Daily Derivatives Report 25th November 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,996.4 (-0.3%), Bank Nifty Futures: 58,871.8 (0.0%).

Nifty and Bank Nifty Futures registered a retreat for the second consecutive session, driven by sustained profit booking and a palpable sense of caution preceding the crucial US Federal Reserve's December policy announcement. The indices initially opened marginally positive, achieving their session highs before a gradual and steady decline took hold, culminating in a pronounced sell-off during the final hour. This late-session capitulation suggested investors were unwilling to hold long positions overnight ahead of the monthly expiry. Market sentiment was further undermined by heightened concerns regarding a potential delay in the finalization of an interim US-India trade pact, introducing geopolitical uncertainty that typically spurs market risk aversion, particularly affecting global trade-reliant sectors. With the international market environment offering no clear directional cues, domestic pressures dominated the trading day. In the derivatives segment, Nifty Futures shed 81.1 points, accompanying a 1.9% rise in Open Interest to 209.71 lakhs (an addition of 3.88 lakh shares), which confirmed a Short Build Up. Conversely, Bank Nifty Futures advanced 2.8 points despite a 4.8% decrease in Open Interest to 20.90 lakhs (a reduction of 1.04 lakh shares), signaling Short Covering. Reflecting increased demand, the Nifty Futures premium expanded to 37 from 9 points, and the Bank Nifty premium surged from 1 to 36 points. Sectoral performance revealed a rotation of preference: Information Technology (IT) and Auto sectors posted marginal gains, showing relative resilience, while Metal and Healthcare sectors suffered sharp declines, and the Public Sector Undertaking (PSU) Banking space witnessed active profit-taking. Finally, India VIX, the barometer of expected market volatility, climbed 2.9% to 13.23. The Indian Rupee recorded a robust surge against the U.S. dollar on Monday, gaining 46 paise to settle the day at 89.20. This positive momentum was reinforced by a simultaneous dip in global crude oil prices, which alleviated pressure on the domestic currency by reducing the demand for dollars required for oil purchases.

Global Movers:

U.S. Equity Markets Surge to Start Holiday-Shortened Week U.S. equity markets have staged a powerful rally to begin the holiday-shortened Thanksgiving week, effectively reversing the sentiment from the previous week's volatility. The rebound has been driven by renewed confidence in the Federal Reserve's monetary policy path and a resurgence in the technology sector. The tech-heavy index soared approximately 2.7% to close at 22,872 on Monday, leading the market's recovery and erasing much of the previous week's steep losses. The S&P 500 closed at 6,705 gained roughly 1.6%, finding support after dipping below key technical levels the prior week. Dow Jones Industrial Average the blue-chip index at 46,448 rose approximately 0.4%. The yield on the 10-year U.S. Treasury edged lower to 4.04%, stabilizing after ending the previous week at roughly 4.06%. Reacting to the solidified rate-cut expectations and a softer dollar outlook, precious metals rebounded. Gold rose to approximately $4,135 per ounce, while Silver climbed to $51.36 per ounce, shaking off the cautious sentiment seen last week. WTI Crude Oil futures rose 1.5% to settle at $58.95 per barrel.

Stock Futures:

NBCC (India) surged as fresh government contracts worth Rs 117 Cr ignited momentum, reinforcing visibility after last week’s Rs 2,966 Cr NMRDA mandate. The stock registered Short Covering with a 3.6% price gain and a 7.4% decline in open interest, shedding 971 contracts to 12,196. Futures traded at a premium of 0.81 points versus 0.65 earlier, marking a 0.16-point rise. Options data showed call open interest at 7,825 contracts, down 1,069, while puts rose marginally by 18 to 3,898, lifting PCR to 0.50 from 0.44. The positioning reflects option buyers shifting toward protective puts, while writers face reduced call exposure, signaling cautious optimism amid contract-driven strength.

KPIT Technologies advanced 2.7% in a relief rally as investor sentiment improved post Q2 FY26 earnings disappointment, aided by management’s clarity on acquisitions and a $232 Mn deal pipeline. The stock saw Long Addition with open interest rising 6.6% to 8,452 contracts, adding 525. Futures traded firm, while options showed call open interest at 4,851, down 122, and puts at 3,823, up 35, pushing PCR to 0.79 from 0.76. The derivatives setup indicates option buyers leaning toward balanced hedging, while sellers maintain confidence in upward momentum supported by deal visibility.

Sammaan Capital slipped 4.3% under renewed selling pressure as F&O ban constraints ahead of expiry triggered unwinding. The stock recorded Long Unwinding with open interest down 1.5% to 23,658 contracts, shedding 352. Futures premium narrowed to 1.6 points from 1.77, a 0.17-point decline. Options data showed calls at 12,984, down 1,375, and puts at 8,249, down 361, lifting PCR to 0.64 from 0.60. The trend highlights option buyers reducing exposure across strikes, while writers consolidate positions, reflecting expiry-driven volatility and restricted fresh build-up.

