Daily Derivatives Report 16th October 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,424.8 (0.9%), Bank Nifty Futures: 56,987.2 (0.5%).

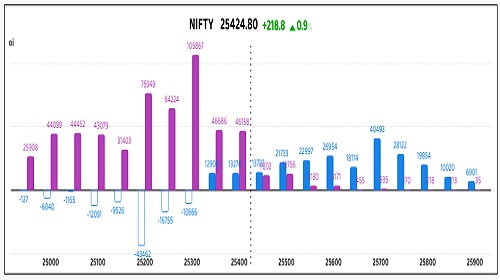

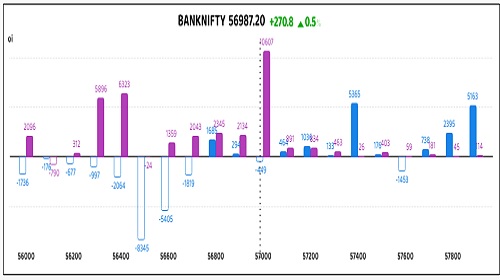

Nifty Futures and Bank Nifty Futures registered a decisive turnaround, posting substantial gains to halt a two-session losing streak. The indices opened with an upward bias and sustained moderate advances, underpinned by favourable global cues and a supportive lift from select index heavyweights. Domestic market sentiment received a significant boost from the IMF's revised projection, which upgraded India's FY22 GDP growth forecast, thereby reinforcing the nation's robust economic outlook. Furthermore, the initial indications of positive Q2FY26 earnings performance from certain large-cap entities likely bolstered confidence. Investor confidence was further bolstered by heightened expectations of an impending U.S. Federal Reserve (Fed) rate cut, while lower domestic retail CPI fueled optimism regarding a potential Reserve Bank of India (RBI) rate reduction in December. On the derivatives front, Nifty Futures closed 218.8 points higher, concurrent with an increase in Open Interest (OI) by 6.1 Lc shares (3.1% rise to 202.1 Lc shares), a setup indicative of a Long Build-Up. Similarly, Bank Nifty Futures advanced 270.8 points, with OI expanding by 0.47 Lc shares (2.5% increase to 19.5 Lc shares), also confirming a Long Build-Up. The Nifty futures premium expanded sharply from 61 points to 101 points, while the Bank Nifty premium saw a contraction from 220 points to 187 points. Market volatility, as measured by the India VIX, saw a sharp de-escalation, tanking 5.51% to 10.54. Concurrently, the Rupee (USD-INR) demonstrated considerable strength in the spot market, closing at Rs 88.08 against the US Dollar, marking its most significant single-day appreciation in nearly four months.

Global Movers:

US stocks broadly rallied yesterday, driven by a strong start to the earnings season, though volatility and US-China trade tensions continue to linger. The S&P 500 advanced 0.4% on the day, recovering from earlier erratic trading, while the Nasdaq Composite outperformed with a 0.7% gain, boosted by strong results and guidance from semiconductor and large technology firms. The Dow Jones Industrial Average lagged, edging down by less than 0.1%. Major Wall Street banks, including Bank of America and Morgan Stanley, reported better-than-expected third-quarter profits, largely due to robust investment banking and trading activity, providing an initial positive signal for the US economy amid an ongoing government shutdown that has delayed key economic data. In related markets, the Cboe Volatility Index (VIX) eased slightly, but remained at an elevated level, suggesting investors anticipate continued market choppiness driven by the renewed US-China spat over rare earth mineral export controls and retaliatory tariff threats. Spot gold continued its surge, climbing another 0.9% to trade above $4,200/ounce and set a new record high, as it remains a key safe-haven asset amidst geopolitical uncertainty and concerns about inflation. The 10-year Treasury yield ticked lower and the dollar index ended slightly down. Brent crude oil prices finished lower, dropping 0.8% to settle just above $62/barrel.

Stock Futures:

ICICI Lombard General Insurance Co Ltd. (ICICIGI) rallied 8.7% following its Q2FY26 earnings beat, with net profit surging 18.1% YoY to Rs 820 Cr, underscoring resilient core profitability and robust expansion in retail health and motor portfolios. Despite a technical dip in GDPI due to regulatory shifts and crop segment weakness, investor sentiment turned decisively bullish. Derivatives action reflected Long Addition with a 9.8% rise in open interest to 19,568 contracts, including 1,745 fresh additions. Options positioning revealed aggressive put build-up, with 9,870 contracts added versus 5,298 in calls, pushing PCR to 1.23 from 0.59. Elevated put interest relative to calls signals defensive hedging by option writers amid heightened bullish momentum.

Persistent Systems Ltd. (PERSISTENT) surged 7.3% as investors cheered its Q2FY26 "near-perfect quarter," marked by a 45.1% YoY jump in PAT and 4.2% QoQ revenue growth in constant currency, its 22nd straight sequential uptick. The rally was fueled by Short Covering, evidenced by a 4.4% drop in open interest to 32,835 contracts, with 1,526 contracts shed. Futures traded at a premium of 48.1 points, slightly narrowing from 50. Options data showed a sharp divergence, with 8,236 put contracts added and a marginal decline of 102 in calls, lifting total put OI to 18,914 versus 16,878 in calls. The skewed put build-up suggests cautious optimism, with option buyers positioning for volatility despite the bullish undertone.

