Daily Derivatives Report 04 July 2025 by Axis Securities Ltd

The Day That Was:

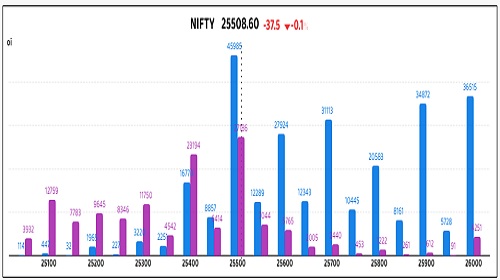

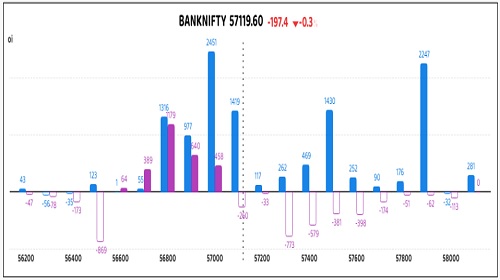

Nifty Futures: 25,508.6 (-0.1%), Bank Nifty Futures: 57,119.6 (-0.3%).

Nifty Futures, despite an initial positive opening, experienced a sharp reversal due to sudden intra-day profit booking, ultimately shedding all gains to close down 38 points. Concurrently, the Nifty Bank Futures suffered a significantly deeper setback, registering a pronounced price cut of 197 points. This broader market downturn on Thursday was primarily driven by persistent foreign fund outflows, a weakening Indian rupee, which depreciated by 8 paise to 85.70 against the US dollar amid renewed global risk aversion, and ongoing uncertainty surrounding the India-US trade negotiations. The weekly Futures & Options (F&O) expiry also intensified the intraday volatility, amplifying the late sell-off as positions were extensively squared off. Sectoral performance was bifurcated, with PSU banks, metal, and realty shares experiencing declines, while media, consumer durables, and healthcare shares advanced. Indicating a slight easing of market apprehension, the India VIX, a key gauge of market volatility, marginally decreased to 12.39 from 12.44, down by 0.50%. The Nifty Futures premium notably widened, increasing to 103 points from 93, while Bank Nifty Futures also saw its premium expand from 318 to 328 points.

Global Movers:

US stocks hit new records yesterday as jobs growth beat expectations. The S&P 500 gained 0.8% and the Nasdaq 100 rose 1%, with each reaching new highs, while the Dow advanced 0.8%. June payrolls increased by 147K after slight upward revisions to readings from the prior two months, while the jobless rate fell from 4.2% to 4.1%. Coming to related markets, the VIX fell 1.6%, the dollar index rose 0.4%, the US 10-yr trsy yield gained for a third day and settled at 4.35%, gold fell 0.9% as better than expected jobs data made investors doubt the chances of an immediate Fed cut, while brent prices dropped 0.5% to around $69 ahead of an OPEC+ meeting that is expected to bring another large production hike at over 400K barrels-a-day starting August.

Stock Futures:

Yesterday’s market session signalled a clear shift in investor focus across key sectors, as seen through increased trading volumes and heightened price volatility in stocks such as Bosch, Blue Star, Punjab National Bank, and InterGlobe Aviation, indicating intensified short-term trading interest and potential positioning ahead of upcoming sector-specific catalysts or earnings announcements.

Bosch Ltd. experienced a meteoric ascent, charting its highest single-day surge in four years and culminating in its peak closing for the year. This propulsive movement was ignited by a recent mandate: all L2 category two-wheelers (exceeding 50cc or 50 km/h) must integrate an Anti-lock Braking System (ABS) adhering to Indian Standard IS14664:2010, effective 1st January, 2026. This regulatory impetus, designed to curtail the alarming rate of two-wheeler fatalities, directly amplifies the market position of Bosch Ltd., a formidable entity in ABS and AEB technologies. The stock's trajectory reflects a 5.8% price appreciation, paralleled by a 4% upsurge in open interest. Current futures open interest stands at 12,700 contracts, with a fresh infusion of 491 contracts, translating to 12,000 shares in open interest. This confluence of regulatory tailwinds and market activity underscores a robust bullish sentiment for Bosch Ltd. The simultaneous climb in share price and open interest suggests strong conviction among market participants.

