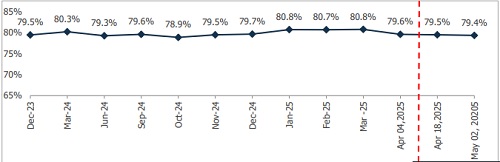

Credit-Deposit Ratio Stays Below 80% Mark for Third Consecutive Fortnight

Synopsis

* Credit offtake and deposit growth slowed over the fortnight. Meanwhile, deposit growth has marginally outpaced credit growth in the current fortnight, resulting in a reversal of the gap to -0.07%. This represents a significant change compared to the same period last year, when the gap was significantly larger at 6.19% (including the merger impact).

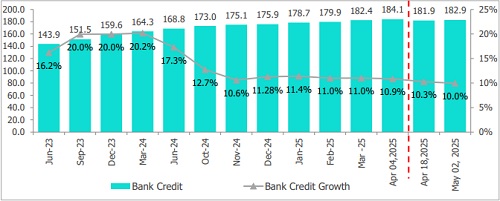

* As of May 02, 2025, credit offtake reached Rs 182.9 lakh crore, marking an increase of 10.0% year-onyear (y-o-y), slower than last year’s rate of 15.8% (excluding merger impact). The slowdown can be attributed to a high base effect, muted growth across segments and typical behavior at the beginning of the fiscal year.

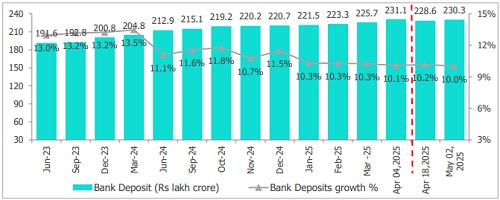

* Deposits rose 10.0% y-o-y, totalling Rs 230.3 lakh crore as of May 02, 2025, a decrease from 13.0% the previous year (excluding merger impact). This slower growth is primarily attributed to a higher base effect and lower deposit interest rates despite special deposit schemes announced by the banks.

* The Short-Term Weighted Average Call Rate (WACR) has decreased to 5.89% as of May 02, 2025, down from 6.59% on May 10, 2024. This decline follows two successive repo rate cuts and liquidity infusion by the Reserve Bank of India (RBI), bringing the WACR below the current repo rate of 6.00%.

Bank Credit Offtake Declines for the Fortnight

Figure 1: Bank Credit Growth Trend (y-o-y %, Rs Lakh crore)

* Credit offtake rose by 10.0% y-o-y and increased by 0.5% sequentially for the fortnight ending May 02, 2025, yet it came in slower than the previous year’s growth of 15.8% (excluding the merger impact). This slowdown can be attributed to a higher base effect, generally slower growth in April, RBI’s commentary on a high creditto-deposit ratio and muted growth across segments.

Figure 2: Bank Deposit Growth Slows for the Fortnight (y-o-y %)

* Deposits increased by 10.0% y-o-y and increased by 0.7% sequentially, reaching Rs 230.3 lakh crore as of May 02, 2025, lower than the 13.0% growth (excluding merger impact) recorded last year. According to the RBI, the fresh issuance of CDs increased to Rs 6.6 lakh crore in H2 from Rs 5.4 lakh crore in H1 of 2024-25. Consequently, the total outstanding amount of CD issuances reached Rs 5.13 lakh crore for the fortnight ending May 02, 2025, a growth of 35.0% y-o-y, as banks continued to rely on raising funds through CDs amidst subdued deposit growth.

Figure 3: Credit-to-Deposit (CD) Ratio Witnesses a Downtick – Incl. Merger Impact

* The Credit-Deposit (CD) ratio witnessed a marginal decline, remaining below the 80% mark for the third consecutive fortnight. As of May 02, 2025, the CD ratio stood at 79.4%, down by 10 basis points from the previous fortnight. This decline can largely be attributed to a higher accretion in deposits, which rose by Rs 1.72 lakh crore, compared to a relatively lower credit expansion of Rs 0.99 lakh crore during the fortnight.

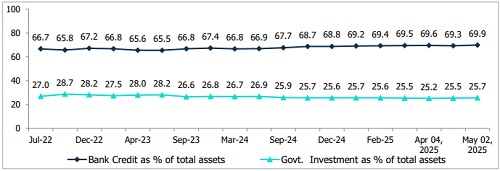

The Proportion of Bank Credit and Government Invs. to Total Assets Witness an Uptick

Figure 4: Proportion of Govt. Investment and Bank Credit to Total Assets (%)

* The credit-to-total-assets ratio and Government Investment-to-total-assets ratio witnessed an uptick and increased to 69.9% and 25.7% respectively, for the fortnight ending May 02, 2025. Meanwhile, overall government investments totalled Rs 67.1 lakh crore as of May 02, 2025, reflecting a y-o-y growth of 7.9% and a sequential increase of 0.3%.

Above views are of the author and not of the website kindly read disclaimer