CG Power corrected 3.6% after cancellation of a Rs 600 Cr CLW order, sparking immediate selling. The stock witnessed Short Addition with open interest rising 4.7% to 20,072 contracts, adding 895. Futures premium widened to 4.7 points from 2.75, a 1.95-point increase. Options positioning showed calls at 8,536, up 283, and puts at 4,768, up 201, keeping PCR steady. The derivatives stance suggests option buyers hedging downside risk while writers expand exposure, reflecting heightened caution amid order cancellation-driven weakness.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.77 from 1.03 points, while the Bank Nifty PCR fell from 0.96 to 0.93 points.

Implied Volatility:

TCS (52% IVR) and HDFC Bank (50% IVR) exhibit high Implied Volatility Ranks, meaning the market is overpricing future price swings, rendering their options contracts remarkably expensive as seen in their realized volatilities of 15% and 19%, respectively. This high IVR environment is highly conducive to Short Premium Strategies (selling options), as astute traders can profit from the anticipated mean reversion of volatility and the decay of the inflated time premium, making Long Premium Strategies (buying options) less viable. In stark contrast, HindUnilever and NTPC are prime candidates for Long Premium Strategies (buying options) because their IVR levels are among the lowest in the F&O segment, signalling that their options contracts are comparatively cheap. Coupled with modest realized volatilities (10% and 16%), this low-volatility scenario favors the purchase of options.

Options volume and Open Interest highlights:

Supreme Industries and Tata Consumer, displaying extreme optimism with Call-to-Put Volume Ratios of 6:1 and 4:1 respectively, have seen their Implied Volatility (IV) significantly spike, making their options premiums expensive for new long option positions. However, this high concentration of Call buying is often read as a contrarian signal, suggesting the current bullish momentum may be nearing a near-term peak or exhaustion point. In contrast, Angel One and NMDC reflect a predominantly hedged or bearish market view, characterized by substantial Put option volumes and a high concentration of Put Open Interest (OI) at lower strikes, which exerts downward pressure toward support levels. Furthermore, a highly positioned state is observed in TMPV and JSW Energy, where Call OI is heavily concentrated at 52-week highs, and similarly in TMPV and PFC on the Put side. Critically, for all these heavily positioned stocks, any period of sustained price stability or consolidation could trigger a swift closure of these concentrated hedges, potentially leading to a sharp price move, such as a short-covering price rally or a sudden liquidation of long positions. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, out of 17,789 contracts that shifted, clients marginally increased exposure by 1,118 contracts, while Foreign Institutional Investors (FIIs) aggressively expanded positions with 8,150 contracts and Proprietary traders mirrored this bullish stance by adding 8,521 contracts, collectively signalling strong institutional conviction; conversely, in stock futures, out of 84,641 contracts traded, clients sharply unwound 21,793 contracts and Proprietary traders reduced 22,310 contracts, even as FIIs alone absorbed the entire 84,641 contracts, underscoring a stark divergence in sentiment where retail and proprietary players turned defensive while FIIs demonstrated dominant risk appetite.

Nifty

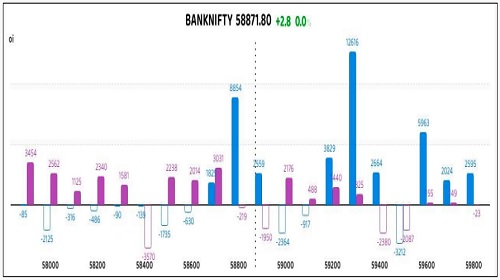

Bank Nifty

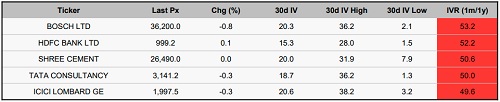

Stocks with High IVR:

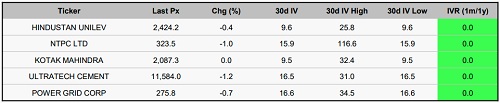

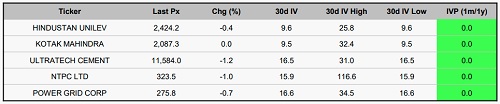

Stocks with Low IVR:

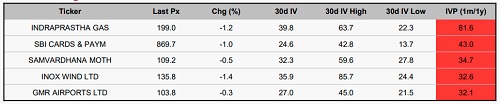

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Traders are advised to maintain cautious approach in current scenario - Religare Broking Ltd