Copper prices are expected to face hurdle on easing supply concerns - ICICI Direct

Bullion Outlook

* Spot Gold is likely to move back towards $3330 as long as it trades under $3400 on easing safe haven demand and extension of tariff truce with China. Additionally, easing geopolitical tension ahead of this week’s Trump-Putin meet would weigh on price. Meanwhile, investors will eye on key US inflation data. Forecast of rise in CPI YoY would hurt the rate cut outlook and restrict its upside. On the flip side, smaller than expected rise in the US CPI would strengthen the chances of rate cut and support bullion prices. Moreover, fear of stagflation would limit the downside in price.

* On the data front, a strong call base at 3450 might act as immediate hurdle. MCX Gold October is expected to dip towards Rs 99,750, as long as it trades under Rs 101,050 level.

* MCX Silver Sep is expected to move lower towards Rs 112,400. On the upside major hurdle exits at Rs 114,500 level. Only below Rs 112,400, it may fall towards Rs 111,800.

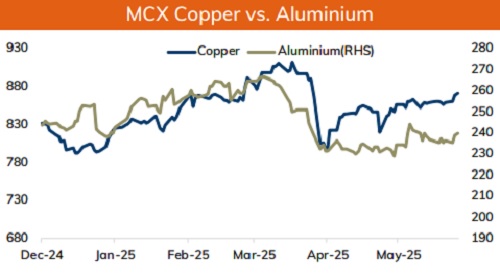

Base Metal Outlook

* Copper prices are expected to face hurdle on easing supply concerns. Codelco has received approval to restart some underground activities at EI Teniete, but a full return is not expected until the comprehensive review process is completed. Additionally, demand concerns and rising inventory levels in LME could also weigh on the metal prices. Meanwhile, further extension to US – China trade truce for another 90-days would limit its downside. On the data front, investors will eye on key economic numbers from China to get more clarity.

* MCX Copper August is expected to face hurdle near Rs 890 and move lower towards Rs 880 level. Only a move below Rs 880 level prices may turn weak towards Rs 875 level

* MCX Aluminum August is expected to consolidate in between Rs 251 and Rs 255 level. Only below Rs 251, it would turn weaker again towards Rs 248. MCX Zinc August is likely to move north towards Rs 271 level as long as it stays above Rs 267 level.

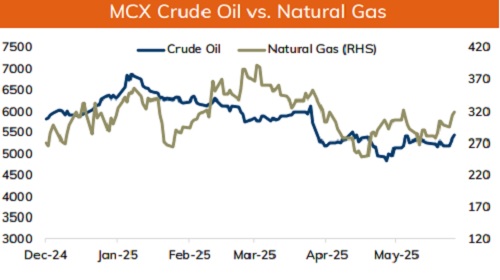

Energy Outlook

* Crude oil is likely to remain in a tight range ahead of the key US-Russia talks. Optimism over potentially productive US-Russia talks to end the war between Russia and Ukraine this week would ease supply concerns. Additionally, higher OPEC+ supplies and concerns over global economic activity amidst higher US tariffs would hurt oil demand. On the other hand, an extension to tariff truce with China by another 90 days would support oil prices. Meanwhile, investors will eye on US CPI data to get more clarity.

* On the data front, 60 put strike has higher OI concentration which would act as key support. On the upside 65 call strike, has higher OI concentration, which would likely to act as immediate hurdle. MCX Crude oil Aug is likely to consolidate in the band of Rs 5500 and Rs 5700 level. On the upside 50-day EMA at Rs 5700 would act as key hurdle.

* MCX Natural gas August future is expected to remain under pressure and move towards Rs 255, as long as it trades under Rs 275. A move below Rs 255 it would turn weaker towards Rs 248.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631