Daily Derivatives Report 26th November 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 26,055.4 (-0.4%), Bank Nifty Futures: 59,139.6 (-0.2%).

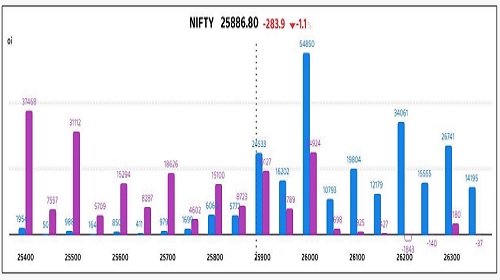

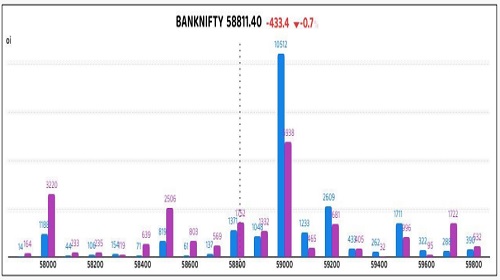

Nifty Futures and Bank Nifty Futures reversed early gains and traded with cuts in mid-afternoon as rollover activity ahead of the monthly F&O expiry heightened volatility and triggered erratic moves. Nifty extended losses for a third straight session Tuesday, surrendering the psychological 26,000 mark as traders unwound positions into the November derivatives expiry, creating late-session pressure that eroded early strength. Nifty December expiry Futures fell 115.3 points with open interest rising 24.4% to 145.51 lakh, an increase of 28.51 lakh shares, signaling short build-up. Bank Nifty December Futures declined 105.2 points with open interest climbing 30.9% to 14.33 lakh, an addition of 3.38 lakh shares, also indicating short build-up. The Nifty Futures premium narrowed to 171 points from 211, while the Bank Nifty premium contracted to 319 points from 409. Sectorally, Nifty IT, Nifty Auto, and Nifty FMCG were the top laggards, dragging the benchmark lower, while Nifty PSU Bank, Nifty Metal, and Nifty Realty bucked the trend to close in the green with gains of up to 1%. The India VIX cooled sharply, dropping 7.5% to close at 12.24, a divergence during a market decline that suggested the fall was orderly and expiry-driven rather than panic-led. Investors remained cautious ahead of the release of FOMC meeting minutes and US GDP data, weighing the probability of a December rate cut against sticky inflation concerns. Meanwhile, the Indian Rupee weakened by 4 paise to settle at 89.20 against the US Dollar, hovering near record lows despite intraday recovery from 89.27.

Global Movers:

U.S. equity markets extended their powerful holiday-shortened rally on Tuesday, with the Dow Jones Industrial Average surging approximately 664 points, or 1.4%, to close at a record 47,112. The S&P 500 gained 0.9% to settle at 6,766, effectively shaking off the prior week's technical weakness, while the tech-heavy Nasdaq Composite climbed 0.7% to finish at 23,026 despite an approximate 4% slide in Nvidia shares. Buoyed by delayed September retail sales data showing a 0.2% increase and solidified expectations now at 85% for a Federal Reserve interest rate cut in December, investor sentiment broadened significantly beyond the technology sector. Government bond markets reacted to the dovish outlook, pushing the yield on the 10-year U.S. Treasury down to 4.02%. In commodities, precious metals capitalized on the softer dollar, with gold futures advancing to roughly $4,177 per ounce and silver holding steady near $51.46, while WTI crude oil futures remained under pressure, slipping 1.5% to settle at $57.95 per barrel.

Stock Futures:

Aditya Birla Capital surged to a fresh 52-week high as bullish sentiment intensified following the successful allotment of Rs 200 Cr in perpetual NCDs via private placement, underscoring strong capital-raising ability and investor confidence. The move builds on a Rs 1,750 Cr debt raise earlier this month, reinforcing its aggressive funding strategy. The stock recorded a Long Addition with a 4% price gain and 0.8% rise in futures open interest to 25,611 contracts, with 209 new additions. Options data showed call OI at 3,771 and put OI at 2,629, both declining sharply, while PCR slipped to 0.70 from 0.79. November series futures OI expanded by 41.29 Lc to 7.93 Cr with rollover at 98.4%, as expiry-to-expiry gains stood at 10.5%. The derivatives setup reflects bullish undertones, though reduced call and put positions suggest option buyers are cautious while writers maintain control.

IIFL Finance broke out strongly, nearing its 52-week high as investors positioned ahead of the Nov 26 board meeting expected to approve a major NCD fundraising plan to accelerate secured lending growth. The stock saw Short Covering with a 3.8% price gain and 7.5% decline in futures OI to 8,643 contracts, shedding 699. Options activity showed call OI at 2,395 and put OI at 1,167, both falling sharply, while November series unwound 11.07 Lc contracts, taking futures OI to 1.42 Cr with rollover at 94%. Expiry-to-expiry gains stood at 8.5%. The derivatives structure highlights aggressive short covering, with option buyers retreating while sellers consolidate positions, signaling cautious optimism.

