Corporate India: Cautiously optimistic amid global uncertainties Credit Quality Assessment for H1FY25 by CareEdge Rating

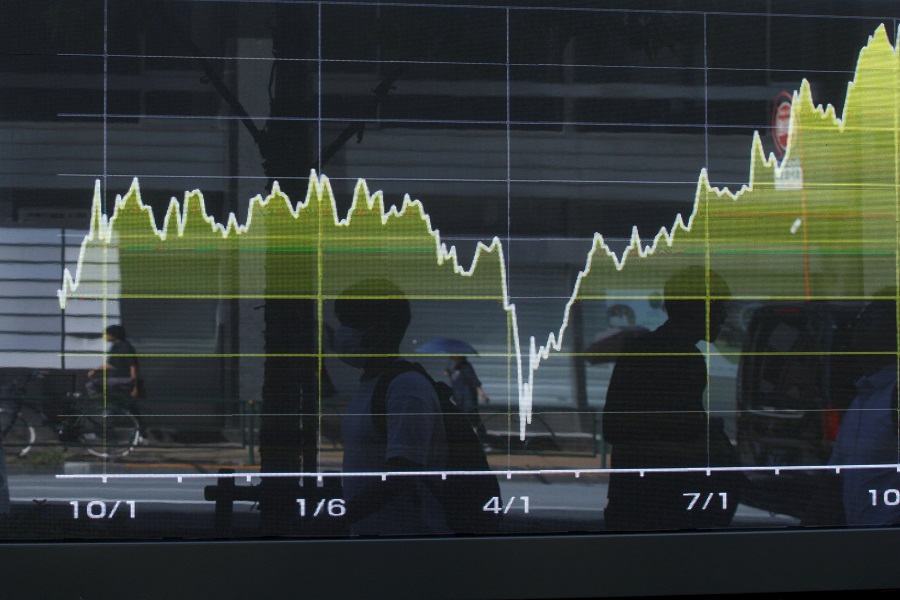

CareEdge Ratings’ Credit Ratio, which measures the ratio of upgrades to downgrades, moderated to 1.62 times in H1FY25 down from 1.92 times in H2FY24. Despite the moderate dip in H1, the credit ratio remained close to the 10 year average of 1.59. Overall, there were 215 upgrades and 133 downgrades across sectors in the first half, with export-oriented sectors like Textiles and Chemicals experiencing higher downgrades. The moderation in the credit ratio can be mainly attributed to the muted performance of the mid & small corporates, especially in export-oriented sectors.

The moderation in the credit ratio can be mainly attributed to the muted performance of the mid & small corporates, especially in export-oriented sectors.

Sachin Gupta, Executive Director and Chief Rating Officer at CareEdge Ratings, commented on the current economic landscape, stating, “In the first half of FY25, Indian corporates have navigated global uncertainties with cautious optimism. Sectors focused on the domestic market have shown resilience, buoyed by steady domestic demand and robust government infrastructure spending. However, we have yet to see a significant uptick in private capital expenditure. Looking ahead, the upcoming festive season, with its potential for increased rural demand and consumer spending, could enhance the credit profile in the second half of FY25. Despite these positive signs, global challenges persist. Weak export demand, the economic slowdown in China, elevated freight costs—particularly due to the Red Sea crisis—and ongoing geopolitical risks continue to pose downside risks.”

The credit ratio of the infrastructure sector experienced an uptick in H1FY25 at 3.50, driven by a significant number of upgrades in the power and construction sectors. Rajashree Murkute, Senior Director at CareEdge Ratings (Infrastructure Ratings), highlighted, “The key drivers for these upgrades included the commissioning of projects, particularly in the road Hybrid Annuity Model (HAM) segment and solar power generation space. Timely payments from most state distribution utilities have resulted in faster-than-expected de-leveraging for power producers. Additionally, the favourable resolution of key regulatory issues, along with the tie-up of power through medium-term Power Purchase Agreements (PPAs), has been crucial. Improved operational scale with good order flow and stable profit levels, bode well for mid-sized infra-EPC players while monetisation of operational HAM assets have aided the financial flexibility of large EPC developers. Yet sluggish execution pace besides weak order book position have surged the working capital intensity of few moderate EPC players thereby putting pressure on their credit profile.”

CareEdge Ratings’ credit ratio for the Manufacturing and services sector has seen a downward revision, driven principally by Mid and Small Corporates Group (MCG), with its credit ratio declining from 1.69 to 0.98 in H1FY25. In contrast, the large players categorized by Large-Corporate Group (LCG) have remained buoyant, with sectors like Capital goods, Realty, Hospitality, Pharmaceuticals, Iron & Steel and Auto & Auto components driving upgrades. Ranjan Sharma, Senior Director, CareEdge Ratings (Corporate Ratings), explained, “Approximately 80% of the total downgrades in the sector during H1FY25 were concentrated in the mid and small corporates segment, which has notably dragged down the overall credit ratio. Companies in this category have been grappling with pricing pressures, volatile input costs that they struggle to pass on, and excess channel inventory due to a substantial supply surge from China. Conversely, the Large Corporate Group (LCG) has shown greater resilience and experienced only a marginal dip in its credit ratio from 2.23 in H2FY24 to 2.09 in H1FY25.”

Small and mid-sized textile manufacturers, particularly those operating within a single segment of the value chain, have been significantly impacted by the challenging industry conditions. Meanwhile, segments of the chemical sector, especially those involved in basic and commodity chemicals, continue to face headwinds due to intense pricing pressure from Chinese competition—a trend that has persisted for over a year. Additionally, smaller entities with inherently weak credit profiles in the agricultural food products and trading sectors have also experienced rating downgrades during H1FY25.

Small and mid-sized textile manufacturers, particularly those operating within a single segment of the value chain, have been significantly impacted by the challenging industry conditions. Meanwhile, segments of the chemical sector, especially those involved in basic and commodity chemicals, continue to face headwinds due to intense pricing pressure from Chinese competition—a trend that has persisted for over a year. Additionally, smaller entities with inherently weak credit profiles in the agricultural food products and trading sectors have also experienced rating downgrades during H1FY25.

In summary, despite the challenges facing the global economy, CareEdge Ratings believes that Corporate India has demonstrated resilience, with the credit ratio expected to remain range-bound on the back of steadfast domestic economic dynamics and infrastructure push. Going ahead, sustenance of domestic demand, fallouts of the geopolitical tensions and slowdown in China, alongside quantum of easing in policy rates by major central banks remain key monitorable

Above views are of the author and not of the website kindly read disclaimer