HDFC Asset Management Company Ltd. (HDFCAMC) climbed 3% after announcing a 1:1 bonus issue, its first since listing, alongside a strong Q2FY26 performance. PAT rose 24.6% YoY and revenue expanded 15.8% YoY, reflecting sectoral tailwinds from India's growing mutual fund landscape. The stock saw Long Addition with a 13.1% rise in open interest to 16,987 contracts, including 1,966 new additions. Options activity was dominated by call accumulation, with 8,889 contracts added versus 3,248 in puts, driving total call OI to 15,742 against 7,438 in puts. The PCR dropped to 0.47 from 0.61, indicating aggressive bullish positioning by option buyers anticipating further upside.

360 One Wam Ltd. (360ONE) advanced 3.4% ahead of its Q2FY26 board meeting on 17th October, which will deliberate quarterly results and an interim dividend, sparking speculative interest. The stock registered Long Addition with a 28.9% jump in open interest to 7,027 contracts, including 1,576 fresh additions. Futures flipped from a prior discount to a 2.9-point premium, a swing of 4.6 points. Options data showed moderate build-up, with 499 put contracts added versus 341 in calls, lifting total put OI to 2,075 against 3,422 in calls. The PCR rose to 0.61 from 0.51, suggesting a balanced stance with option writers hedging cautiously ahead of event-driven volatility.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.21 from 0.82 points, while the Bank Nifty PCR rose from 1. to 1.1 points.

Implied Volatility:

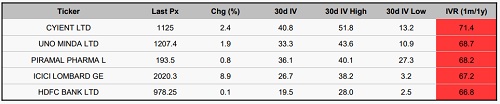

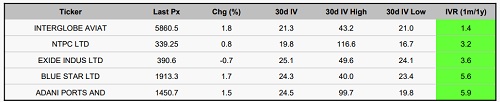

Cyient Ltd and UNO Minda have entered a heightened volatility phase in the derivatives market, underscored by elevated Implied Volatility Ranks of 71% and 69%, respectively. These lofty percentiles align with vigorous Expected Volatility metrics 41% for Cyient and 33% for UNO Minda signaling pronounced investor anticipation of near-term price swings. The surge in volatility has inflated option premiums, triggering a sharp rise in margin and capital requirements for both hedging and speculative deployments. Consequently, these contracts have become capital-intensive, diminishing their appeal for lean directional plays. Conversely, Interglobe Aviation and NTPC are navigating a subdued volatility regime, with Expected IVs of 21% and 19% respectively well below the broader F&O spectrum. This compression in implied risk has deflated option premiums, creating a cost-efficient landscape for directional strategies. Long Call and Long Put positions on these counters now offer a more favourable risk-reward profile, enabling traders to pursue speculative exposure with reduced upfront capital and enhanced payoff potential.

Options volume and Open Interest highlights:

IRCTC Ltd and Jindal Steel are exhibiting strong bullish undertones, as reflected in their elevated Call-to-Put Volume Ratios of 5:1 and 4:1, respectively. These skewed ratios point to aggressive long positioning and a pronounced upward bias in market sentiment toward the underlying stocks. The surge in Call option demand has driven up implied volatility, resulting in higher premiums and increased cost of initiating fresh directional longs. However, such a sharp tilt toward Calls may also suggest rally fatigue, warranting a contrarian perspective as it could signal near-term overbought conditions. Conversely, ITC Ltd and Wipro Ltd are seeing a rise in Put option volumes, with Put-to-Call Volume Ratios remaining relatively balanced. This uptick in Put activity indicates a cautious stance among market participants, reflecting elevated risk aversion and a preference for downside protection. A notable build-up in Put Open Interest typically aligns with bearish sentiment or portfolio hedging. That said, concentrated Put exposure may also imply these counters are nearing technical support zones, potentially presenting contrarian buying opportunities for value-oriented investors. HDFC AMC and Infosys (Infy) have registered increased activity on the Call side, generally interpreted as a bullish indicator and reflective of positive price expectations. However, this trend requires closer scrutiny, as the rise in Call volumes could also be attributed to Call writing strategies, including short-covering or hedging, rather than outright speculative interest. Bandhan Bank and ICICI Lombard General Insurance Co Ltd (ICICIGI) continue to show sustained accumulation in Put Open Interest, reinforcing a defensive market posture. While directional conviction remains subdued, the persistent build-up in protective Puts highlights prevailing concerns around near-term volatility and downside risk. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, the net reduction of 6,451 contracts by Retail Clients contrasts sharply with the 5,265 contracts accreted by Foreign Institutional Investors (FIIs) and the 2,779 contracts accumulated by Proprietary traders, collectively suggesting a countervailing institutional bullish bias amidst retail deleveraging. Conversely, in stock futures, the significantly pronounced Client offloading of 6,981 contracts was substantially eclipsed by the robust 15,676 contracts procured by FIIs and the sizable 4,758 contracts secured by Proprietary traders, a divergence that underscores a decisive institutional conviction toward single-stock positive directional bets.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

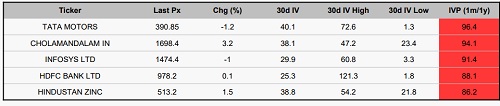

Stocks With High IVP:

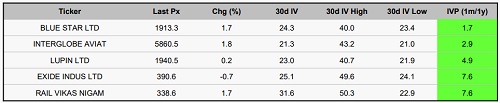

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Tag News

Daily Derivative Report - 04th March 2026 by Religare Broking Ltd

More News

The index opened on a weak note and slipped below the 25,000 mark, breaking key support and ...