Daily Derivatives Report 02nd December 2025 by Axis Securities Ltd

Nifty Futures: 26,334.7 (-0.2%), Bank Nifty Futures: 59,914.0 (-0.3%).

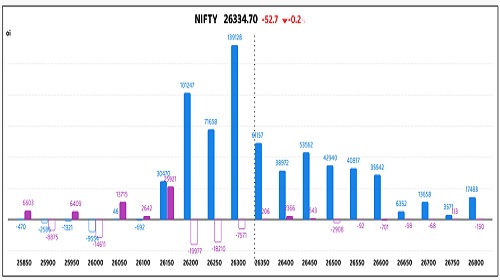

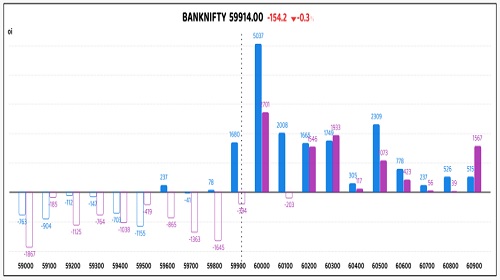

Nifty Futures and Bank Nifty Futures extended their losing streak to a second session on Monday, posting marginal declines despite the 8.2% Q2 FY26 GDP growth in India. The day's action was characterized by a tight, range-bound consolidation near all-time highs, with the fractional losses suggesting a healthy technical pause ahead of the RBI's MPC meeting. Derivative positioning diverged, Nifty Futures fell 52.7 points concurrently with a 3.4% rise in Open Interest (OI) to 151.86 lakhs, marking a clear Short Build Up. In contrast, Bank Nifty Futures shed 154.2 points as OI decreased by 2.4% to 16.92 lakhs, signalling Long Unwinding. Premium contraction was observed across the board, with the Nifty premium narrowing from 184 to 159 points and the Bank Nifty premium decreasing sharply from 316 to 233 points. Sectoral performance highlighted rotation: auto, metal, and IT shares advanced, offsetting declines in the realty, consumer durables, and pharma segments. The market's stability was underscored by the India VIX closing lower at a sub-12 level, indicating low near-term uncertainty, even as the rupee weakened by 8 paise to 89.53 against the U.S. dollar amid persistent global risk appetite fueled by US Fed rate cut expectations.

Global Movers:

U.S. equity markets modestly retreated yesterday, ceding a portion of recent advances as escalating Treasury yields exerted downward pressure. This pronounced decline was compounded by palpable weakness in peripheral asset classes, notably cryptocurrencies. The Dow Jones Industrial Average shed a significant 427 points, while the S&P 500 index recorded a 36-point decrease. Concurrently, the tech-heavy Nasdaq Composite slipped by 90 points, indicating broad-based selling. Investor sentiment remains critically hinged upon the imminent trajectory of future monetary policy, specifically anticipating the outcome of the upcoming Federal Reserve meeting. Reflecting this mixed outlook and the rise in global sovereign yields, the yield on the benchmark 10-year U.S. Treasury note traded higher, hovering decisively near 4.09%. Gold futures maintained a commanding position, trading firmly above the $4,200 threshold, settling near $4,230 per ounce. The metal burnished its classic safe-haven appeal, buoyed by the pervasive expectation of an eventual Fed rate cut and a softening U.S. dollar index. WTI Crude Oil ticked upward, trading near $59.32 per barrel. This moderate ascension was catalyzed by the firm commitment of OPEC+ to unchanged production quotas for the first quarter of 2026 and persistent geopolitical tailwinds, underscoring a moderately stable to constructive sentiment in the energy sector.

Stock Futures:

Indian Energy Exchange (IEX) surged 5.4% on heavy volumes, propelled by favourable legal momentum in the Market Coupling case that spurred investor optimism over potential delays or reversal of implementation. Futures open interest rose 2.7% to 16,668 contracts with 439 additions, signalling long build-up. Options activity showed call OI at 11,186 contracts and put OI at 9,123, with fresh additions of 1,447 and 1,157 respectively. The PCR stood at 0.82, reflecting a balanced yet cautious stance where option buyers leaned toward calls while writers maintained hedged positions.

Cyient Ltd. advanced 3.7% in a rebound from 52-week lows, driven by short covering as futures OI fell 6% to 9,117 contracts with shedding of 583. Options positioning revealed call OI at 2,380 and put OI at 2,079, with calls declining by 312 and puts rising by 279. The PCR climbed to 0.87 from 0.67, highlighting renewed defensive hedging by option buyers while sellers adjusted exposure to downside risk.

