Company Update : Hindustan Unilever Ltd By JM Financial Service

HUL released a pre-quarter update on the current operating context and its corresponding impact on the performance of the company in the near term.

* c.40% of HUL’s portfolio sees benefit from GST rationalisation: HUL highlighted that the company is ensuring GST benefits are passed on to consumers through price cuts and enhanced value across its portfolio, which has seen rationalisation in GST rates (benefit seen for c.40% of its portfolio). Our checks suggest the company has implemented highsingle-digit to low-double-digit price cuts across key beneficiary categories.

* GST transition impacts ordering activity in September: As existing inventory with old prices in the trade channel (at distributor and retailer level) had to be cleared there has been a transitory impact in the quarter. Ordering activity was impacted in September due to: a) lower primary sales as distributors/retailers postponed the orders in anticipation of receiving new orders with revised MRP and b) lower ordering across the portfolio as consumers too delayed their pantry loading.

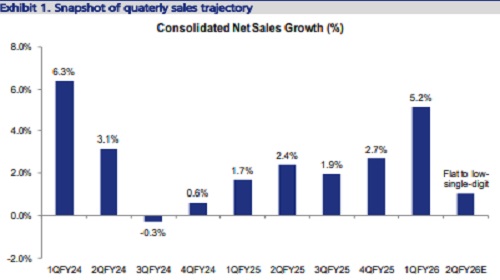

* Flat to low-single-digit consolidated sales growth in 2QFY26: Our channel checks suggest underlying demand trends in July and August were largely similar to that in 1QFY26. With GST transition-led impact in September, HUL expects near flat to low-single-digit consolidated sales growth in 2QFY26.

* Impact to be seen in October too, stabilisation expected from November: While the transition issue is more short term/transient in nature, considering the pipeline inventory the impact is expected to continue in October too and recovery is expected from November once prices stabilise.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361