Federal Bank rallied as markets cheered shareholder approval of a Rs 6,197 Cr capital infusion from Blackstone, expected to bolster credit growth in high-yield segments despite Q2 margin compression. The stock registered Short Covering with a 2.4% price gain and 2.4% drop in futures OI to 10,776 contracts, shedding 259. Futures shifted to a discount of 0.37 versus a prior premium of 1.35, marking a 1.72-point swing. November series unwound 2.80 Cr contracts, taking OI to 5.38 Cr, while rollover rose to 94.3%. Expiry-to-expiry gains stood at 8.6%. The derivatives profile indicates strong short covering momentum, with option buyers reducing exposure while writers gain leverage, reflecting confidence in the capital buffer.

Adani Enterprises came under heavy selling pressure as its Rs 24,930 Cr rights issue opened on Nov 25, priced at Rs 1,800, nearly 23% below market levels, triggering arbitrage-led profit booking. The stock saw a Short Addition with a 2.9% decline and 9.7% rise in futures OI to 46,378 contracts, adding 4,117. Futures premium narrowed to 14.7 from 17.8, down 3.1 points. November series unwound 2.77 Lc contracts, taking OI to 1.43 Cr, while rollover stood at 95.2% versus 94.7%. Expiry-to-expiry losses were 3.5%. The derivatives setup signals bearish positioning, with option buyers retreating amid rising OI, while writers strengthen their stance, reflecting pressure from discounted rights pricing.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.95 from 1.04 points, while the Bank Nifty PCR fell from 1.21 to 1.1 points.

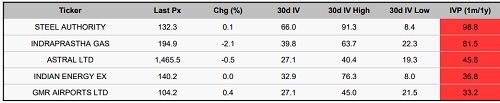

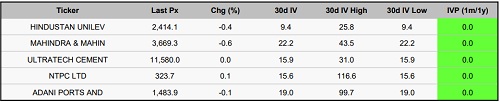

Implied Volatility:

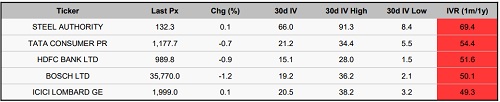

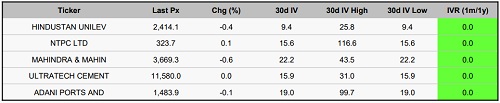

With Implied Volatility Ranks (IVR) hitting 69% for Steel Authority of India and 54% for Tata Consumer, the market appears to be overestimating future price variances. This has pushed option premiums significantly higher as their actual realized volatilities stands at 66% and 21%, respectively. Such an environment creates a prime opportunity for Short Premium Strategies (selling options). Experienced traders can leverage these inflated prices to benefit from time decay and the eventual reversion of volatility to the mean. Conversely, Mahindra & Mahindra and NTPC present a completely different picture. Their IVR levels are currently among the lowest in the F&O sector, indicating that their options are undervalued. Supported by stable realized volatilities of 22% and 16%, this low-cost environment strongly supports Long Premium Strategies (buying options), allowing traders to acquire exposure at a bargain.

Options volume and Open Interest highlights:

Ashok Leyland and RVNL appear supposedly bullish with Call-to-Put ratios of 4:1 and 3:1, the associated spike in Implied Volatility has rendered their premiums expensive. More importantly, this crowded Call buying can often be interpreted as a contrarian warning, suggesting the rally might be nearing a near-term peak. On the other end of the spectrum, Nestle India and SAIL are weighed down by defensive posturing. Their high Put volumes and Open Interest accumulation at lower strikes reflect a bearish outlook, adding drag to their price action. Meanwhile, TMPV and NMDC are sitting on heavy Call OI at 52-week highs, while TMPC and REC Ltd face similar saturation on the Put side. Traders should watch for consolidation in these names as a lack of movement could spark a swift "shake-out," where the unwinding of these massive positions fuels a sudden and sharp breakout or breakdown. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Foreign Institutional Investors (FIIs) drove a decisive bullish pivot in Index Futures, aggressively adding 67,008 contracts to counterbalance the 50,127 contracts offloaded by Proprietary desks and the 17,274 unwind by Clients. This institutional conviction contrasted sharply with Stock Futures, where Proprietary traders emerged as the primary liquidity providers, absorbing 77,207 contracts to capitalize on sector-specific rotation. This accumulation countered a massive retail capitulation, as Clients liquidated 82,248 positions alongside a 19,543 contract reduction by FIIs, highlighting a stark divergence between macro-index positioning and single-stock sentiment.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

_Securities_(600x400).jpg)

Nifty consolidates; above 26050 bullish, below 25740 downside risk - Tradebulls Securities P...