PCR fell from 0.82 to 0.71 points.

Implied Volatility:

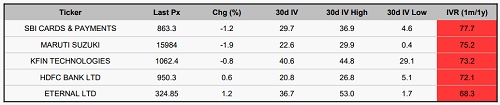

SBI Cards and Maruti Suzuki are currently experiencing a high-volatility environment, with elevated implied volatility (IV) rankings of 78% and 75% respectively, supported by strong realized volatility. This market expectation of significant price action has led to expensive option premiums, increasing the capital required for hedging or speculative positions. Conversely, DLF and NTPC exhibit a low-volatility regime, with subdued IV and stable realized volatility at 10%. The resulting compressed option premiums create a more favourable environment for establishing directional views through long call or put positions. This stability also benefits premium-harvesting strategies, as the diminished probability of large price swings increases the likelihood of option writers retaining the premium through expiration.

Options volume and Open Interest highlights:

Page Industries and Bosch Ltd are displaying pronounced bullish sentiment. This is evidenced by high Call-to-Put Volume Ratios of 9:1 and 5:1, respectively. Such positioning indicates strong market expectations of upward price movement. Consequently, the increased demand for call options has led to an expansion in option premiums, thereby increasing the cost of establishing new long positions. Conversely, Dixon Technologies and Sun Pharma show significant bearish sentiment, reflected by a Put-to-Call Ratio of two puts for every one call. This ratio suggests active hedging against downside risk or speculative bets on a price decline. However, this heavy bearish positioning could also signal that the stocks are in an oversold state, potentially presenting a contrarian opportunity. Sammaan Capital and Crompton Greaves demonstrate an ambiguous directional outlook. A concurrent increase in Open Interest (OI) for both Call and Put options indicates that market participants are pricing in heightened short-term volatility. However, there is a discernible lack of directional conviction among traders. Similarly, Godrej Properties is seeing a build-up in Put option positions, signalling a cautious and defensive posture among market participants. While directional clarity is absent, the accumulation of these protective position’s points to expectations of near-term volatility. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

The index futures segment revealed a pronounced bullish stance from proprietary trading desks, which aggressively added 6,411 contracts. This accumulation starkly contrasted with the risk-off sentiment from retail clients and Foreign Institutional Investors (FIIs), who collectively shed their positions by 3,164 and 2,622 contracts, respectively, indicating a cautious outlook on the broader market. Conversely, the stock futures arena was dominated by a monumental display of bullish conviction from FIIs, who single-handedly absorbed 57,563 contracts, while clients and proprietary traders exhibited bearishness, reducing their exposure by 9,517 and 7,508 contracts, respectively. The conflicting bullish bets, with proprietary traders favouring the overall index and FIIs focusing on specific stocks, signal a highly selective and fragmented market sentiment against a backdrop of broad retail caution.

Nifty

Bank Nifty

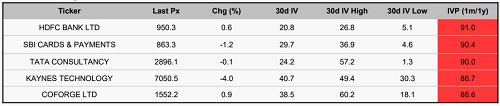

Stocks with High IVR:

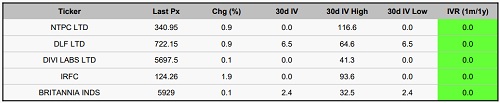

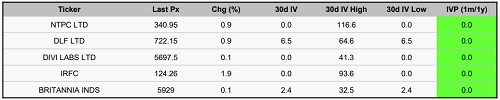

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Nifty immediate support is at 23000 then 22800 zones while resistance at 23400 then 23550 zo...