Blue Star Ltd. ascended significantly, marking its fourth consecutive day of gains. This upward trajectory is largely attributable to the vigorous expansion within the Indian HVAC sector, propelled by escalating temperatures, accelerated urbanisation, and governmental initiatives championing energy-efficient innovations. This conducive sectoral landscape, synergising with Blue Star's unwavering cadence of product introductions and its strategic inroads into commercial refrigeration and smart AC segments, fortifies investor conviction. Blue Star has garnered a long addition, manifested by a 4.5% price surge and a 25.8% expansion in open interest. Current futures open interest stands at 5,750 contracts, bolstered by a record-breaking single-day addition of 1,179 contracts, equating to 3.8 Lc shares in open interest. In option positioning, total call option open interest is at 3,331 contracts, while put option open interest is at 4,080 contracts, culminating in a put-call ratio of 1.22. This composition reflects new additions of 1,467 call option contracts and 1,706 put option contracts. This persistent upward momentum, bolstered by a surging open interest in futures and a dominant put-call ratio above unity, signals a potent bullish sentiment surrounding Blue Star Ltd. The record-breaking single-day addition to futures open interest underscores robust speculative interest and fresh long positions, potentially constraining short sellers.

Punjab National Bank (PNB) stock experienced a reversal, declining after a remarkable nine-session winning streak, characterised by elevated trading volumes. This abrupt downturn was triggered by the release of its Q1FY26 business updates yesterday. Despite reporting commendable YoY growth of 11.6% in gross business and an 11.1% expansion in domestic business, the market's adverse reaction suggests that these positive metrics fell short of investor expectations. PNB witnessed a short addition, evidenced by a 3.3% price decrease and a 1.2% increase in open interest. The current futures open interest stands at 30,058 contracts, with a new accretion of 353 contracts. In the options segment, call option open interest is at 13,037 contracts, while put option open interest is at 9,842 contracts, resulting in a put-call ratio of 0.75, a contraction from the previous 0.83. This dynamic is underscored by a substantial addition of 1,681 call option contracts, in stark contrast to the 375 new put option contracts. The simultaneous price decline and increased open interest in futures point towards aggressive short positioning by market participants, signalling a bearish outlook. This sentiment is further corroborated by the skew in options data, where the significant increase in call option open interest, particularly when juxtaposed against the relatively meagre addition in put options and a declining put-call ratio, suggests a higher conviction among option writers of limited upside.

InterGlobe Aviation Ltd. (IndiGo) stock experienced a precipitous decline, erasing prior sessions' gains and closing at its lowest level for the week. This downturn was primarily instigated by an "anti-consensus Sell" rating from Investec, which augurs a subdued Q1FY26 for IndiGo, projecting a 13% YoY contraction in profit after tax. The brokerage's rationale posits that diminished Pratt & Whitney compensation and soft yields will overshadow any benefits from lower fuel costs, asserting that the stock's recent surge has diverged from its fundamental earnings reality. IndiGo has observed a long unwinding, marked by a 3.2% price decrement and a 0.9% decrease in open interest. The current futures open interest stands at 50,432 contracts, with an unwinding of 432 contracts. This marks the eighth consecutive session of open position unwinding for the stock. In options positioning, the put-call ratio is at 0.67, with total call option open interest at 17,789 contracts and put option open interest at 11,836 contracts. This composition reflects a substantial addition of 2,584 call option contracts, contrasting sharply with the mere 388 new put option contracts. The persistent long unwinding in futures, manifesting as an eight-session streak of decreasing open positions, reflects a significant reduction in bullish bets and a potential shift towards bearish sentiment among institutional investors. In the derivatives realm, the dominant increase in call option open interest alongside a low put-call ratio suggests a strong conviction among option writers that the stock's upside is capped.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 0.99 from 0.78 points, while the Bank Nifty PCR fell from 1.02 to 0.98 points.