Max Healthcare Institute dropped 3.1% on profit-booking after a strong rally, marking a technical correction despite resilient fundamentals supported by 27% EBITDA margins. Futures OI increased 3.4% to 31,262 contracts with 1,022 additions, indicating short build-up. Options data showed call OI at 5,513 and put OI at 4,127, with additions of 940 and 877 respectively. The premium to spot widened slightly to 13.5 points, underscoring option buyers’ tilt toward calls while writers priced in near-term volatility.

Kaynes Technology fell 2.5% in a volatile session, extending its correction of over 25% from recent highs as the IPO lock-in expiry released 20% equity into trade. Futures OI jumped 11.4% to 25,768 contracts with 2,643 additions, signaling aggressive short build-up. Options positioning showed call OI at 29,855 and put OI at 13,306, with additions of 5,761 and 2,661 respectively. The PCR edged up to 0.45 from 0.44, reflecting option buyers’ preference for calls while sellers reinforced bearish bets amid heightened supply pressure.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.89 from 1.14 points, while the Bank Nifty PCR fell from 1.21 to 1.12 points.

Implied Volatility:

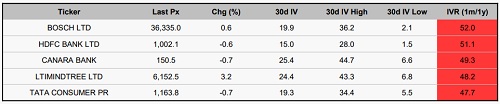

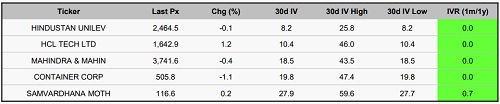

HDFC Bank 51% and Canara Bank 49% signal that options premiums are currently inflated, reflecting underlying anxieties likely driven by regulatory headwinds and global interest rate uncertainty that suggest market participants expect realized volatility to escalate further above its already elevated median levels. Conversely, the dramatically lower IVR seen in HCL Tech and M&M implies that options for these stocks are currently under-priced relative to historical norms, suggesting a consensus of stability and low immediate risk, underpinned by resilient domestic auto demand and the stabilization of the IT sector's operating environment, creating a distinct volatility selling opportunity in Banks and a volatility buying opportunity in Tech and Auto.

Options volume and Open Interest highlights:

Bharat Dynamics Limited (BDL) and HFCL are attracting substantial interest from traders, as indicated by their bullish call-to-put volume ratios of 5:1 each. While these elevated ratios signal a strong positive market sentiment, they also carry a contrarian warning that the current upward price momentum may be approaching a short-term peak. Conversely, ITC and HDFC Bank are characterized by rising Put option volumes and relatively neutral put-to-call volume ratios for both, reflecting heightened concern among traders regarding potential price declines, though this balanced ratio could also imply a contrarian reversal. The combination of high Put volumes and a significant concentration of Open Interest (OI) at lower price levels points toward a bearish sentiment that is currently restraining price appreciation in these two stocks. Looking ahead in options positioning, GAIL and Kaynes Ltd, which are seeing a major accumulation of Call Open Interest near their 52-week highs, as well as Tata Motors Passenger Vehicles (TMPV) and TVS Motors, which are witnessing a similar saturation on the Put side. All these stocks are primed for a potential high-velocity price move following a period of consolidation, as the subsequent liquidation of these heavily concentrated option positions could generate a sharp directional spike. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Index Futures witnessed a net increase of 2,767 contracts, driven predominantly by robust long accumulation from Clients (+2,341 contracts) and Foreign Institutional Investors (FIIs) (+426 contracts). This bullish bias was partially offset by a significant liquidation of short positions totaling 1,655 contracts by Proprietary traders, suggesting divergent yet overall positive sentiment in the benchmark indices. Conversely, Stock Futures recorded a substantial net decrease of 48,033 contracts, indicating a widespread risk-off move. The decline was characterized by simultaneous aggressive shorting across all major segments: Proprietary traders led the selling with 32,774 contracts, closely followed by notable short unwinding by Clients (8,254 contracts) and FIIs (7,005 contracts), reflecting a uniformly negative outlook and bearish positioning in the underlying stocks.

Nifty

BankNifty

Stocks with High IVR:

Stocks with Low IVR:

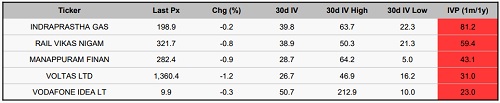

Stocks With High IVP:

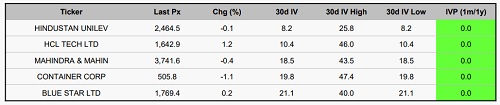

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

.jpg)

Nifty opened on a flat note and remained in a small range throughout the day - Jainam Share ...