CPI Inflation Moderates Further in May 2025 by CareEdge Ratings

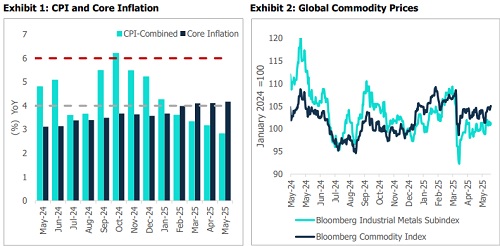

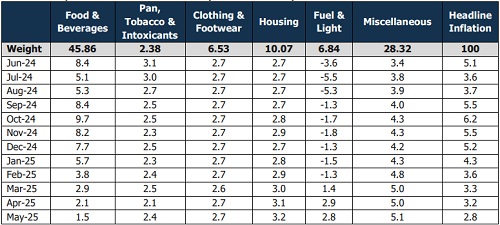

The CPI inflation eased further to 2.8% in May, coming in below expectations and marking the lowest reading since February 2019. The decline was largely driven by sustained moderation in food inflation (1.5%) and a favourable base effect from the previous year. This is the fourth consecutive month when inflation has remained below the 4% mark. Core inflation inched up to 4.2% in May but remains within the comfort zone.

Easing Food Prices Support the Lower Inflation Print

Food and beverage inflation eased to 1.5% in May, down from 2.1% in April. Deflation in key components such as vegetables (-13.7%), pulses (-8.2%), spices (-2.8%), and meat (-0.4%) contributed to this decline. However, double-digit inflation in edible oils (17.9%) and fruits (12.7%) partially offset the broader moderation. The persistent rise in edible oil prices remains a concern, driven by a contraction in oilseed sowing, rising global prices, and India’s dependence on imports in this segment. However, the government's recent move to reduce the basic customs duty (BCD) on imported crude edible oils from 20% to 10% is expected to offer some relief going forward. Looking ahead, food inflation is likely to remain contained, supported by healthy agricultural activity and a favourable base. Positive developments include good reservoir levels, the arrival of the fresh Rabi harvest, and encouraging agricultural production prospects. The India Meteorological Department’s (IMD) forecast of an abovenormal monsoon further reinforces this outlook. However, the spatial and temporal distribution of the monsoon will be critical, especially given the ~34% cumulative rainfall deficit observed so far. Despite the early onset, monsoon activity has slowed. Although it remains early in the monsoon season, with potential for recovery in the coming weeks. Weather-related risks will need close monitoring.

Global Commodity Prices Remain Comfortable Despite Recent Uptick

On the external front, international commodity prices have softened amid growing pessimism around global growth, following an escalation in tariff wars. The imposition of fresh U.S. tariffs has raised concerns over a global supply glut, especially due to surplus production from China. In May, average Brent crude prices declined by ~23% YoY, while the Bloomberg Industrial Metals Subindex was down by 12% YoY. The depreciation in the U.S. dollar index has also helped ease concerns about imported inflation pressures. However, renewed geopolitical tensions in the Middle East have led to a recent rebound in Brent crude prices, which have risen 9.2% since the end of May. This underscores the need to track geopolitical developments closely.

Way Forward

We expect CPI inflation to remain at comfortable levels in the near term, averaging 4% for FY26. This will be supported by moderating food prices, stable core inflation, and favourable base effects. However, downside risks from supply chain disruptions due to trade policy uncertainties and geopolitical tensions remain key monitorable. On the monetary policy front, the RBI’s frontloaded rate cuts are likely to limit the room for further easing. Looking ahead, we do not expect further rate cuts from the RBI unless downside risks to growth materialise.

Above views are of the author and not of the website kindly read disclaimer