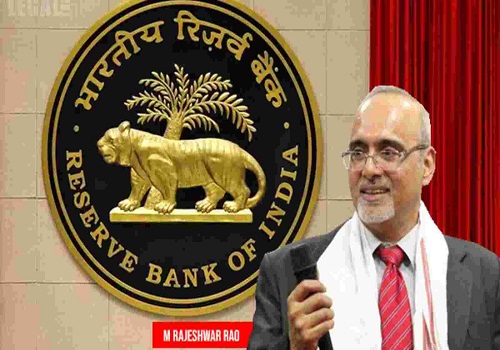

Constant vigil needed to mitigate risks in financial sector: M Rajeshwar Rao

Deputy Governor M Rajeshwar Rao has said the Reserve Bank of India (RBI) will keep continuous vigil to mitigate risks as unbridled credit growth can be deleterious to the health of a financial entity and if widespread, it could give rise to systemic concerns. Rao said as a regulator, the RBI's endeavour always is to promote a robust and resilient financial intermediation system with an appropriate regulatory and supervisory framework.

He said the technological developments and innovations hold great promise for the financial sector as they have immense potential to increase the reach of financial firms, enhance the range of product offerings and conveniences for customers, expand the ambit of finance to hitherto excluded segments.

He stated ‘At the same time, we need to be alert to the possibilities that the new entrants into the financial services space, including FinTech firms, could significantly alter the universe of financial services providers.’ He added this could affect the degree of market concentration and competition and may give rise to new challenges.