Daily Derivatives Report 27th October 2025 by Axis Securities Ltd

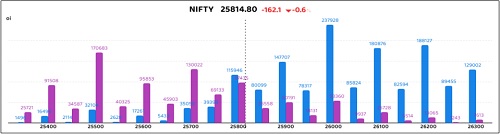

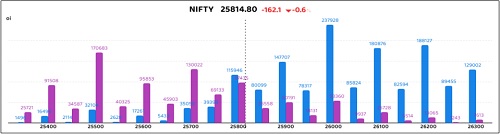

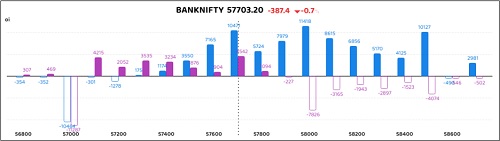

Positioning Stack by Strike (Nifty Current Week Expiry & BankNifty Monthly Expiry)

For the Nifty, the 26,000 Call and the 25,500 Put had the highest call and put concentration (contracts). For the Bank Nifty, the 58,000 Call and the 57,000 Put saw the most amount of open interest.

Chart quotes show front-month Nifty and Bank Nifty futures levels along with absolute and percentage change from prior trading session

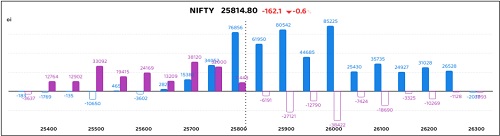

Open Interest Change (Nifty Current Week Expiry & BankNifty Monthly Expiry) Call Put

The largest open interest changes (contracts) were seen at the 26,000 Call and the 26,000 Put

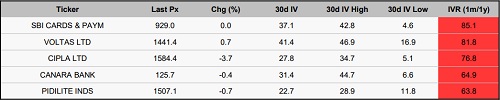

Stocks with High IVR:

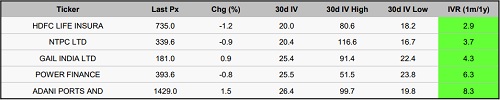

Stocks with Low IVR:

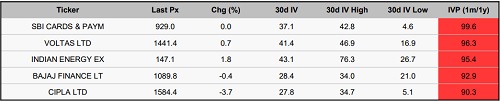

Stocks With High IVP:

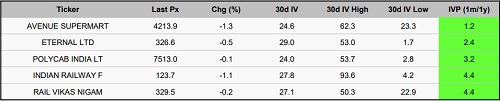

Stocks With Low IVP:

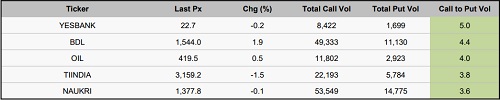

Stocks With High Call Volume To Put Volume

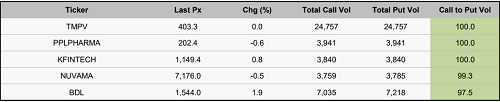

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)

More News

Nifty volatile on new expiry, ends in green - Religare Broking Ltd