Daily Derivative Report - 24th November 2025 by Religare Broking Ltd

Market Outlook

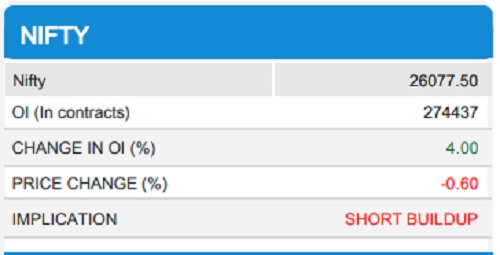

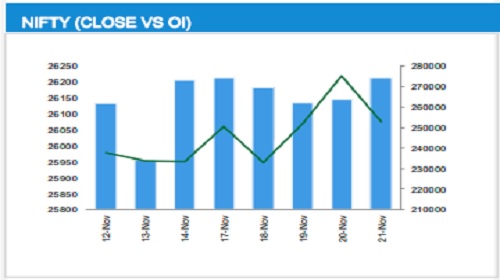

The Nifty 50 closed at 26,068, sustaining above the 26,000 mark and settled the week with uptick of 0.61%. This level continues to hold firm, supported by significant Put OI accumulation, which reflects solid downside protection. On the derivatives front, heavy Call OI at the 26,200 strike still acts as an overhead supply zone, and the index hovering just above it places the market at an important turning point. Technically, Nifty remains in a broad consolidation phase on the daily chart, and a clear breakout on either side is required to determine the next decisive trend. Sustaining above 26,000 could pave the way for further upside, while any drop back below 25,800 may shift momentum in favour of the bears.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330

Tag News

Indian stock markets plummet over 2 pc rattled by Middle East tensions