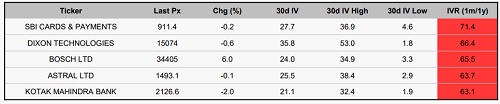

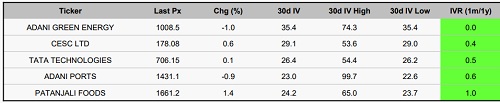

Implied Volatility:

SBI Cards and Dixon Technologies (India) are currently experiencing significant stock price movements, as evidenced by their elevated implied volatility (IV) levels—71 and 66, respectively. At present, SBI Cards is trading with an IV of 28%, while Dixon Technologies (India) shows a slightly higher IV of 36%. The recent uptick in implied volatility has driven up option premiums, prompting traders to reassess and adjust their risk management strategies accordingly. In contrast, CESC and Adani Green remain among the most stable names in their sector, with IVs at 29% and 35%, respectively. Their relatively low volatility and consistent price behaviour continue to position them as appealing candidates for long-hold strategies, especially in a market environment marked by heightened uncertainty and broader volatility.

Options volume and Open Interest highlights:

Bosch Ltd and Tata Chemicals are exhibiting strong bullish sentiment, with call-to-put ratios at 5:1—signalling heightened trader optimism around short-term upside potential. However, such elevated ratios may also reflect potential overvaluation in the options market, warranting caution when considering fresh long positions. In contrast, Shree Cement and Godrej Properties are showing more defensive positioning, with higher put-to-call ratios and a noticeable uptick in put volumes. This suggests growing investor concern over downside risk. While this points to a bearish outlook, the increased put activity could also be a sign of oversold conditions, potentially offering contrarian opportunities for traders anticipating a reversal. On the positioning front, Glenmark Pharma and Kaynes Technology are seeing substantial call option interest, reflecting strong expectations of upward price movement. On the other hand, Mankind Pharma and Blue Star show significant open interest concentrated in put options, suggesting bearish sentiment and the possibility of key support levels forming. Collectively, these option activity patterns reflect heightened market volatility, prompting a shift toward strategies that seek to capitalize on price swings. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, out of a total change of 12,586 contracts, retail clients significantly augmented their bullish exposure by adding 7,889 contracts. This substantial increase in client long positions contrasts sharply with the proprietary segment, which also demonstrated a positive bias by adding 2,721 contracts. Conversely, Foreign Institutional Investors (FIIs) exhibited a decidedly bearish stance, having decreased their positions by an identical 12,586 contracts, effectively offsetting the net additions from other participant categories. A similar, albeit distinct, pattern emerged in stock futures, where 12,558 contracts underwent changes. Here, the retail client segment continued its aggressive accumulation, adding a remarkable 10,083 contracts, indicative of a strong retail-driven bullish outlook on individual equities. Proprietary traders mirrored this positive sentiment, albeit with a more moderate increase of 2,475 contracts. In stark contrast, FIIs further reduced their exposure by 2,688 contracts, signalling a continued cautious to bearish bias from institutional players in the single stock derivatives space. This divergence highlights a clear split in market conviction: retail and proprietary traders are bullish, increasing long positions in both index and stock futures, while FIIs remain consistently conservative to bearish.

Securities in Ban for Trade Date 04-July-2025: NIL

1) RBLBANK

Nifty

Bank Nifty

Stocks with High IVR:

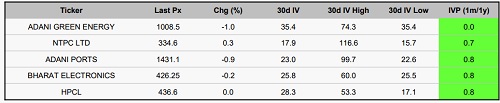

Stocks with Low IVR:

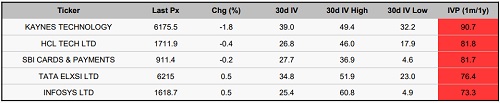

Stocks With High IVP:

Stocks With High IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633